Culture

17:18, 13-Oct-2017

Children's education is a booming market in China

CGTN

In Beijing's Dongcheng District, Cong Cong and other children watch videos of submarines, and after their teacher explains some basic physics, they build their own submarines with Lego.

Lego building is a popular extracurricular class. Cong Cong, 6, also attends an English class and swimming lessons here, at a Lego education center. In the eyes of Chen Chen, Cong Cong's mother, English is "a must," Lego "stimulates creativity" and swimming "enhances physical fitness and coordination."

China's education market has developed rapidly, especially in large cities, where piano, painting, chess, skating and other lessons spring up in major shopping districts. Expensive summer camps claiming to broaden children's horizons are also popular, and the amount of money spent on children's education is rising each year.

A survey of early education - 0 to 6 years - in Shanghai, conducted by the Shanghai Association for Quality, found that 60 percent of children under 6 attended extracurricular classes, of which those aged between 4 and 6 surpassed 70 percent.

On average, each child attends two classes for around two hours a week and the average annual family spending on extracurricular classes is 17,832 yuan (roughly 2,703 US dollars).

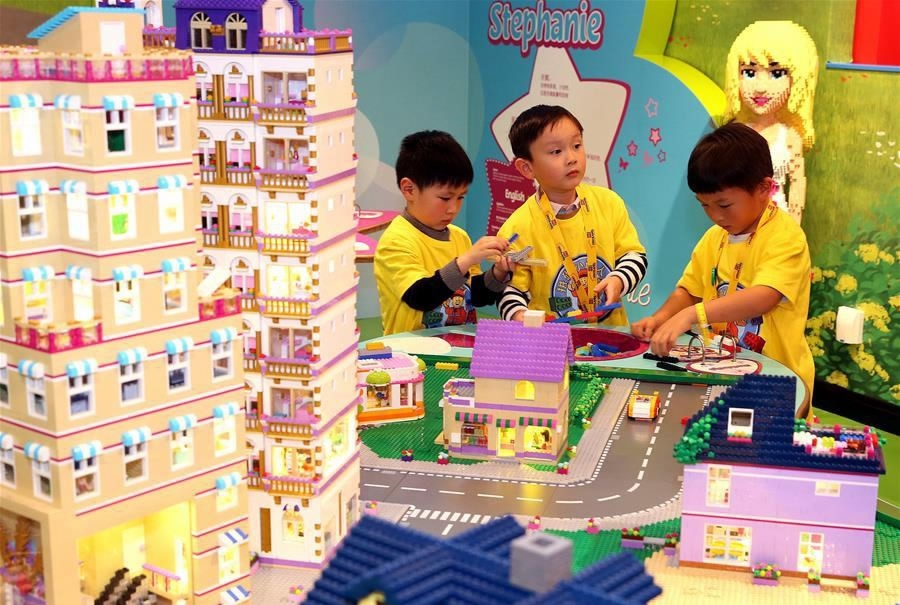

Children have fun in China's first LEGOLAND Discovery Center in east China's Shanghai, April 7, 2016. /Xinhua Photo

Children have fun in China's first LEGOLAND Discovery Center in east China's Shanghai, April 7, 2016. /Xinhua Photo

Chen Chen, a mother of two sons, learned that most of the children in her son's kindergarten attend several classes, which their parents carefully arrange. "If the children are interested and parents can afford the cost, it does no harm," says Chen.

Born in the 1980s, she is a typical parent with higher education and disposable income. Compared with her thrifty parents, she spends more freely on the next generation's early education.

Chen grew up in an exam-oriented system and she hopes her children can have more opportunities to cultivate their interests and broaden their horizons. "Our next generation is facing increasingly harsh and unknown competition. We are prone to anxiety and not likely to adopt a laissez-faire approach to raising children," she says.

International market research firm Nielsen found those born in the 1980s are the main force of consumption in China. Because most of them are married, spending on family accounts for most of their consumption, children's education in particular, which makes up 55 percent of their expenditures.

Some foreign companies are now looking to get involved in China's education market.

Part of the Lego Group, Lego Education entered China in 2000, and has been providing innovative education programs for some Chinese kindergartens and schools. Lego promotes the idea of learning through play. In China, more Chinese parents are paying attention to their children's ability to innovate, wanting to stimulate their interests through hands-on experiences instead of rote learning.

Children attend painting class with the guidance of a teacher in Hefei, capital of east China's Anhui Province, July 16, 2017. /Xinhua Photo

Children attend painting class with the guidance of a teacher in Hefei, capital of east China's Anhui Province, July 16, 2017. /Xinhua Photo

With the popularity of overseas study, China's Gaokao - National College Entrance Exam - is no longer the only path to success for many children and the aim of nurturing versatile talents fuels diverse demands. Many Chinese education companies are seizing the opportunity to grow the market.

Deloitte's 2017 education industry report shows as Chinese education policymakers favor STEAM (science, technology, engineering, arts and math) subjects, the number of institutions and companies involved in STEAM education has expanded.

Children's online education is also flourishing. VIPKID is an online English education startup, allowing teachers from North America to offer one-on-one video courses with children. Its paying users have grown rapidly from 10,000 in 2016 to 200,000 in 2017.

Investors are also bullish, with VIPKID netting financing from both China and abroad. In August, VIPKID finished its series D financing and received investment totaling 200 million dollars, the largest financing globally for the K-12 (kindergarten to Grade 12) online education sector.

A videographer shoots inside China's first LEGOLAND Discovery Center in east China's Shanghai, April 7, 2016. /Xinhua Photo

A videographer shoots inside China's first LEGOLAND Discovery Center in east China's Shanghai, April 7, 2016. /Xinhua Photo

However, the growing education market also piles pressure on parents, especially those like Chen Chen, who has two children.

"We have to double the education spending, which means we have to tighten other family spending. So I think twice before enrolling my son in extracurricular classes, which usually cost more than 10,000 yuan (about 1,516 US dollars) a year," Chen says.

Some parents on social media have lamented that they are not raising children but "cash burners".

According to Liu Chenglian, a family education expert, some parents spend whatever it takes to give their kids an edge, but sometimes they just blindly follow trends and over-schedule their children.

Dr. Cai Weizhong warns parents to keep their eyes wide open. Some education companies are not qualified and the market needs more regulation and supervision.

"Children's education cannot rely entirely on the market," Cai says. "The company and attention of parents counts for a lot in children's growth."

Source(s): Xinhua News Agency

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3