Business

20:11, 15-Dec-2017

Moon’s Beijing breakfast highlights global growth of Chinese mobile payments

By CGTN's Nicholas Moore, Qi Jianqiang, Yang Jing

The visit of South Korean President Moon Jae-in to China has come at a time of improving relations between the two countries, and a simple breakfast in Beijing on Thursday morning was enough to show what could be achieved through closer collaboration.

President Moon surprised locals as he sat down with his wife and embassy staff at a quiet and humble restaurant, ordering a range of dishes as stunned staff and fellow customers looked on.

But, according to S. Korean media, it was Moon himself who was left most surprised, after being shown how to pay for a meal using Wechat Pay, one of China’s most popular mobile payment apps. S. Korean newspaper Dong-a Ilbo reports that the president showed a keen interest in the app, and asked ambassador Noh Young-min “does this make all payments?”

South Korean President Moon Jae-in and S. Korean First Lady Kim Jung-sook check out China's mobile payment apps. /VCG Photo

South Korean President Moon Jae-in and S. Korean First Lady Kim Jung-sook check out China's mobile payment apps. /VCG Photo

China Daily reported last month that 520 million Chinese people now use their phones to make payments, while a report jointly produced by Tencent, Renmin University of China and French market researchers Ipsos found that 84 percent of Chinese are comfortable leaving their homes without a wallet.

In fact, mobile payments have become so big that the People’s Bank of China issued a warning to shops earlier this year that they must still continue accepting cash, amid reports that several stores would only accept payments via QR codes.

Mobile payments have grown rapidly in China in recent years, and while other countries are starting to catch up and launch similar apps of their own, the unique Chinese payment ecosystem continues to be the envy of many other developed nations.

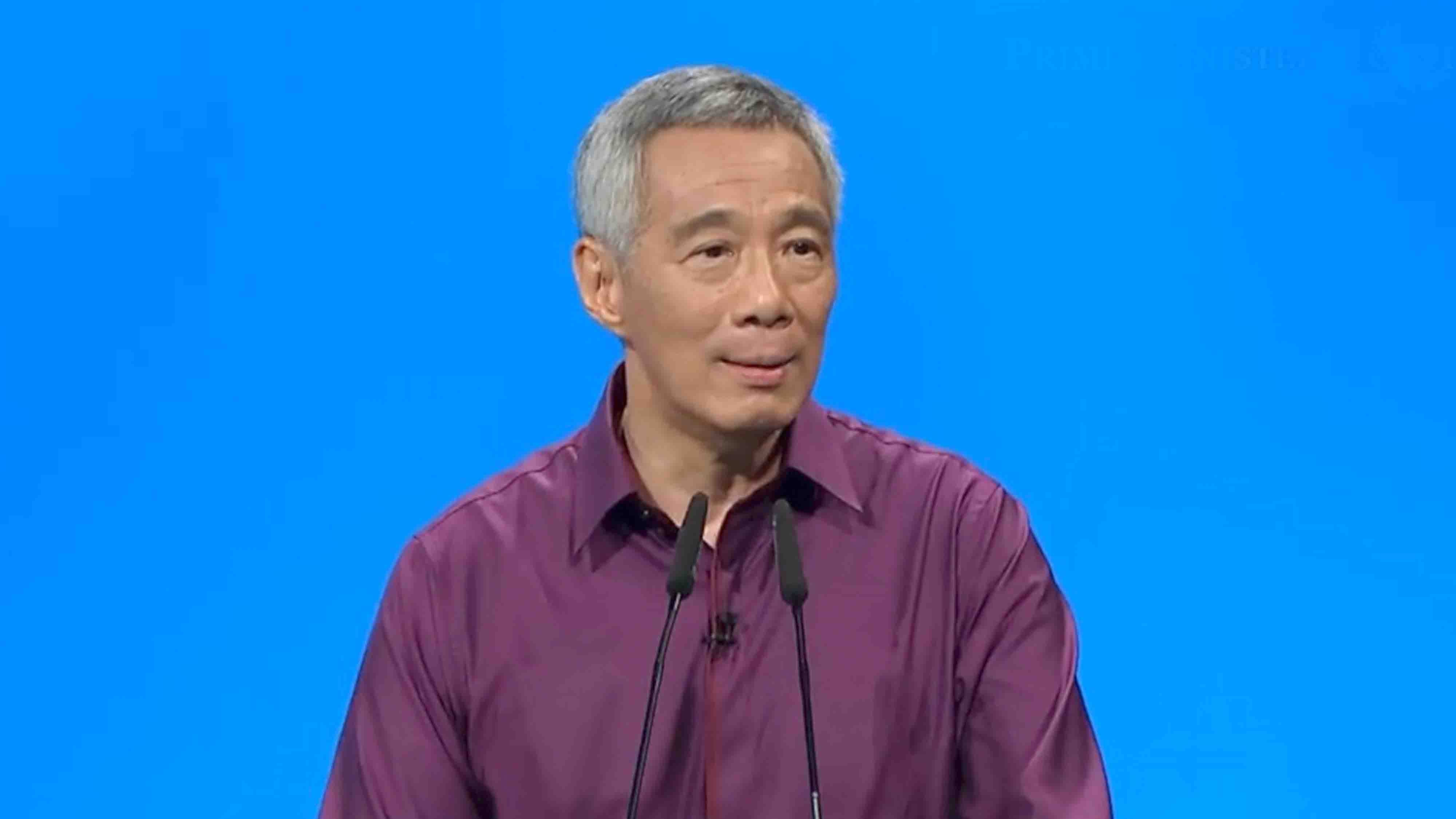

In August, Singaporean President Lee Hsien Loong marked his country’s national day with a speech calling for a wider adoption of e-payments, in which he praised Wechat Pay and Alipay and bemoaned how Singapore had fallen behind.

Part of Singapore’s strategy for boosting mobile payments is collaboration with Alipay, with some 2,000 merchants in the city-state capable of accepting money via the Chinese app.

Canadian Prime Minister Justin Trudeau is also keen to boost the use of mobile payments back home, and spoke at Alibaba’s Gateway 17 event in Toronto in September, before discussing further cooperation with the company’s CEO Jack Ma.

This year has seen Alipay team up with its Canadian partner SnapPay, in a move which allows Chinese tourists to use their mobiles to pay either in US dollars or Chinese yuan at a wide range of stores.

There have been many more maneuvers overseas by both Wechat Pay and Alipay, with various partnerships seeing Chinese mobile payment apps rolled out in the UK, France and the US. Meanwhile, services like Apple Pay, Android Pay and Samsung Pay are growing worldwide, despite not offering as many functions or integration as their Chinese rivals.

A store in Bangkok, Thailand offers both Alipay and S. Korea's Samsung Pay, highlighting the growing international competition for mobile payments. /VCG Photo

A store in Bangkok, Thailand offers both Alipay and S. Korea's Samsung Pay, highlighting the growing international competition for mobile payments. /VCG Photo

However, one frustration that was evident at President Moon’s breakfast is that these Chinese services are by and large only available to people with Chinese bank accounts. While Moon was impressed with the app, he could only look on as his China-based ambassador footed the bill.

Cross-border cooperation is increasing between China and other countries when it comes to mobile payments and S. Korea is one of the leading examples. In February, Alibaba’s Ant Financial invested 200 million US dollars in S. Korea’s Kakao Pay.

Kakao is the country’s most popular messaging platform, and its payment services will eventually be available to both Chinese and S. Korean users of Alipay and Kakao Pay through cooperation with Ant Financial and Alibaba.

However, S. Koreans and other foreign visitors to China are still unable to use Kakao, Alipay or any other payment app without a Chinese bank account. Rita Liu, head of Alipay Europe, Middle East, and Africa, told Bloomberg last year that it was targeting Chinese tourists in Europe, but not Europeans.

While the partnerships being launched by China’s mobile payments giants overseas provide solid foundations for the future, other tourists, businessmen and world leaders visiting China will have to wait a bit longer until they can use their own phones to try out some of the local food.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3