Business

22:29, 26-Sep-2017

Russian banking system to strengthen after clean-up: deputy finance minister

CGTN

Russian bank bailouts will have no knock-on effects on the budget or inflation, Deputy Finance Minister Vladimir Kolychev said in an interview in which he countered investor concerns about the health of the sector.

The central bank has launched rescues for two major private lenders in the space of a month, Otkritie Bank and B&N Bank, as well as providing ongoing support to state-owned development bank VEB.

“It (rescues of Otkritie Bank and B&N Bank) will only make the banking system more healthy,” Kolychev said at the Reuters Russian Investment Summit at the Reuters office in Moscow.

Deputy Finance Minister Vladimir Kolychev /Reuters Photo

Deputy Finance Minister Vladimir Kolychev /Reuters Photo

The banks’s problems were hangovers from the past when they were growing too fast via aggressive acquisitions, he said. VEB is in a different category as it is a state investment vehicle, which is exposed to the politically-important projects.

The central bank plans to provide capital support to both private banks via a special fund, so the rubles used will not reach the market and not affect inflation, Kolychev said.

The central bank plans to meet its inflation target of 4 percent by the end of this year. In August, consumer prices growth was 3.3 percent in annual terms.

People dressed as blocks of currency notes as part of a marketing campaign walk in Moscow. /Businessinsider.com Photo

People dressed as blocks of currency notes as part of a marketing campaign walk in Moscow. /Businessinsider.com Photo

Though budget money is not being used to rescue Otkritie or B&N, according to Kolychev, some budget cash is being pumped into VEB which Russia decided to bail out in 2015 due to the impact of bad loans issued to fund politically important projects, including infrastructure for the 2014 Winter Olympics.

Last week, the finance ministry said it was cutting annual support to VEB by a third to 100 billion rubles, prompting the bank to say it would have to cut lending or borrow more to meet its obligations.

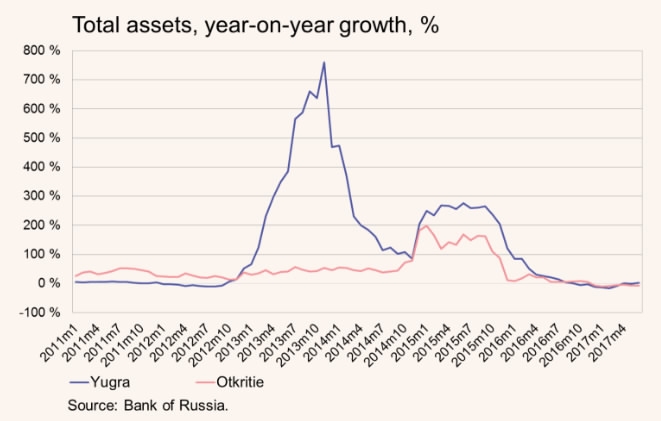

Russian year-on-year growth in assets of Yugra Bank and Otkritie Bank /Russia Bank Chat

Russian year-on-year growth in assets of Yugra Bank and Otkritie Bank /Russia Bank Chat

“It’s important to separate funding from capital ... Of course, we need to look closely at the expected (VEB) revenues, but so far, we don’t have the feeling that there will be a need for additional liquidity from the state,” he said.

The finance ministry plans to continue swapping outstanding sovereign Eurobonds for new issues after testing the tool this month, he said. The swap allows the ministry to ease the burden on the state budget and postpone some repayments.

Asked if the ministry plans to continue the practice, Kolychev said: “Yes, this year and beyond. The program is worth 12 billion US dollar in total, 4 billion US dollar per year.”

He said one of the outstanding Eurobonds, Russia-2018, will be redeemed next year, leaving two other papers, Russia-2028 and Russia-2030, which are candidates for swaps.

Source(s): AP

,Reuters

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3