Business

08:30, 16-Jul-2017

China walks a fine line in deleveraging

By CGTN's Yang Chengxi

For economic policymakers in China, deleveraging is the number one task at hand. For the past few quarters, China has managed to keep its growth rate above six and a half percent.

Experts say it provided room for officials to keep tightening, which is important, as significant indicators still suggest that China is over-leveraged.

"The most important one is the credit to deposit ratio. Currently, it's about 120 percent, which is higher than the target set up by the central bank,” said Oliver Rui, a professor of China Europe International Business School.

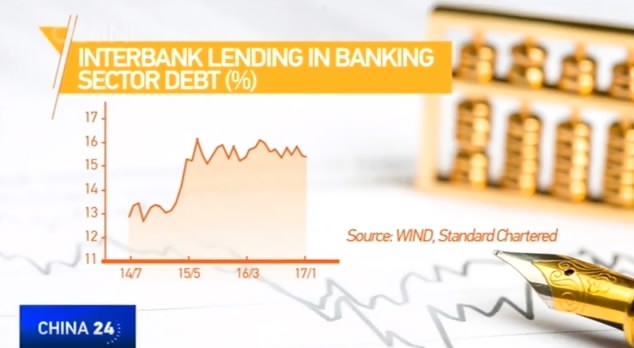

The first place that policymakers focused on has been the financial sector.

Major measures were started since last year to retract liquidity in the interbank market, where transactions are usually done with leverage and have been contributing to a bigger and bigger portion of overall debt in the sector.

The measures are designed to put restrictions on many transparency-lacking banking products.

CGTN Photo

CGTN Photo

"The aggregate total of structured bank product has declined by more than 1.6 trillion yuan. So it's clear that when Beijing do want to deleverage, their policies do have an effect,“ said Brock Silvers, managing director of Kaiyuan Capital.

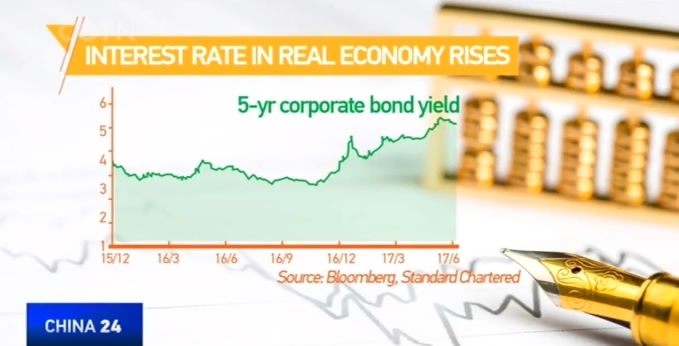

But that's also a double-edged sword. Credit tightening has resulted in a rise in financing cost for the real economy.

"Those small firms or medium companies rely on new loans to repay their old debts. Because in general, the duration of borrowing, or the term of leverage in China is very short. For example six months of one year,” said Oliver Rui.

CGTN Photo

CGTN Photo

China's central bank the People's Bank of China (PBOC) sees some of those concerns. That's why it resumed injecting a certain level of liquidity into the financial market since last month through open market operations.

Experts say while policy directions won't change, officials are walking a fine line between deleveraging and maintaining growth.

"Given a reasonably healthy economy, we will see similarly constructive measures into the future,” said Brock Silvers.

PBOC governor Zhou Xiaochuan reiterated last month that China should prevent systemic risks in the financial sector. Experts say to realize that, interbank leverage still needs to drop and banks' capital adequacy ratios still need to rise. Financial deleveraging is seen making progress.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3