Mobile

19:20, 13-Sep-2017

Apple Pay faces competitions from domestic brands in China

By Yang Chengxi

Apple's recent revenue hike in China has taught the US tech giant that collaboration with local companies can be a way to win over domestic users' hearts.

China is now representing roughly 17 percent of the revenue to Apple as a whole, according to Steven Lu, partner at consulting firm Bain & Company. The revenue comes from not only the sales of hardware but the growing service fee as well, thanks to the local mobile payments.

"When it comes to mobile payment in China, Tencent's WeChat pay and Alibaba's Alipay dominate 90 percent of the sector," said Lu.

The Greater China region is now the biggest market for the App Store, iPhone's software marketplace. Apple product and service users in China have grown by 12 percent to 185 million people as of August. Apple executives credit the growth to the firm's decision to allow China's Alipay as a payment channel for the App Store after its own Apple Pay suffering from a lack of Chinese customers.

Apple has also given a green light to WeChat payment at the end of August.

It was an unexpected move by Apple as it had been in a spat with Tencent. The latter shut down its user tipping function on its WeChat platform due to Apple's accusation of the app's bypassing the iPhone's payments mechanism. The latest green light seems to be a move to ease the tension, but the competition over payment is far from over.

"Apple needs to think about how they work with companies like Tencent to create a win-win for both consumers and itself," said Lu. "Otherwise whoever wants consumers to make a tough choice will be disliked by the consumers."

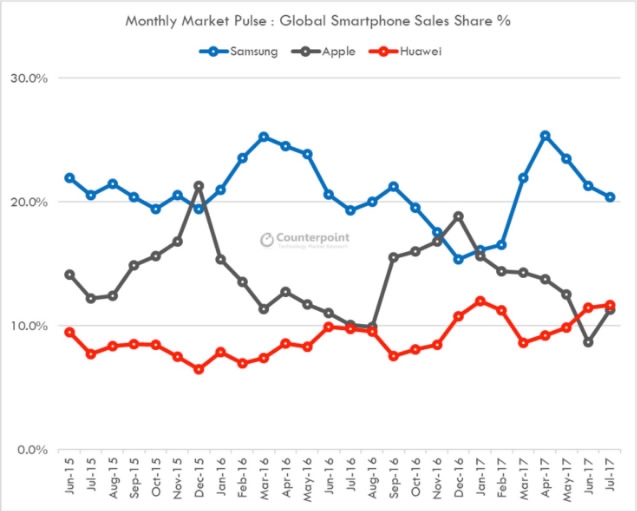

Apple Pay only accounts for 1 percent of the mobile payment market in China and it is finding it harder to catch up. It is facing challenges from the hardware sphere too. Chinese phone maker Huawei has already surpassed Apple to become the number two biggest phone maker in the world. With Android phones getting more powerful, it is getting easier for users to switch phones.

Huawei’s share of smartphone sales has surpassed Apple in 2017. /Counterpoint Photo

Huawei’s share of smartphone sales has surpassed Apple in 2017. /Counterpoint Photo

This gives cross-platform developer Tencent more bargaining power that Apple is trying to catch up with this year. It launched its first subsidy campaign after more than a year's presence in China.

"Three, four years ago, there might be a chance, but for now it's harder and harder for companies like Apple Pay to gain momentum," said Lu. "Because you need consumers to buy in, you also need merchants to buy in."

Sales of the iPhone had been slipping in China, which makes catching up in other services more important for Apple.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3