19:58, 03-Oct-2018

Asian Idol Industries: S. Korea hit idol show breaks into Chinese market

Updated

19:37, 06-Oct-2018

03:58

And, the K-pop craze has also spread to China. The country has made its own version of "Produce 101" for local fans. Ren Xueqian tells us more about how this popular Korean franchise has excited fans and investors in China.

With its massive population, China's entertainment industry has long been a priority for investors at home and abroad. And this huge fan base helped made China's version of South Korea's "Produce 101" a hit before it aired.

YE FENG DEPUTY DEAN OF SCHOOL OF DIGITAL MEDIA BEIJING FILM ACADEMY "Variety shows are a big part of entertainment consumption. South Korea has a lot of experience in creating such products, and it's one of the regional leaders in the industry."

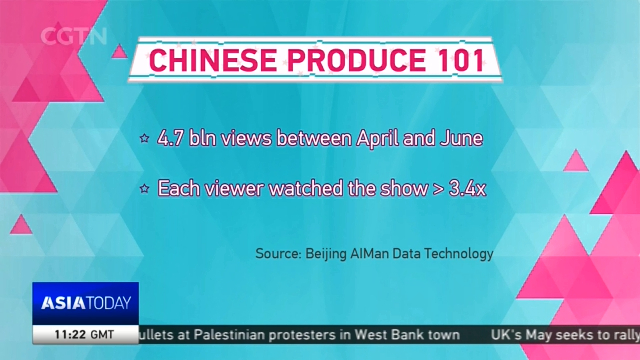

Backed by mega Chinese tech company Tencent Holdings, Chinese "Produce 101" garnered more than 4 billion views via online streaming platforms between mid-April and mid-June. This means each viewer in China watched the show at least 3 times or more during its two-months of broadcasting. Over 13-thousand contestants or "idol trainees" from more than 400 talent agencies auditioned for the show, competing for 11 spots in a girl group that will be signed to a prestigious management label.

REN XUEQIAN CGTN "But debuting in a talent competition isn't something new in the Chinese entrainment industry. In fact, Beijing AIMan Data Technology says it's the second most popular way for new artists to 'come-out' next to acting. But what is new, is streaming the competitions online, which increased these artists' or pop groups' exposure and intensified their battle for viewers' attention."

CAO YONGSHOU PRESIDENT, BEIJING AIMAN DATA TECHNOLOGY "Users are more involved now. I think this is a change of habits and preferences in China from how it was back in the age of television and films."

Fans are playing a major role in determining the worth of a pop group. When "Produce 101" was broadcasting in China, many people were buying Tencent streaming platform memberships or even donating large sums of money in support of their favorite trainees.

In the company's 2018 second quarter interim report, Tencent's streaming service reported a total of 74 million paid memberships, with year on year growth rate of 121-percent by the end of June. AIMan attributed such growth to the popularity of the talent show as it began airing towards the beginning of the period.

Such spending from fans, according to AIMan, is considered normal fan behavior, but intensified with help from the Internet.

CAO YONGSHOU PRESIDENT, BEIJING AIMAN DATA TECHNOLOGY "The show and how it was streamed online changed the game. Fans can start donating and support their favorite idols before they even become one, it used to be the other way round."

With the Internet reshaping the industry and facilitating growth, Cao says there's still a need to ensure popularity of these trainees after the talent show ends, a problem that long-term pop culture investor Chen Yuetian says the Chinese industry is working to change, and he points out why he thinks the industry is worth the investment.

CHEN YUETIAN PARTNER, SEA OF STARS CAPITAL "The estimated market value to manage these new talents is high, and they usually are in the market. So investors might think the cost is too high because a company of 10 or more employees might need 200 to 300 million yuan. But on the upside, the ceiling is high for growth in the industry, and I think return on capital can be ensured."

Another Chinese data consulting company, EntGroup estimates that the country's idol-making reality show market could reach 100 billion yuan in the next two years.

With the internet expediting the growth of the Chinese idol-making industry, AIMan says 2018 marks the dawn of a new era for talent show idols. But experts say the biggest challenge is whether or not the industry and its artists can outshine leading pop industries in Asia. RXQ, CGTN.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3