Business

22:29, 06-Dec-2017

Luxury brands boosted by court ruling for online sales ban

By Han Jie

Coty and other luxury brand owners made a big win on Wednesday in their bid to prevent retailers selling their products on online, after the European Supreme Court said they have the right to do something to protect themselves, and their bids are in place to keep retailers online such as Amazon and eBay online Platform to sell their products, according to Reuters report.

The dispute between US cosmetics maker Coty and German retailer Parfumerie Akzente, which sells Coty's goods on sites including Amazon against Coty's wishes, reached the Court of Justice of the EU after a German court asked for guidance on whether online sales bans on third-party sites curb competition.

Rimmel cosmetics owned by Coty Brands /Reuters Photo

Rimmel cosmetics owned by Coty Brands /Reuters Photo

Luxury brands in European market

After a court adviser backed its case and argument that such a ban protects the image and exclusivity of its products, Coty, the brands includes Marc Jacobs, Calvin Klein and Chloe, received a boost in July.

After intense lobbying by LVMH and Richemont, EU regulators sets up new rules in 2010 to allow brand owners with less than a 30 percent market share to block online retailers without a bricks-and-mortar shop from distributing their products.

Although luxury owners have long been battling what they called as a free driver for their exclusivity and branding, online platforms such as Amazon and eBay argue that, the restrictions on online sales are anti-competitive and hurt small businesses.

Galeries Lafayette Paris Haussmann, the world famous French luxury store chain Galeries Lafayette /CGTN Photo

Galeries Lafayette Paris Haussmann, the world famous French luxury store chain Galeries Lafayette /CGTN Photo

The European Court of Justice (ECJ) ruling came in a case involved the German subsidiary of US cosmetics maker Coty and German retailer Parfumerie Akzente, which sold Coty's merchandise on its Web site, including the Amazon.

A German court had sought guidance on whether banning online sales on third-party sites restricted competition.

“A supplier of luxury goods can prohibit its authorized distributors from selling those goods on a third-party internet platform such as Amazon,” the ECJ said. “Such a prohibition is appropriate and does not, in principle, go beyond what is necessary to preserve the luxury image of the goods.”

The issue has split EU countries, with Germany more eager to promote e-commerce. In two test cases in recent years, the German cartel office forced Adidas and Asics to drop such bans, saying online platforms are crucial for small- and medium-sized companies and consumers.

VCG Photo

VCG Photo

Luxury brands in Chinese market

According to McKinsey report, 7.6 million Chinese households spent an average of 71,000 yuan (10,686 US dollars) each on luxury items last year, reaching more than 500 billion yuan (7.4 billion US dollars) in total purchases, which is about one thirds of the global luxury market.

China was seen by the European luxury brands as the next retail hub as early as the year 2000. The influx of Western brands flooding the Chinese market swelled by 2014 with about 10 of the top luxury retail brands putting up as many as 1,320 physical stores.

Much of the shift is attributed to e-commerce, namely the rise of local e-commerce platforms like Alibaba and JD.com. Alone with more high-end brands to kick-start this year’s sale, Alibaba generated more than 14.3 billion US dollars in sales from last year’s the Singles' Day event.

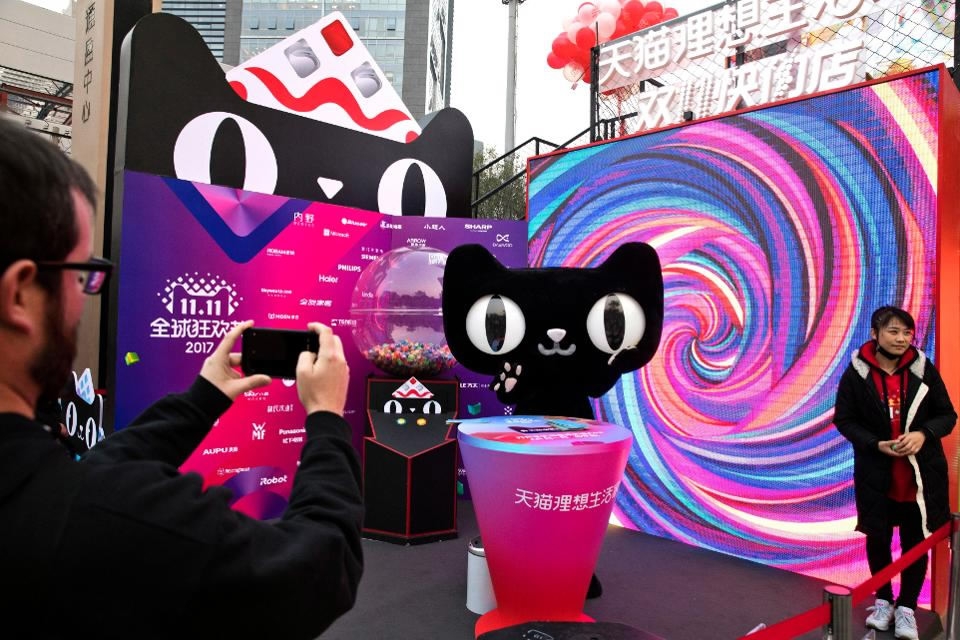

A mascot for Tmall, an online shopping website owned by Alibaba, promotes Singles' Day in Beijing, China, Monday, November 6, 2017. /AFP Photo

A mascot for Tmall, an online shopping website owned by Alibaba, promotes Singles' Day in Beijing, China, Monday, November 6, 2017. /AFP Photo

Historically, Chinese consumers tended to buy luxury goods when they traveling overseas. Under this situation, the government imposed high import taxes on goods meaning designer bags sold inside the country were likely to be 50 percent more expensive than abroad, according to consultancy firm Bain & Co. Now, a tax regime change, coupled with a stronger yuan and active price adjustments by labels including Chanel and Cartier, mean the gap is within 30 percent.

“Luxury, while not the same scale as mass consumer categories, still carries significant revenue opportunity for Alibaba and JD,” said Brian Buchwald, chief executive of New York-based consultancy Bomoda. “The Chinese lead the luxury market and it would be business malpractice not to attack it for the domestic players.”

1km

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3