Business

20:23, 14-Oct-2017

Two Chinese firms bidding for Chicago Exchange withdraw

By CGTN's Han Jie

Two of the three China-based bidders for the Chicago Stock Exchange (CSE) have withdrawn from the group trying to acquire the market, after the US Securities and Exchange Commission sought more details from the participants about their bid, the Wall Street Journal reported on Saturday.

Chongqing Jintian Industrial Co Ltd and Chongqing Longshang Decoration Co Ltd had agreed to invest about 8 million US dollars as part of a consortium that offered up to 25 million US dollars, the report said.

The firms’ managers dropped out as they felt abused by political criticism of the deal in Congress and the slow progress of approval at the SEC, the WSJ reported on Friday, citing people familiar with the matter.

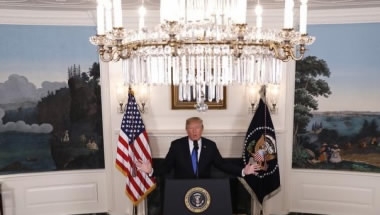

The United Sated Securities and Exchange Commission has stalled a decision on whether to let the deal go through. US President Donald Trump railed against the deal on the campaign trail last year. /Reuters Photo

The United Sated Securities and Exchange Commission has stalled a decision on whether to let the deal go through. US President Donald Trump railed against the deal on the campaign trail last year. /Reuters Photo

According to the report, the CSE plans to file records with the SEC, disclosing the investors’ exit as soon as next week. However, CHX Holdings Inc., the parent of the Chicago Stock Exchange, could recruit new American investors to replace the lost funding.

The United Sated Securities and Exchange Commission has stalled a decision on whether to let the deal go through. US President Donald Trump railed against the deal on the campaign trail last year.

The proposed sale of the privately owned exchange for an undisclosed amount to a consortium led by Chinese conglomerate Chongqing Casin Enterprise Group has drawn criticism from US lawmakers, who questioned the US SEC’s ability to regulate and monitor the foreign buyers if the deal is approved.

In August, the SEC put on hold a decision approving the sale of the Chicago Stock Exchange, giving the regulator more time to mull over the politically sensitive deal.

10615km

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3