14:31, 20-Mar-2018

Ringgit Surge Pain: Exporters feel pinch but rise reflects economic health

This time last year, Malaysian consumers, importers and the government were complaining about the weakness of the ringgit, especially against the US dollar. But in the latter part of 2017 and this year, the ringgit has surged around 13 percent against the greenback, making it one of Asia's strongest performers. As Rian Maelzer reports from Kuala Lumpur, the surge has cheered consumers and the government but not many exporters.

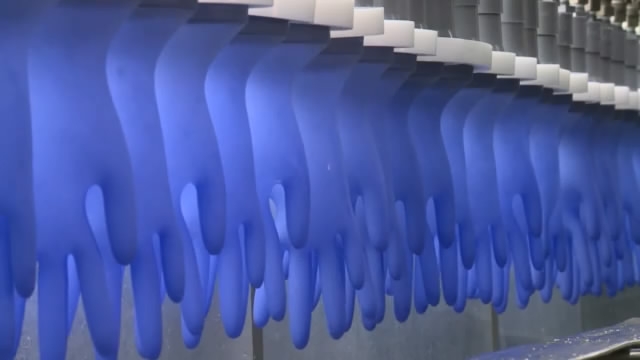

Malaysia produces more than 60 percent of the world's rubber gloves for medical and other uses. The 4-billion-dollar industry's sales are denominated in US dollars.

The same goes for other major Malaysian exports such as wood furniture and semiconductors, so the stronger ringgit will hit their profits. The rubber glove industry has a built-in currency hedge, though, with half its raw materials imported, and paid for in the now cheaper dollar.

DENIS LOW JAU FOO, PRESIDENT MALAYSIAN RUBBER GLOVE MANUFACTURERS ASSN. "Of course all exporters in Malaysia would enjoy a strong US dollar. But this industry is run by entrepreneurs, and they are a very mature lot. They know how to anticipate that the US dollar is going up and down. We have seen all kinds of headwinds. To remain as number one in the world you have to be that anticipatory. You must read the situation well enough."

RIAN MAELZER KUALA LUMPUR "The weakening dollar in fact reflects the United States' improved economic performance, and the generally positive global outlook, which should translate into higher orders for Malaysian exporters down the line."

And a stronger ringgit is good news for many.

MOHD. AFZANIZAM ABDUL RASHID CHIEF ECONOMIST, BANK ISLAM MALAYSIA "It's like a double-edged sword. If the ringgit continues to appreciate obviously those importers will benefit because their import costs will be much lower, especially those in automotive sectors or even food sectors; companies with US dollar debts; the aviation sector, especially for the outbound tourism."

Economists believe the ringgit has been undervalued.

MOHD. AFZANIZAM ABDUL RASHID CHIEF ECONOMIST, BANK ISLAM MALAYSIA "If the rate hike in the US is going to be gradual, if the trade protectionist policies may not happen in a big way, and oil prices continue to stabilize slightly about 60 dollars, I think there's a hope that the ringgit could appreciate further."

And with Malaysians having grumbled about the weak ringgit since 2016, the currency's surge is welcome news for the ruling coalition, which is expected to call an election within weeks. Rian Maelzer, CGTN, Kuala Lumpur.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3