17:37, 17-Apr-2019

Small Business Financing: Foreign lender calls for micro lending ecosystem support

Updated

17:30, 20-Apr-2019

03:43

Building your dreams and business ventures often starts with needing a loan. Yet millions cannot get the funding for a number of reasons. CGTN's Wei Lynn Tang spoke to a business owner in southwestern China, and a foreign lender to see how the funding gap can potentially be bridged.

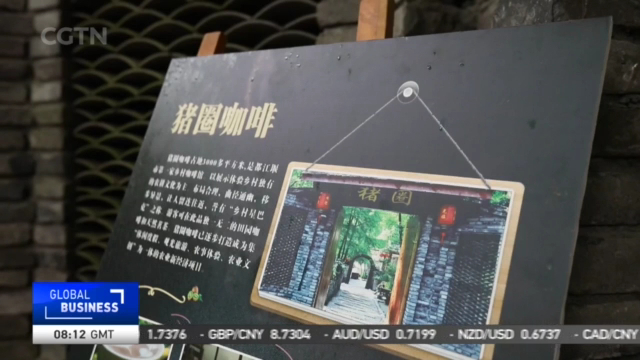

This piece of land was previously used to rear pigs. But now, behold, you can get your coffee fix here on the outskirts of southwest China's Chengdu city.

A unique proposition but a bet that's paying off. Song Jianming took out a 300-thousand yuan business loan in 2016 to build this cafe which costs three times more. Since then his profits have grown 20 percent annually, out-pacing his pre-financing days.

SONG JIANMING, GENERAL MANAGER ZHUQUAN COFFEE, LIUJIE TOWN, DUJIANGYAN CITY "In 2016, the government introduced a village rejuvenation strategy. I thought it was a good development opportunity and wanted to expand our scale. Our cafe has since become well-known."

The cafe is an extension to Song's restaurant business within the same compound, which has been in operation since 2013.

But even with a three-year profit track record, it wasn't easy initially to get funding.

SONG JIANMING, GENERAL MANAGER ZHUQUAN COFFEE, LIUJIE TOWN, DUJIANGYAN CITY "We approached banks, but they required collateral which we don't have, as we operate on rented collective land. I have invested close to 10 million yuan in this business."

WEI LYNN TANG CHENGDU "This farm stay is just one of the tens of millions of micro and small-sized companies in China that is under-served when it comes to access to financing. Micro and small-sized companies account for about 60 percent of China's GDP. Yet, only one - third of corporate loans by financial institutions are given out to this group."

Song found a solution through a foreign lender. An unsecured loan, the rates are slightly higher than those of major commercial banks. But, he welcomes the convenience.

Fullerton Credit, wholly owned by Singapore's Temasek Holdings, has been serving China's self-employed mass market for the past 10 years. Its CEO Mark Lim commends recent policies announced for commercial banks to boost lending to smaller firms. But he believes policies should also be extended to the entire micro lending ecosystem.

MARK LIM, CEO FULLERTON CREDIT SERVICES GROUP "The leverage cap that is currently placed on micro financial institutions. At 2.5 times I think for selective MFIs that could be lifted. Also the type of funding sources currently available to MFIs are quite limited, so if the range of funding sources can be expanded, it'll also help MFIs to grow more scale to lend to small and micro enterprises."

Fullerton Credit is funded by its parent company and banks. Net income and return on equity were volatile for the Chengdu-headquartered lender over the past few years. But it is determined to compete long-term in China.

MARK LIM, CEO FULLERTON CREDIT SERVICES GROUP "China is a very huge market, if you're able to get a certain share of it, no matter how small, it's already fairly significant. Two, it's a very exciting market - very high up on fintech evolution. I think if we do well we'll be able to benefit from the experience that we learn in China market across the other markets that we are currently operating in the world."

To remain relevant, Fullerton Credit is investing in technology and its online processes to capitalize on the scale of the Chinese market. WLT, CGTN, Chengdu.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3