China

14:18, 03-Oct-2017

Rise in unlocked shares to weigh on China's stock market

CGTN

Unlocked shares are expected to hit the market hard in the coming months, thus increasing liquidity strains through the Chinese stock market.

According to information service provider Wind, lock-up shares from the initial offerings of 44 companies will become eligible for trading.

In the first trading week after the long National Day and Mid-Autumn Festival holiday, the lock-up period will expire for 21 companies' initial offerings.

A further 43 will expire in November and 56 in December, which is much more than the monthly average of around 30 for the first half of the year, putting the stock market under pressure.

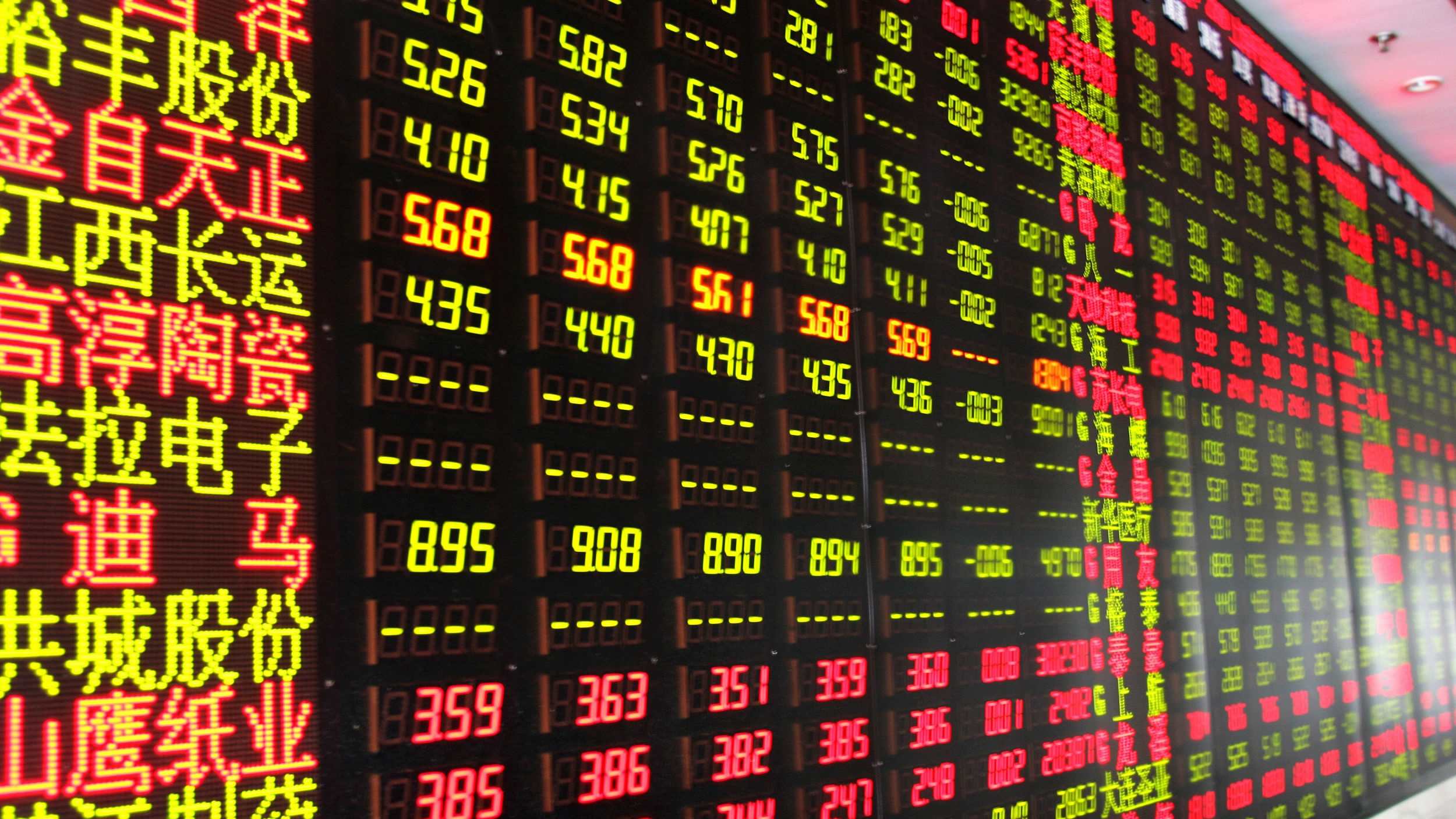

The Shanghai Stock Exchange/VCG photo

The Shanghai Stock Exchange/VCG photo

Southwest Securities estimates 111 billion yuan (about 16.7 billion U.S. dollars) of restricted shares from initial offerings will be unlocked in October, a surge of 69 percent from a month earlier.

Under China's market rules, major shareholders must wait one to two years before they are permitted to sell their shares.

The benchmark Shanghai Composite Index went up 0.28 percent to 3,348.94 points at the last trading day, and the Shenzhen Component Index closed 0.51 percent higher at 11,087.19 points.

Source(s): Xinhua News Agency

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3