Business

16:51, 22-Feb-2018

African startup venture capital increased 50% in 2017

Nicholas Moore

2017 saw the amount of venture capital pumped into African startups grow by more than 50 percent, according to a new report that suggests fintech and digital technology are leading an entrepreneur boom across the continent.

The report, by San Francisco-based venture capital firm Partech Ventures, says 560 million US dollars was pumped into African startups last year, a 53 percent increase on the year before. 128 funding rounds (held by 124 different companies) were staged, compared to 77 rounds by 74 startups in 2016.

VCG Photo

VCG Photo

Partech Ventures last month announced plans to raise a 100 million US dollar African startup fund, one of the largest ever to focus solely on Africa. The investment firm also said it would look to steer investment towards underdeveloped markets like francophone Côte d’Ivoire, Senegal and Cameroon.

45 percent of investment went into the “financial inclusion” sector – with more and more startups looking to connect people to financial services such as banking, saving accounts, credit and insurance.

Africa lags far behind other parts of the world when it comes to financial inclusion – The World Bank found in 2014 that only 34 percent of adults in sub-Saharan Africa had bank accounts, and only 16 percent had access to formal savings services.

However, people in sub-Saharan Africa have adopted mobile money accounts faster than many other populations – 12 percent of the population had such accounts in 2014, compared to two percent in the rest of the world.

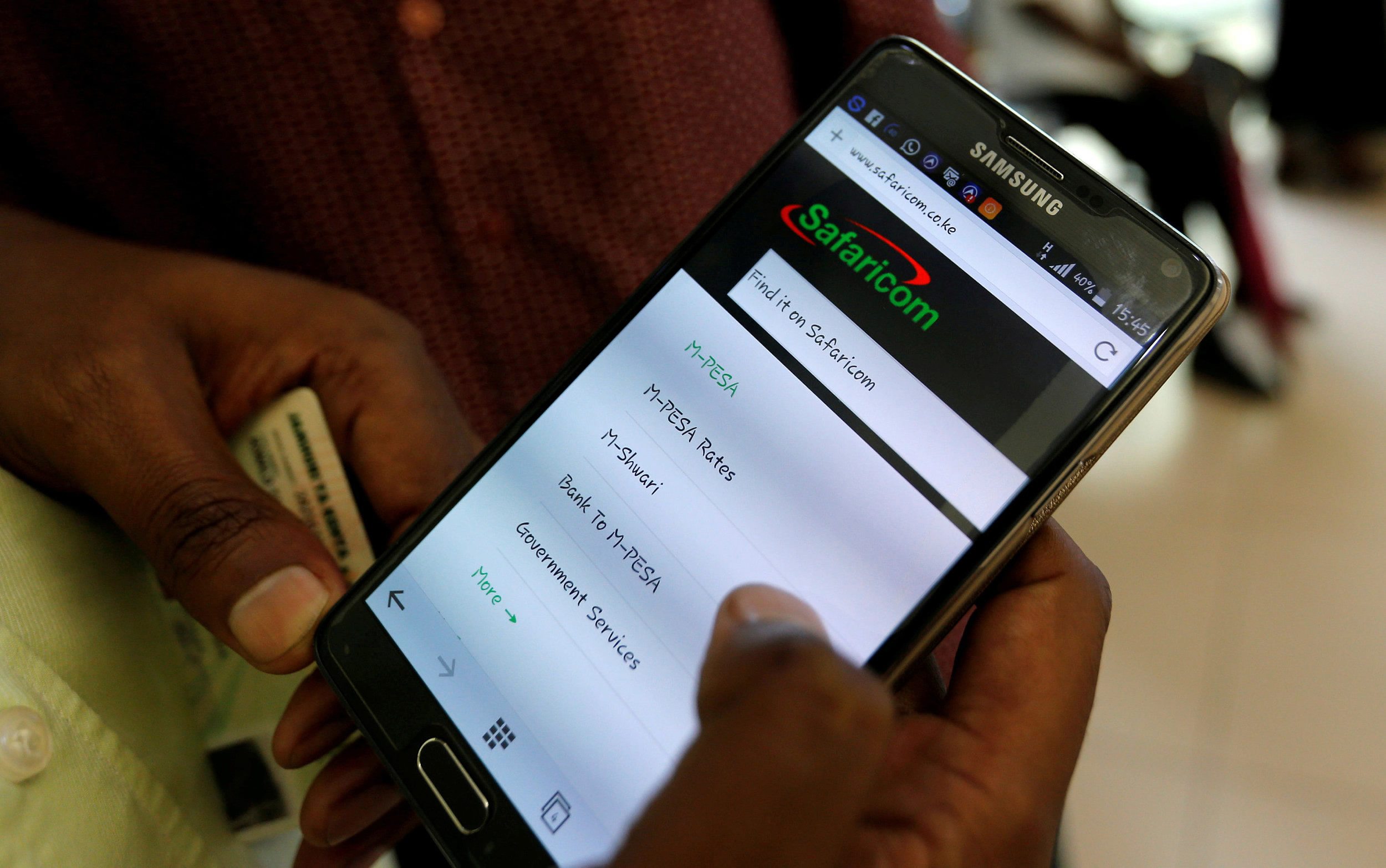

An employee assists a customer to set-up M-Pesa money transfer services on his handset in Nairobi, Kenya. /VCG Photo

An employee assists a customer to set-up M-Pesa money transfer services on his handset in Nairobi, Kenya. /VCG Photo

That trend has continued, with Kenya taking the lead in mobile payments on the continent. 36 million Kenyans have signed up to mobile money accounts, with some 16 million daily transactions taking place over M-Pesa – the country’s most popular payment app.

The collapse of cash in Zimbabwe has also seen rapid adoption of mobile payments, with some 80 percent of transactions now taking place through apps according to The Guardian, citing Lance Mambondiani, the CEO of Steward Bank, a subsidiary of Zimbabwe’s biggest mobile provider.

“Online and mobile consumer services” represented 42 percent of venture capital last year, with 105 million US dollars pumped into the e-commerce sector.

An Africab car leaves the company's headquarters in Abidjan, Nigeria, in November 2016. Africab is a homegrown company that has tapped into the global car-sharing boom. /VCG Photo

An Africab car leaves the company's headquarters in Abidjan, Nigeria, in November 2016. Africab is a homegrown company that has tapped into the global car-sharing boom. /VCG Photo

76 percent of the startup capital raised went to companies based in South Africa, Kenya and Nigeria. While the three countries continue to dominate investment, Egypt (36.9 million US dollars in venture capital) and francophone countries (14 percent of total transactions) are showing signs of growth as upcoming tech hubs.

One major factor in the growth of African startups is Chinese investment in the continent and its infrastructure. In 2016, China became the largest source of foreign direct investment (FDI), with Ernst and Young saying the country had spent 66.4 billion US dollars and created more than 130,000 jobs in Africa since 2005.

21 billion US dollars alone has been spent on improving infrastructure, boosting interconnectivity and business.

Chinese investment into African technology has seen just one mobile phone manufacturer – Hong Kong-based Tecno – achieve 25 percent market share across the entire continent.

A Tecno Mobile store opening in Kigali, Rwanda, September 2013. /VCG Photo

A Tecno Mobile store opening in Kigali, Rwanda, September 2013. /VCG Photo

A report last year by McKinsey found that as many as 10,000 new firms may have been created thanks to Chinese FDI. While the majority of those are Chinese firms, on average 64 percent of Chinese firms in Africa offer training and apprenticeship schemes to local people.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3