Politics

22:02, 02-Jul-2017

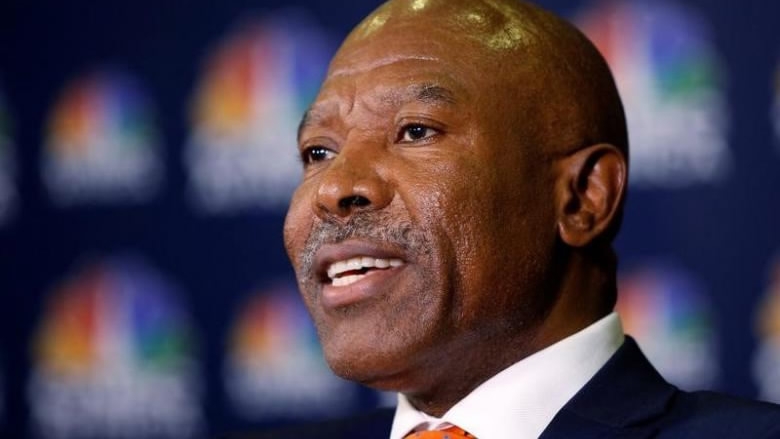

Central bank governor fears South Africa may fall into recession

The South Africa Reserve Bank's Governor Lesetja Kganyago on Sunday said the country risks falling into a long and painful economic recession if the central bank is forced to abandon its policy of reducing inflation and protecting the currency.

In an editorial article published in the Sunday Times newspaper, Kganyago said the recent recommendation by an anti-graft agency for the central bank to focus on growth misunderstood the dangers of persistently high consumer prices.

"The past half-century is littered with examples of painful recessions caused by the need to reduce runaway inflation created by authorities trying to create growth by printing money," Kganyago said.

Credit downgrades by two of the top three ratings agencies, based on the economic and political turmoil, have dented business and consumer confidence in South Africa, which has just suffered two quarters of economic contraction.

Public Protector Busisiwe Mkhwebane set-off a political row this month when she called for an overhaul of the bank's mandate – to focus on growth rather than inflation and the currency – rattling investors and hitting the rand hard.

The bank has since filed a court challenge to quash the recommendation. On Friday, Finance Minister Malusi Gigaba echoed parliament's and the ruling party's denouncement of the recommendation, accusing the agency of overstepping the mark.

The bank aims to keep price-growth below six percent, currently at 5.4 percent, and since early 2014 has lifted benchmark interest rates by 200 basis points in a bid to cool inflation and encourage long-term investment.

"Monetary policy is always about supporting economic growth in a sustainable way. Experience shows economies grow stronger and more consistently at lower inflation rates," Kganyago said.

(Source: Reuters)

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3