Business

15:13, 22-Jun-2017

Guidelines to Bond Connect delete expressions about investment quota

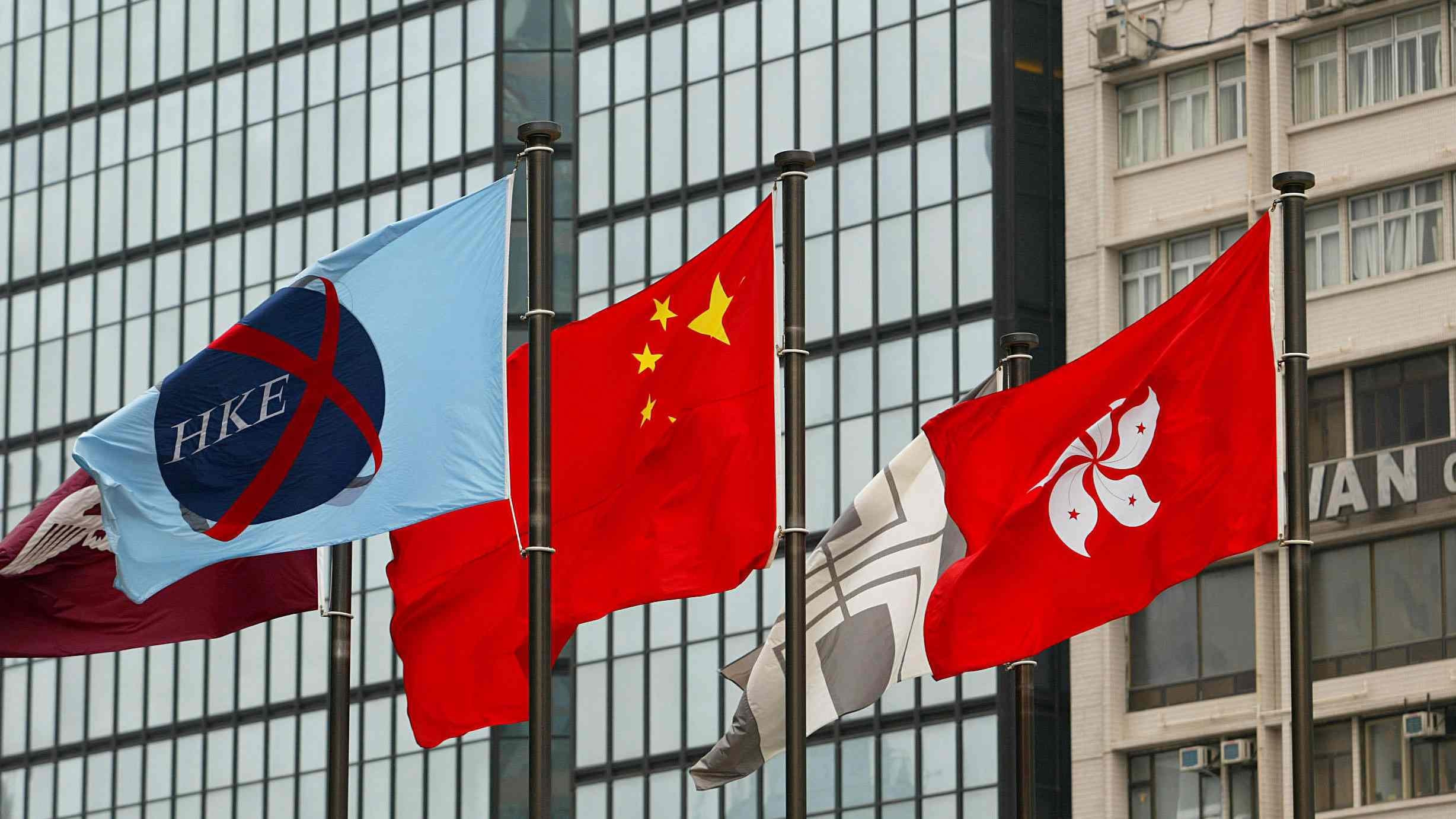

China's central bank on Wednesday announced its preliminary management guidelines for the Bond Connect scheme, which allows cross-border trading of bond products. It comes into effect immediately.

International investors will be eligible to buy and sell in the mainland's interbank bond market with either RMB or foreign currencies, via the so called "northbound trading".

VCG photo

VCG photo

Mention of investment quota limit deleted

It's also worth noting that the "guidelines" have deleted the part that there's no investment quota limit for the northbound trading from the exposure draft version released on May 31. The latest document gives no regulations about investment quota.

Market observers and investors suggested that the People's Bank of China is leaving a leeway for the future, and there's no necessity to over interpret it.

Societe Generale's global market director in China He Xin believed that it reflects the central bank's foresight and flexibility.

Bond Connect was designed basically to attract more overseas capital to China's fixed income market, however is also posing a threat to the link between both sides, explained Zhong Wenquan, Moody's managing director for credit analysis in great China area. "Is the system able to process such a massive amount of investment?" Taking out the expressions about investment quota leaves space for refining the regulation in the future and maintains the central bank's credibility.

The "guidelines" were introduced one day following stock index provider MSCI's inclusion of China's A-shares market, seen as another step internationalizing the yuan and opening up its door of the financial market.

Compared to MSCI's inclusion of A-shares market, Bond Connect plays a more influential role in Chinese market, said Peng Cheng, investment strategist with Citi's private bank sector. With the debt market worthy of six to seven trillion US dollars opens up, a larger amount of capital inflow could be expected, even larger than it in the stock market.

VCG photo

VCG photo

The opening up of Chinese bond market

China is the world's third largest bond market, worth 7.5 trillion US dollars, following the US at 35 trillion and Japan at 11 trillion US dollars.

However, foreign investors hold less three percent of that total as the market has not yet been opened up, according to Standard Charterd.

Over the last two decades, Chinese authorities have taken numerous steps to make its onshore sovereign and corporate bond market available to overseas investors.

In 2002, the country introduced the Qualified Foreign Institutional Investors (QFII) scheme;

In 2011, RMB Qualified Foreign Institutional Investors (RQFII) scheme has been introduced;

In 2016, some foreign investors are allowed to access the interbank bond market directly, with the removal of quotas, lock-up periods and repatriation limits of QFII and RQFII scheme.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3