Business

19:48, 20-Sep-2017

China's Oceanwide hopes to close Genworth deal by year's end

CGTN

Having secured approval from a US government panel, a senior executive said on Tuesday that China's Oceanwide Holdings Co Ltd can now go ahead with its 2.7 billion US dollar acquisition of US insurer Genworth Financial Inc, aiming to complete the transaction by the end of the year.

At the start of the fiscal year, the two companies refiled their application to the Committee on Foreign Investment in the United States (CFIUS), a US government panel that examines foreign acquisitions with regard to national security concerns. The companies then refiled the application for the second time in July.

Han Xiaosheng, executive director and president of Oceanwide Holdings, told reporters on Tuesday that getting CFIUS’s approval by the end of next month was difficult, and that the company would try to close the deal by the end of this year.

Genworth Financial Inc /VCG Photo

Genworth Financial Inc /VCG Photo

“We are still working on it,” Han said, referring to the Genworth deal. “It could be relatively difficult to receive it (CFIUS approval) by the end of October. Therefore we will try to get it by the end of the year.”

The deal was expected to be complete by the middle of the year, but the outlook has been clouded by the more conservative stance, taken by CFIUS under President Donald Trump, toward Chinese takeovers of US companies.

Trump last week prevented a Chinese-backed private equity firm, Canyon Bridge Capital Partners, from buying US based chipmaker Lattice Semiconductor Corp in a 1.3 billion US dollar deal.

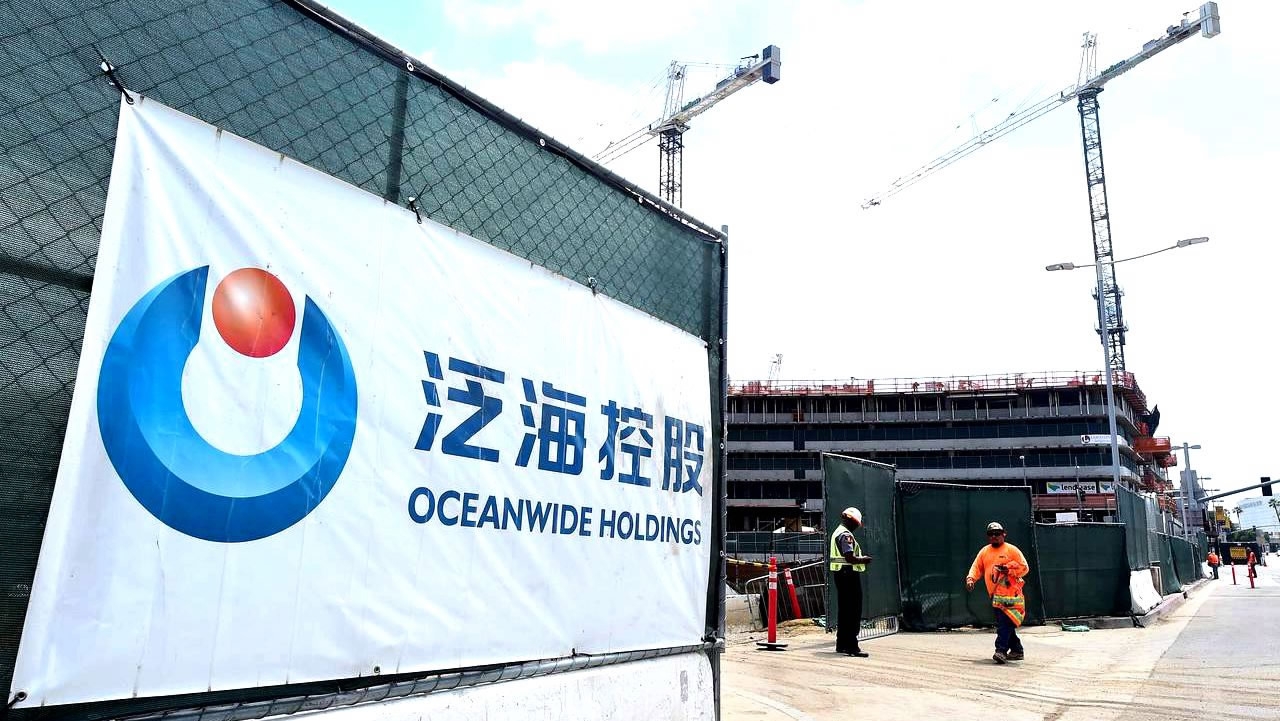

Beijing based Oceanwide bought San Francisco's iconic First and Mission site for 300 million US dollar 2016. /VCG Photo

Beijing based Oceanwide bought San Francisco's iconic First and Mission site for 300 million US dollar 2016. /VCG Photo

When asked if Oceanwide planned to refile its application with the CFIUS for the third time, the Chinese company executive said that option depended on the pace of the response in the current round.

“Genworth is a very important platform for us as there’s a blank in China’s insurance industry, in the long term care-related business,” he said, adding that the US life insurer could fill that gap with its experience and products.

Oceanwide, a Beijing-based investment firm founded by low-profile but well-connected billionaire Lu Zhiqiang, agreed in October last year to pay 2.7 billion US dollars in cash for all Genworth shares.

11002km

Source(s): AP

,Reuters

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3