13:34, 21-Aug-2019

Apple Payments: Apple credit card now available in US

Updated

15:41, 21-Aug-2019

Apple has a new product rolling out this month. And it's not a device, or software. It's a credit card. How exactly does it play into the Apple strategy? Mark Niu has the details.

Apple sent its new card to a select group of customers and launches for all U.S. consumers over the next several weeks.

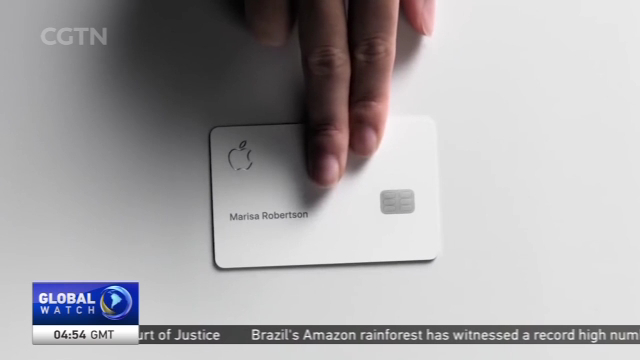

Apple has partnered with MasterCard and Goldman Sachs to introduce the sleek Titanium, laser-etched Apple Card.

JOHN MEYER MANAGING PARTNER, STARSHIP CAPITAL "I think this will likely be the fastest growing credit card in history. I don't think any other credit card will match the speed of how quick this will likely grow."

Venture Capitalist John Meyer says via Apple Wallet, it took him less than 30 seconds to apply for a card.

JOHN MEYER MANAGING PARTNER, STARSHIP CAPITAL "Because Apple on your phone already has your personal information, the form is already filled out. All you really have to do is sign up, enter your social security and from there, an offer you can accept and then you get a card in the mail."

MARK NIU MOUNTAIN VIEW, CALIFORNIA "Unlike other major credit cards, Apple and Goldman Sachs have said they will not share your personal information. The card also has no late fees and no annual fees. And through its software, it encourages you to pay less interest."

Via Skype, I asked Ted Rossman of Creditcards.com how the companies will make money off this card.

TED ROSSMAN INDUSTRY ANALYST, CREDITCARDS.COM "I think that's an open question. I don't think this card is going to be a big money maker for Goldman or for Apple. I think both are playing the long game. For Goldman, it's their entry into consumer finance for credit cards. For Apple, I think it's part of this longer term view towards the payment ecosystem."

The Apple Card offers 1% cash back when you use the physical card, 2% cashback when using Apple Pay and 3% when buying something from Apple

Rossman says while Apple is known for targeting affluent customers, this time it's going for a broader base.

TED ROSSMAN INDUSTRY ANALYST, CREDITCARDS.COM "I'm starting to think less of a card for reward chasers, because they can do better with other cards, but more of an option for people who are new to credit or rebuilding credit."

Recent earnings reports show Apple iPhone sales are falling while its services revenues continue to rise.

But venture capitalist Meyer says the two are intertwined, just like the Apple Card is with the iPhone.

JOHN MEYER MANAGING PARTNER, STARSHIP CAPITAL "They've designed this, so if you get rid of your iPhone you can't even pay the bill, so it's probably one of the strongest forces in the future to keeping people on IOS as opposed to switching to Android."

So, it might look like Apple is creating a new revenue stream by getting into banking. But the card is also a way to boost sales of its core product-the iPhone.

Mark Niu, CGTN, Mountain View, California.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3