22:12, 30-Apr-2018

Asset Management Sector: China bars guaranteed principal repayments

01:59

We open with a look at asset management in China. The People's Bank of China has officially issued a regulation that defines qualified investors and eliminates the tacit rule of guaranteed repayments in the asset management sector. Take a look.

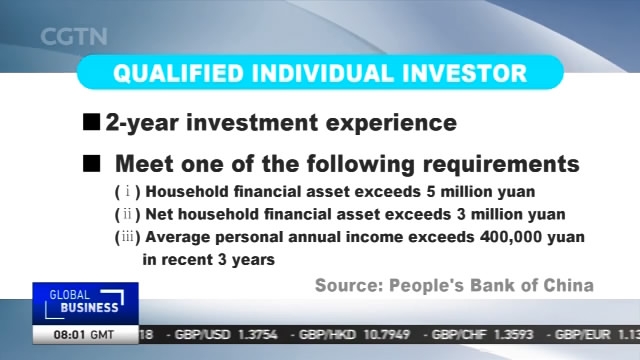

Individuals now will have to have at least two years of investment experience to become qualified investors. In addition, they must have household financial assets of at least 5 million yuan or annual income more than 400 thousand yuan. Institutional investors' net assets must exceed 10 million yuan to be qualified. The regulation sets minimum investment amounts in different financial products and expressly prohibits investors from using leverage.

YOU YU, VICE PRESIDENT ZHONGRONG TRUST "Previously, financial regulators have their own definitions of qualified investor and they are not coherent. The new rules unify the definition."

The regulation expressly prohibits financial institutions operating asset management businesses from guaranteeing principal repayments to investors. That had been a tacit rule in the sector. The new rules also bar multi-layered asset management products, increasing transparency for investors.

LIU DONGHAI, GENERAL MANAGER INVESTMENT BANKING & ASSET MANAGEMENT, BANK OF CHINA "The regulation removes the risks of financial bubbles created by shadowing banking and complex structuring of financial products."

The official regulation also extends the transitional period to the end of 2020 compared with mid-2019 set in the draft. That will largely reduce the risk of massive sell-offs.

WANG ZENGWU, DIRECTOR INSTITUTE OF FINANCE AND BANKING, CHINESE ACADEMY OF SOCIAL SCIENCES "The short-term impact is minimized. The transitional period in the draft regulation was short and that would lead to sell-offs. A longer transitional period will give enough time for institutions to replace their old products with new ones."

Analysts say capital may turn to open-ended public funds as the repayment of principal invested in asset management products is no longer guaranteed.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3