Business

11:18, 12-Jan-2018

S&P cuts Brazil debt rating as pension reform doubts grow

CGTN

Ratings agency Standard & Poor’s cut Brazil’s credit rating further below investment grade on Thursday as doubts grew about a presidential election in October and a push to trim its costly pension system, seen as vital to closing a huge fiscal deficit.

S&P lowered its long-term rating for Brazil sovereign debt to BB- from BB previously, with a stable outlook, citing less timely and effective policymaking. S&P also cited a risk of greater policy uncertainty after this year’s elections.

The decision underscored concerns that a business-friendly reform agenda proposed by the unpopular President Michel Temer may stall this year.

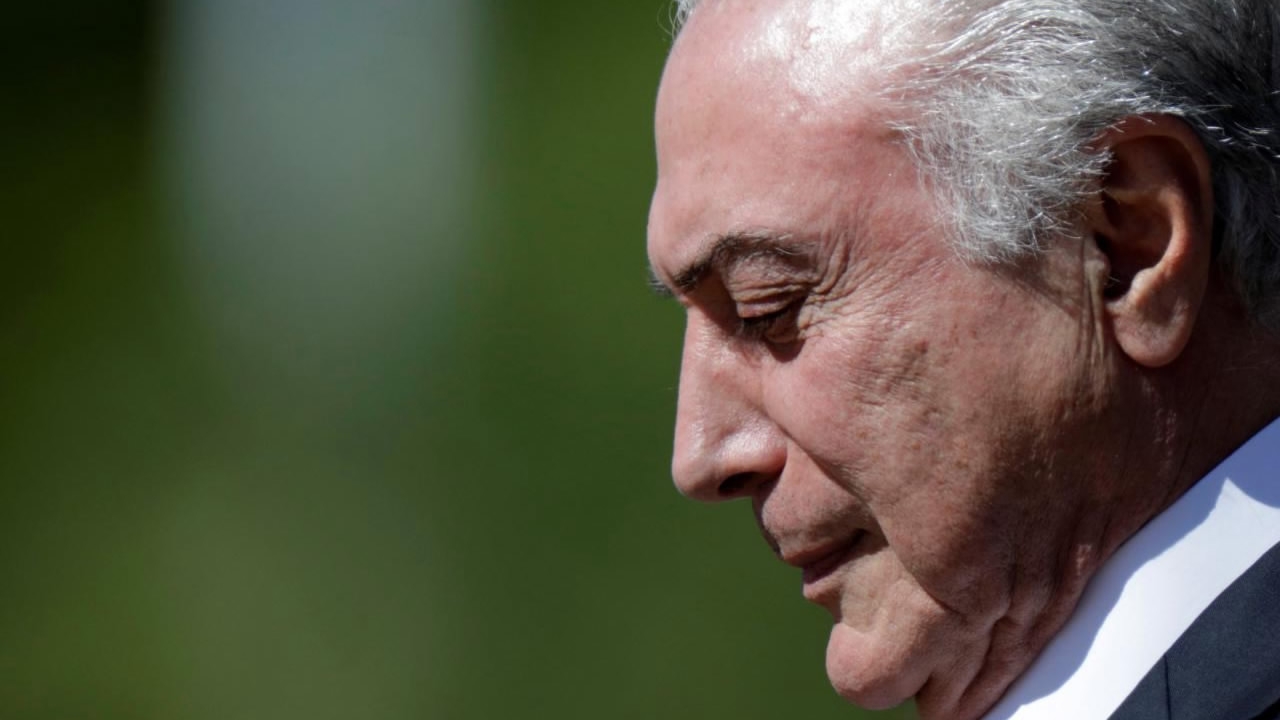

Brazil's President Michel Temer speaks at the Planalto Palace in Brasilia, Brazil. /Reuters Photo.

Brazil's President Michel Temer speaks at the Planalto Palace in Brasilia, Brazil. /Reuters Photo.

The Finance Ministry said in a statement that it would continue to push for an overhaul of Brazil’s social security and tax policies, adding that S&P’s decision underscored the urgency of those fiscal reforms.

Finance Minister Henrique Meirelles had met with ratings agencies to try and stave off a downgrade after the government delayed until February a vote on pension reform that had been expected last year.

“I think it’s a warning of the economic and social consequences of not approving pension reform,” said Wellington Moreira Franco, secretary-general for President Michel Temer.

Brazil's Finance Minister Henrique Meirelles /Reuters Photo.

Brazil's Finance Minister Henrique Meirelles /Reuters Photo.

The move by S&P brings its long-term sovereign rating for Brazil three notches below investment grade. Brazil is rated Ba2 by Moody’s Investors Service and BB by Fitch Ratings, both two notches into “junk” territory.

Brazil lost its investment grade rating in 2015 as the country headed into its deepest recession in decades and the government of then-President Dilma Rousseff failed to tame a budget deficit that exploded when a commodities boom faded.

The downgrade highlights the stakes heading into this year’s wide-open presidential election, with key fiscal measures hanging in the balance and voters seething after years of corruption scandals that tarred major political parties.

Many in Brazil regarded S&P’s decision to award Brazil an investment-grade rating in 2008, then the 14th government to receive the distinction, as validation of the country’s growing leadership among emerging markets.

Since taking office last year, Temer has vowed to regain Brazil’s investment grade by cutting red tape, halting growth of public debt and privatizing state firms.

Yet Temer has struggled to close the deficit and was forced to shelve much of his reform agenda last year as he fought corruption charges that sank his approval rating into single digits.

Source(s): Reuters

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3