21:50, 30-Oct-2018

Banking and Insurance Sectors: China to escalate efforts to support private, small enterprises

Updated

20:54, 02-Nov-2018

01:06

China's Banking and Insurance Regulatory Commission said Tuesday the nation's banks and insurers have performed well in serving private enterprises and micro- and small-sized enterprises. By the end of September, loans from private enterprises reached 30.4 trillion RMB, while loans from macro- and small-sized enterprises totaled over 8.9 trillion RMB. That's an increase of nearly 20 percent YoY. It's also 7 percentage points higher than average loan growth. The commission says their next step is to urge the banking and insurance companies to further implement relevant policies to better serve those enterprises.

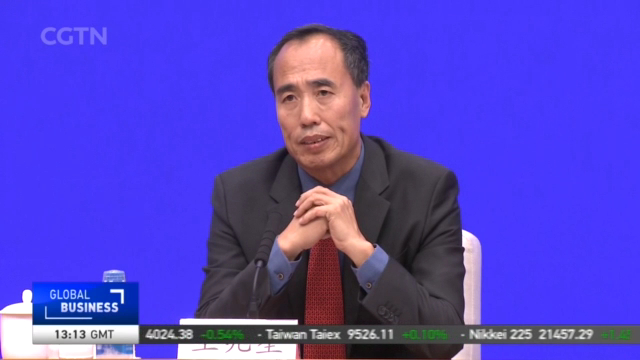

WANG ZHAOXING, VICE CHAIRMAN CHINA BANKING AND INSURANCE REGULATORY COMMISSION "We will further motivate banks and financial institutions to better serve private enterprises, encourage them to issue more credit loans, and reduce their dependence on loan mortgages for private enterprises and micro- and small-sized businesses. We also need to shorten the time for loan approval and better meet the capital needs of private enterprises."

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3