Business

16:51, 30-Nov-2017

Mobile short videos a new favorite for investors in China

By Song Yuanyuan

China's mobile short video industry has witnessed explosive development with the increasing number of smartphone users in the country.

It is now replacing traditional online live streaming as the newest trend among investors cashing in on China's mobile Internet businesses.

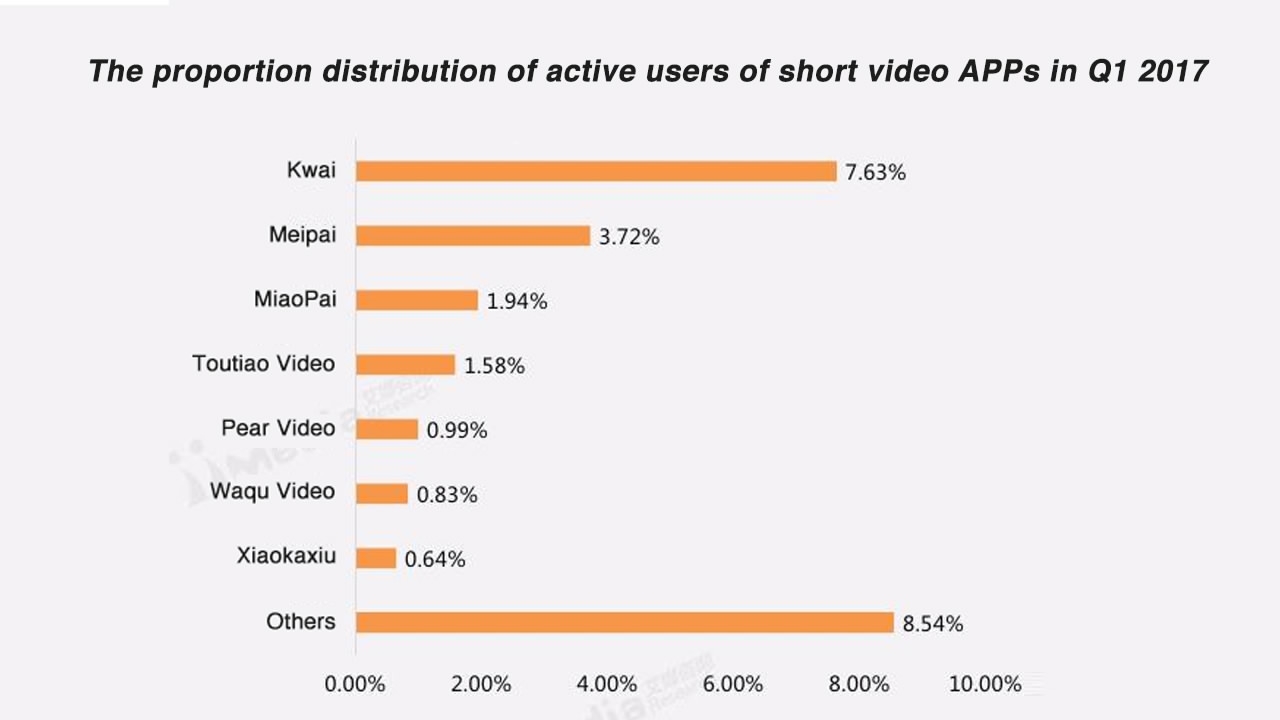

In March 2017, Internet giant Tencent announced a 350 million US dollar investment in Kwai (Kuaishou in Chinese pinyin), and most recently, many media sources say it was preparing for IPO in Hong Kong.

Although Kwai didn’t confirm the news, Tencent’s March investment has placed this rising app’s valuation at about 3 billion US dollars.

With a claimed 400 million users in total and as many as 40 million daily active users, Kwai is believed by many to be the fourth largest social media app after WeChat, Weibo and QQ.

And this fast-growing platform is just one case in the flourishing short video industry in China.

Short video, an investor's new favorite

Source: iiMedia Research

Source: iiMedia Research

Wang Xinxi, a senior TMT analyst said that during the past year, there have been over 30 investment deals struck in the short video business, amounting to 5.37 billion yuan (813.01 million U.S. dollars), including from well-known investment institutions Sequoia Capital, Zhen Fund and MatrixPartners China.

China’s internet giants Alibaba and Tencent, have both been aggressively expanding into the industry.

Alibaba’s subsidiary video-sharing website Tudou announced in May a scheme to reward the best 2,000 short videos with 2 billion yuan in cash.

Tencent said in February it will pour 1 billion yuan (152 million US dollars) into subsidizing producers of original short videos this year.

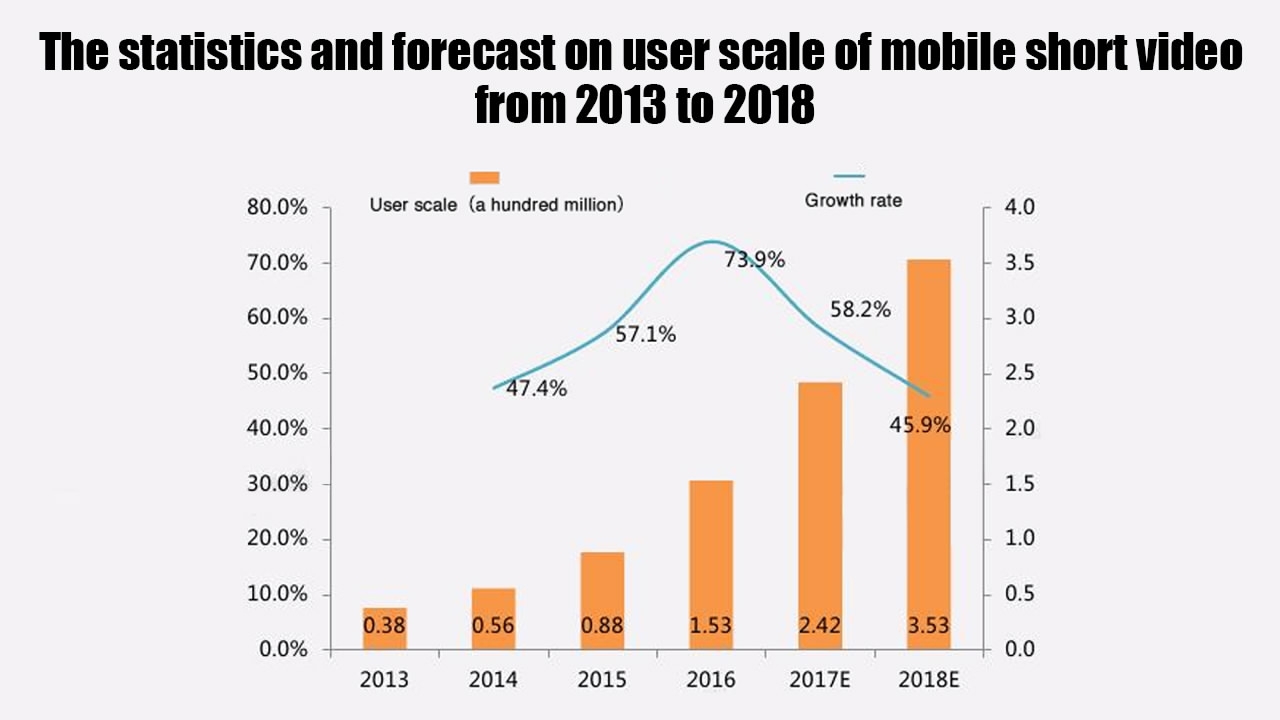

According to iiMedia Research, watchers of mobile short video, less than 20 minutes in length, will reach 242 million by the end of this year, up 58.2 percent on last year and by the end of next year, that number is expected to reach 353 million, topping the US population.

Short video vs. live streaming

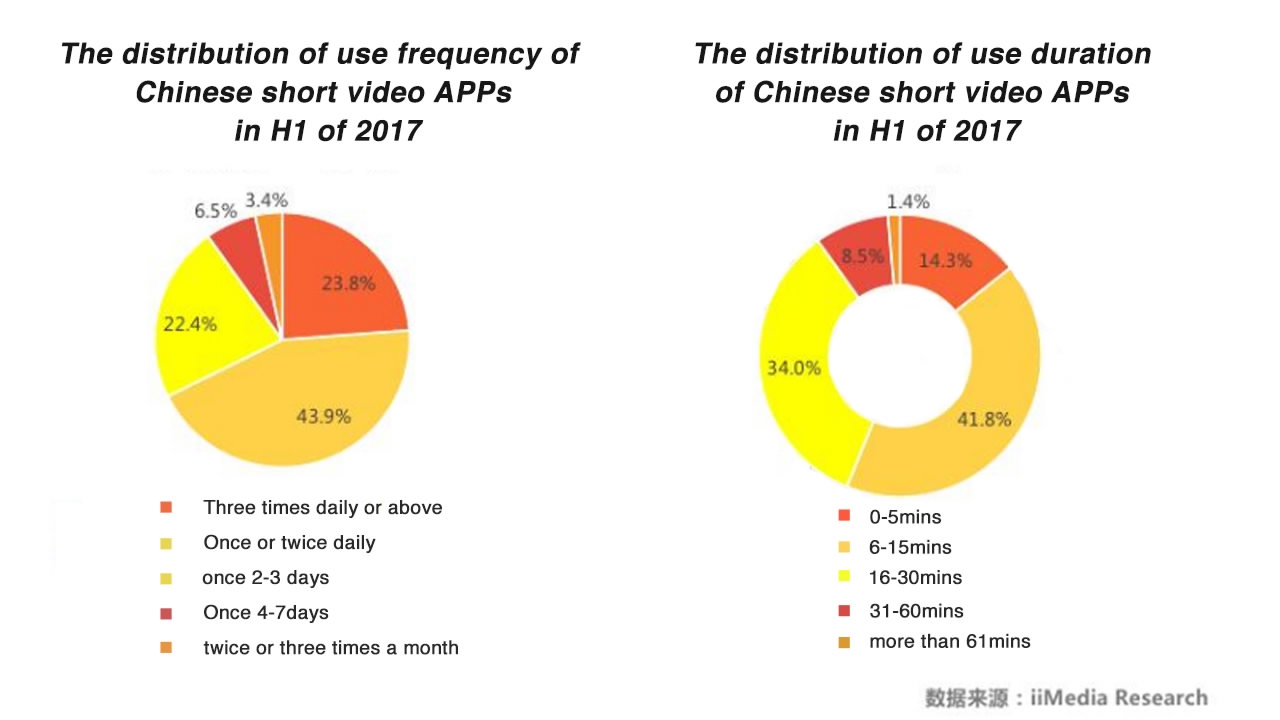

22-year-old college student Amanda Liu spends nearly half an hour on the Dou Yin app every day, a creative music short video social app where users can upload 15-second clips.

Liu told CGTN she used to spend a lot of time on live streaming apps a year ago, but now finds short video sharing platforms more interesting and original.

“I love singing and pop music. With this app, I can choose any type of music and then upload and edit with my own videos, I can also share it on social platforms, it is very fun and creative,” she said.

Liu said a lot of streamed content is boring but that short video apps are much more flexible.

Source: iiMedia Research

Source: iiMedia Research

In August, Dou Yin was bought by Jinri Toutiao, a major news and information content platform powered by artificial intelligence technology.

And in early November, Toutiao announced its overseas expansion by purchasing Musical.ly, a popular musical short video social app in America.

Through this move, Dou Yin will merge with Musical.ly, to race against Kwai, sources say.

As Wang points out, the market for live streaming users is close to saturation.

With the current number at nearly 400 million providing content to more than 200 platforms, it is very unlikely to see new stars coming out.

But much of the live streaming industry still focuses on pretty looks and boring content, leading many users to suffer from aesthetic fatigue. And although live streaming is more interactive than short video platforms, its deadly shortcoming lies in the defects of redistribution.

Source: iiMedia Research

Source: iiMedia Research

In addition, news of vulgar content is published almost on a daily basis which adversely affects the image of the industry.

On the flipside, short videos are still on the uptrend. On the one hand, its users scale is still increasing, while on the other users themselves have better participation experiences in creating the videos.

Ads, main source of income

How to make a sustainable and profitable business model from short video platforms is an ongoing topic.

Currently, ads still account for a big chunk of revenue. According to iResearch, by 2020, ad revenue from short videos will reach 60 million yuan (9.08 billion US dollars) .

Source: iiMedia Research

Source: iiMedia Research

And mobile video, as China’s fastest-growing digital ad platform, is predicted to overtake traditional television spending by 2021, already accounting for 13 per cent of all media ad outlay.

According to iiMedia Research’s survey, 50.8 percent of interviewees say headlines affect whether they will click a video or not, and 48.2 percent and 37.9 percent respectively think content tags and comments affect the clicks.

As for the duration of the video, 29 percent responded that a 1 to 2-minute long video is the best, with 25.7 percent thinking between 31 to 60 seconds is the optimum length.

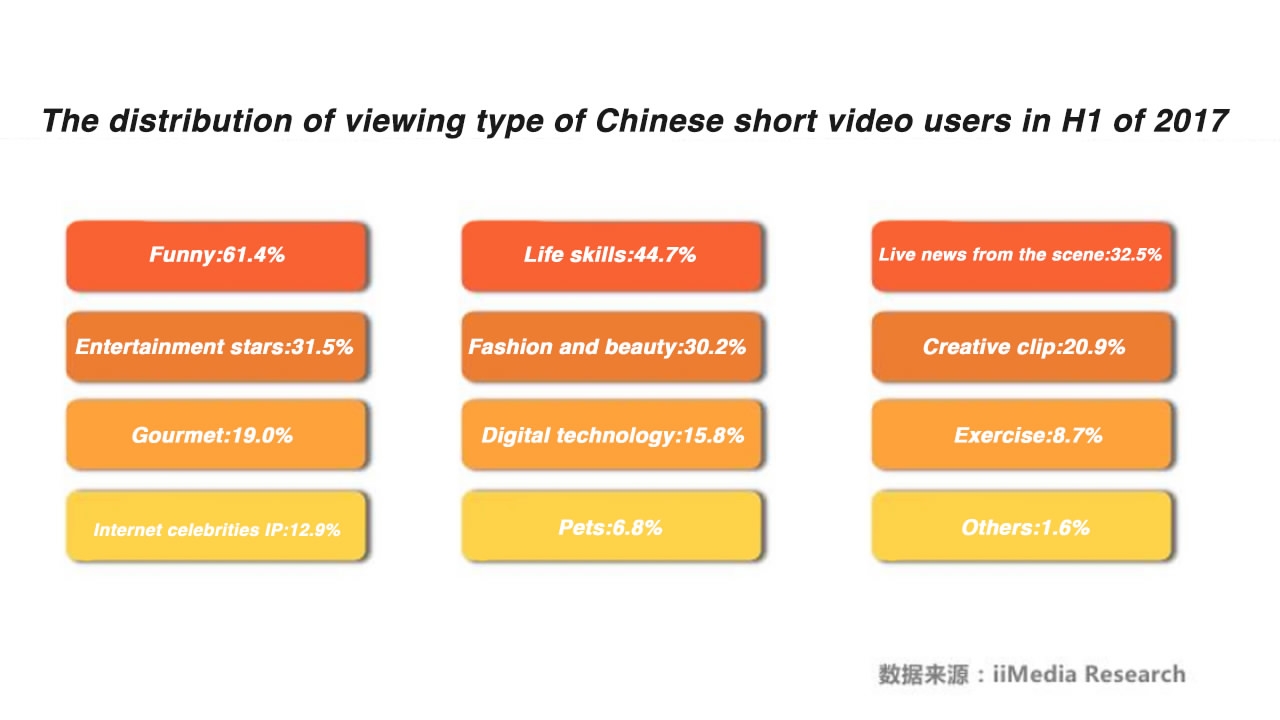

In future, core competition will focus on good quality content and diversity for different viewers, as iiMedia research points out.

In the meantime, the vast amount of short video content also poses challenges for regulators.

For example, in February, Pear Video was ordered to revamp due to a lack of internet video service licenses. In addition, copyright violations online is another pressing task for regulators.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3