Business

15:29, 04-Sep-2017

ICOs ruled illegal by China's central bank amid multi-billion dollar boom

Nicholas Moore

The People's Bank of China (PBOC) on Monday declared all initial coin offerings (ICOs) illegal, and ordered all related fundraising activities to be halted immediately.

The central bank said on its website that ICOs which have already raised funds should refund investors, and promised strict punishment for any continued ICO activity.

The ruling came days after the National Internet Finance Association of China (NIFA) warned that ICOs, which have attracted billions of yuan so far this year, represent “relatively high risks.”

Prior to the PBOC's statement, Bitcoin China and several other high-profile ICO platforms halted their services as speculation grew that a crackdown was imminent. But what are ICOs, why do they matter, and are the authorities justified in ruling them illegal?

VCG Photo

VCG Photo

What is an ICO?

ICOs are fundraising schemes that work in a similar way to crowdfunding. Mostly initiated by tech startups developing blockchain technology, investors use a cryptocurrency (e.g. bitcoin) to invest in the startup, receiving a blockchain-based coin unique to the ICO in return.

ICOs can be compared to traditional stock market IPOs, with investors receiving coins instead of shares (although the coins do not represent any ownership rights). If the startup is a success, the value of the investors’ coins increases, representing a return on the investment.

But what makes ICOs different from IPOs is the lack of regulation – investors can anonymously invest using cryptocurrencies, avoiding costly and time-consuming red tape.

Are ICOs a big deal?

Increasingly so. You might not have heard of them, or are struggling to get your head around blockchains and cryptocurrencies, but ICOs are booming.

In China, official figures found that in the first half of the year, 105,000 investors put 2.6 billion yuan (397 million US dollars) into 65 different ICOs. However, The Paper reports citing various cryptocurrency analysis sites, that August alone saw five billion yuan (763 million US dollars) invested in ICOs. Fintech research organization Autonomous NEXT calculates that there could be as many as two million ICO investors in China.

AFP Photo

AFP Photo

On a global scale, US-based analysis firm Chainalysis estimates that 1.6 billion US dollars have gone into ICOs this year. Bloomberg reports that respected hedge fund investors are quitting their jobs to focus on ICOs, citing one such investor, Richard Liu, as saying “unlike the traditional financial sector, there are no ceilings or barriers. There’s so much to imagine."

So what's the downside?

While many investors have made quick profits from ICOs, lack of regulation is a double-edged sword. According to Bloomberg, 10% of ICO investors suffer from fraud, with criminals taking 225 million US dollars so far this year through phishing scams, hacks and Ponzi schemes.

Jiemian reports that some Chinese platforms fraudulently promote some fundraising activities as ICOs, even though they have no relationship at all with blockchain technology. According to Jiemian, investors have poured funds into what they believed were ICOs on well-known platforms, only to find their money gone without a trace.

Beyond scams, many investors are suspicious of the entire concept of ICOs. Most ICO startups are looking to raise funds to develop new virtual blockchain-based technology – there is no physical end product, and therefore no way of placing a value on the startup.

The global speculation surrounding ICOs has seen millions of dollars poured into startups which may be grossly overvalued, or eventually worthless.

Trust issues

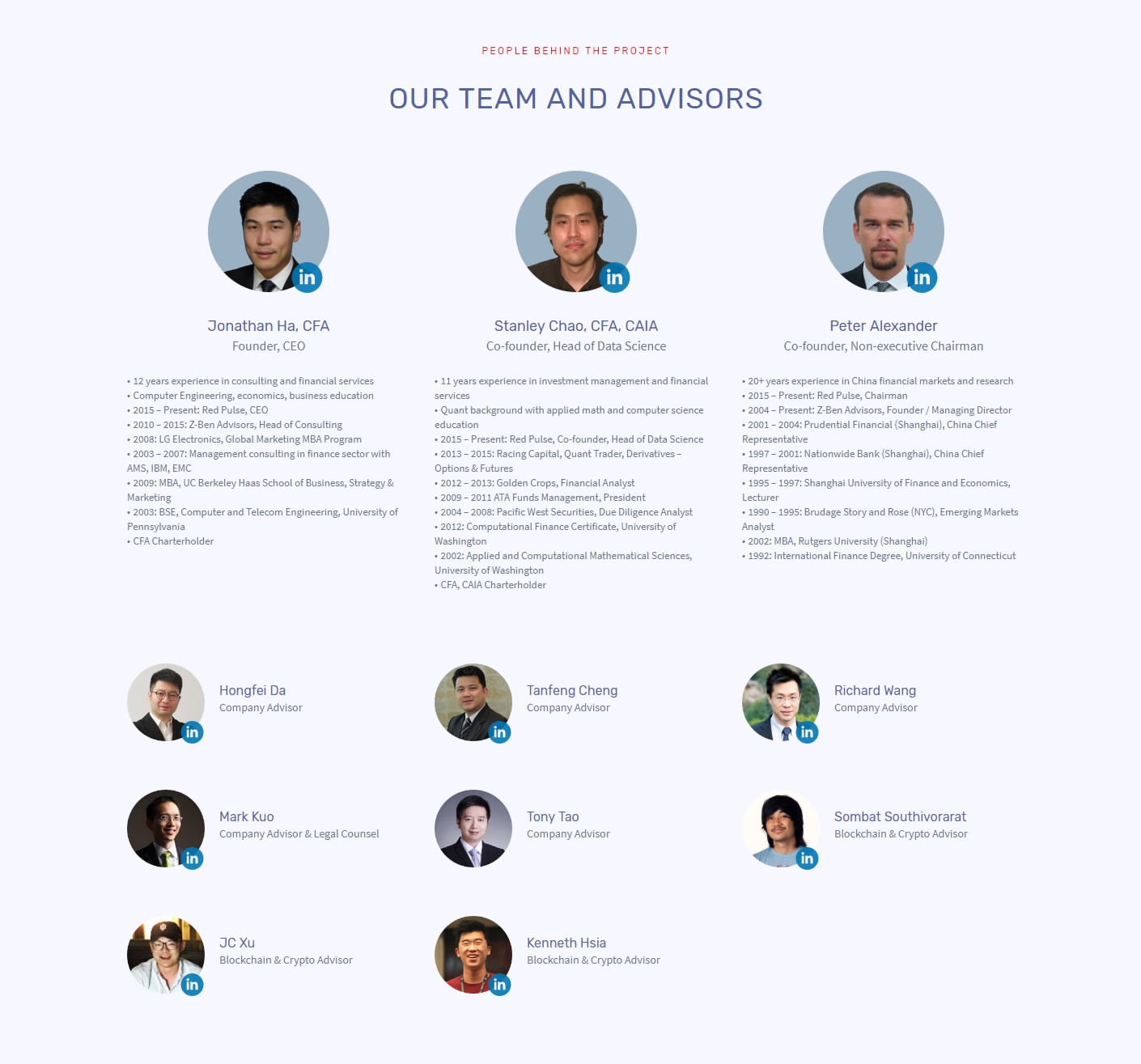

Click on any Chinese ICO website’s profile, and at the bottom, you’ll find a section highlighting who the human faces behind the startup are, along with their apparently robust backgrounds in finance and technology. These efforts to instill confidence show that trust has clearly been an issue in the sector.

Red Pulse is a startup that was looking to launch an ICO on September 10 to raise funds for a China markets "content ecosystem." This screenshot, introducing the backgrounds of the startup's team, is a typical feature on an ICO startup's webpage. /Screenshot from Red Pulse's website

Red Pulse is a startup that was looking to launch an ICO on September 10 to raise funds for a China markets "content ecosystem." This screenshot, introducing the backgrounds of the startup's team, is a typical feature on an ICO startup's webpage. /Screenshot from Red Pulse's website

Li Xiaolai is one of China’s most well-known cryptocurrency investors – with his startup Press.One raised 82 million US dollars through an ICO earlier this year. On Weibo, in response to NIFA’s warning, Li wrote “I don’t have an American passport, I don’t have an escape route, I’ve never received an [official] talking to… what more can I say?”

Regulations part of wider global trend

For Chinese authorities, it appears that there is nothing Li can say. The PBOC's ruling represents a wider global trend for greater regulation of cryptocurrencies.

Earlier this year, China launched investigations into bitcoin in January and February, while authorities warned exchanges would be closed down if they failed to comply with anti-laundering rules.

Japan officially legalized bitcoin in April and is combining its support of cryptocurrencies with greater regulations, while Australia in August proposed regulating bitcoin and putting exchanges under the remit of its financial crime authority.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3