China

19:50, 27-Oct-2017

Achieving digital financial inclusion in China

By CGTN's Song Yuanyuan

Digital financial inclusion – a concept widely recognized for its significance in enabling an inclusive economy and reducing poverty – has increasingly become a more urgent part of the agenda for all countries.

The World Bank defines the concept as “when individuals and businesses have access to useful and affordable financial products and services that meet their needs – transactions, payments, savings, credit and insurance.”

Prof.Ben (Left 3) at the Sino-US Fitech Dialogue held in Silicon Valley on Oct 6/Photo from AIF

Prof.Ben (Left 3) at the Sino-US Fitech Dialogue held in Silicon Valley on Oct 6/Photo from AIF

China has already seen the impacts of this, and at a recent Sino-US dialogue, a cloud infrastructure lab and the Academy of Internet Finance (AIF) of Zhejiang University’s Silicon Valley office launched a plan to facilitate a closer partnership between the US and China on financial technologies.

“So far Fintech has had a more profound impact on financial inclusiveness in China than in the USA considering the former’ huge market,” said Professor Ben Shengling, dean of (AIF) at the Sino-US Fintech Dialogue held by AIF and Amino Capital in Silicon Valley in early October.

At the 2016 G20 Hangzhou Summit, high-level principles were set up to provide a basis for countries to leverage the huge potential offered by digital technologies. World Bank President, Jim Yong Kim, has also called for Universal Financial Access by 2020.

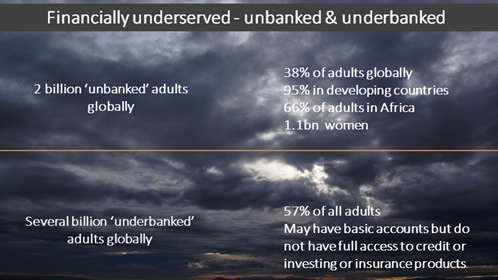

According to the World Bank, around two billion people don’t use formal financial services and more than 50 percent of adults in the poorest households are unbanked. Financial inclusion is a key enabler to reducing poverty and boosting prosperity.

Financially underserved, a universal problem

The financially underserved, including those who have no or insufficient access to mainstream banking products or services, are seen not only among the poor in developing countries, but also among the middle class in the US as well.

Anju Patwardhan speaks at the Sino-US Fintech Dialuge/Photo from AIF

Anju Patwardhan speaks at the Sino-US Fintech Dialuge/Photo from AIF

Anju Patwardhan, a Fulbright Fellow and former global chief innovation officer at Standard Chartered Bank addressed the problem at the meeting, pointing to the pyramid problem: At the top of the pyramid, only 5 percent have access to all financial services, at the middle of the pyramid, 57 percent or 2.98 billion have limited access (underbanked) , and at the bottom of the pyramid, 38 percent or 2 billion have no access (unbanked).

“And the number of underbanked in the US is over three times the number of unbanked. Suffice it to say it is a large enough problem,” Patwardhan said. The US underserved market is 67 million adults or 27 percent of all households, while 7 percent of all households are unbanked (16 million adults) and 20 percent of all households are underbanked (51 million adults).

Africa still has the most financially excluded population, with 66 percent in 2014, down from 76 percent in 2011, mainly due to the increase of mobile financial accounts.

Table illustrate made by Anju Patwardhan

Table illustrate made by Anju Patwardhan

Nearly half Americans adults live in a continuous state of financial insecurity

Patwardhan pointed out that nearly half of the adult US population live in a continuous state of financial insecurity or distress. “46 percent of Americans said they will not be able to come up 400 US dollars for an emergency without borrowing or selling something, 37 percent are not confident they can come up with 2,000 US dollars within the next month for an unexpected need.”

In the Eurozone, findings came as surprising as well: 29 percent responded they did not have enough money for a dignified existence and 39 percent were worried that after paying their bills, money that is left will not suffice.

Patwardhan said, “The key point here is that financial insecurity is not just a low-income bottom-of-the-pyramid problem in the unbanked population. It has been democratized."

China, a latecomer, but a fast runner in Fintech

Patwardhan believes technology can help support financial inclusion and financial health in a commercially viable manner. Key technology enablers for financial inclusion include mobile technology, big data, cloud computing, and robo-advisors for wealth management.

China has eight of the 27 Fintech unicorns globally, with a combined valuation of 96.4 billion US dollars.

“China and the US as global leaders in fintech, both will benefit from a closer partnership,” Professor Ben stressed. “US remains a pioneer in some of the most original innovations in terms of hardcore technologies while China offers a much bigger market for their applications, especially in meeting the financial needs of the consumer and small businesses, who are also more enthusiastic adopters of fintech services,” he said, adding that China is the world’s largest mobile payments market since 2015.

Darwin Tu, CEO and founder of two credit companies, 51credit.com and xyb100.com attending the dialogue also compared the development history of fintech between US and China. “In the US, the development history of financial technologies is 30 years’ gradual evolution while in China, it is more like an innovation explosion of Internet Finance since 2013.”

He believes it will only take China 10 years to complete the journey that America has taken in 30 years when it comes to fintech industry. Tu estimates Chinese credit card holders will total 600 million with 80 percent of market penetration in the next 10 years.

A good learning model from India

Both Prof. Ben and Patwardhan agreed that India has made a lot of progress in financial inclusiveness, offering a good learning example.

According to a 2014 World Bank report, India has the largest number of unbanked in the world, but huge progress has been made in the last few years. India now has over one billion mobile phone subscribers, of which 300 million are smartphones. Governments in India are leading Digital India efforts, making it now a world leader in using technology to support financial inclusion.

Taj Mahal in India/VCG photo

Taj Mahal in India/VCG photo

Notably, India’s JAM trinity plays as key enablers. JAM refers to the Jan Dhana Yojana Program, which opens bank accounts, insurance, line of credit, debit card and pension for the unbanked. Since the launch, 258 million new banks accounts were opened for the unbanked; A refers to Aadhar, unique national digital identity for all residents – based on demographics and biometrics (fingerprints and iris scans), and now over 1.13 billion Indians have an Aadhar ID number; M refers to its over one billion mobile phone users. In this way, various government subsidy programs account for over 3 percent GDP are linked through Aadhar and bank accounts for direct benefits transfers, as Patwardhan’s survey reveals.

With India’s success story as a good example, China should integrate the current fragmented regulatory regime, adopt some international best practices and improve the regulatory tools, Prof. Ben told CGTN, “Our objectives eventually should be to provide a conductive policy environment which encourages innovation and contains the risks, for both consumer/investor protection and financial stability.”

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3