17:32, 03-Jun-2019

China Market Reforms: New tech board faces initial review on Wednesday

Updated

09:41, 04-Jun-2019

02:46

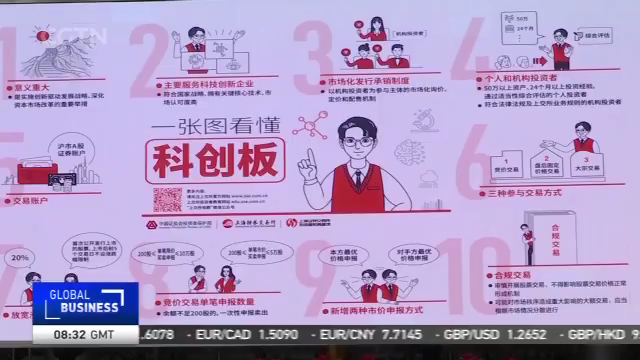

Staying with the stock markets. The Shanghai Stock Exchange will conduct its first review session of the new Science and Technology Innovation Board on Wednesday. The board has seen increased VC/PE funds flow into various science and technology firms since its inception. CGTN sat down with sector experts to look at the new board.

Data from China's Asset Management Association shows that over 100 companies so far have applied to be listed on the Science and Technology Innovation Board. About 80% of those companies are backed by PE/VC funds and attracted over 22 billion yuan from around 200 institutions.

LI QIUSHI, MANAGING PARTNER GTJA INVESTMENT GROUP "The new tech board is widely regarded as China's Nasdaq, and would definitely facilitate the country's science and technology innovation. For example, start-ups like bio-pharmaceutical enterprises could hardly gain revenue or cash flow, when they're developing the clinical trial of new medicine. It's obviously impossible for them to list on the A-share market. While based on the cases we've investigated, those ones who are processing series B and C rounds of funding are very suitable to file applications for the new board. The first priority we'll consider about the company is its capacity to innovate, then comes the corporate governance."

Abel Halpern, the founder of a London-based private equity investment company, says that it's important for China to aim for the future and invest for the longer term.

The new trading platform will experiment with a registration-based system for listed companies. Those "Value Investing" investors are also calling for regulators to require stricter information disclosure for IPOs.

CHENG HOUBO, PRESIDENT CMAF MANAGEMENT COMPANY "With the registration system, investors must decide for themselves which companies are worthy, unlike in the past when the government decided which companies qualified for listing and which didn't. So now all they can rely on to make their decision is corporate disclosures. Information such as company basics and prospectus details must be complete and accurate for investors to examine. With the gradual implementation of multi-faceted capital market, I'm positive that problems like the absence of institutional investors and long-term capital participation could be solved."

CGTN.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3