21:35, 28-Feb-2018

US Economy: Powell hints at quicker interest rate hikes

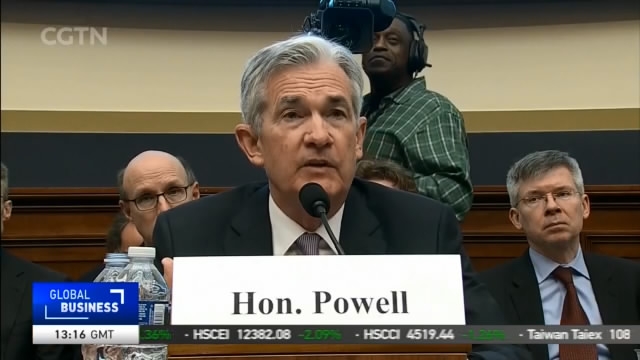

The new U.S. Federal Reserve chairman -- Jerome Powell -- is indicating that there's been a pretty smooth handover from his predecessor, Janet Yellen. No major surprises so far, although he's keeping open the possibility of a faster rise in interest rates. From Washington, Daniel Ryntjes reports.

As Jerome Powell gets his feet under the table in his first appearance before Congress as Chairman of the Federal Reserve, it looks like he's what economists had expected. He's much like his predecessor Janet Yellen, perhaps a little more upbeat as the U.S. economy cooks up.

JEROME POWELL, CHAIRMAN US FEDERAL RESERVE "We've seen continuing strength in the labor market, we've seen some data that will in my case add some confidence to my view that inflation is moving up to target. We've seen continued strength around the globe, and we've seen fiscal policy becoming more stimulative."

When he says 'fiscal' policy, he's talking about the central pillar of "Trumponomics". Congress passing major tax cuts - pumping billions of dollars into corporate America. Does that mean raising interest rates more than the three times that members of the Federal Reserve's rate-setting committee indicated in December?

JEROME POWELL, CHAIRMAN US FEDERAL RESERVE "So I think each of us is going to be taking the developments since the December meeting into account and writing down our new rate paths as we go into the March meeting, and I wouldn't want to prejudge that."

So no prediction before the March meeting, but certainly a hint that he's open to an additional rate rise this year, to four in total.

DANIEL RYNTJES WASHINGTON "And if things do continue to heat up as we're seeing right now and inflation begins to rise, then it will be Jerome Powell's job to pour on some cold water to balance things out, by raising rates even more. Daniel Ryntjes, CGTN, Washington."

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3