14:06, 27-Mar-2019

A Need for Concerted Action: Is China sinking in debt?

Updated

14:00, 30-Mar-2019

06:24

In the previous episode of the CGTN special series, Reshaping China's Economy, we touched upon the issues of rising labor cost and economic transformation. Today, our reporter Ge Yunfei went to the northern industrial city of Tianjin, to see how the mounting debt changed China.

China's gone crazy for skyscrapers. Among the world's ten tallest buildings, the country takes seven spots. Along with the country's massive investment in its infrastructure, is the mounting debt. Will China's debt crash its economy? I took the question to Tianjin, a northern coastal industrial city, neighboring Beijing.

The world's third tallest skyscraper is here in Tianjin. Standing alone on the outskirts of the city, the Goldin 117 building represents the city's ambitions for the future.

Topping off at 597 meters, it has 117 floors and cost about 18 billion RMB or nearly 3 billion US dollars.

GE YUNFEI TIANJIN "I'm now standing almost 500 meters above the ground. It looks so intimidating from here."

The race to reach for the sky is sweeping the county. But, as the skyline goes up-so does the debt.

GE YUNFEI TIANJIN "In the past decade, China's second-tier and third-tier cities have tried their best to catch up with the first-tier cities. For them, lifting the skylines is perhaps the best way to showcase their economic development. But the question is, where did they get the money from?"

GE YUNFEI "When talking about China's economy, the most frequently used word is leverage. Simply put, leverage is to borrow money to invest."

For China, the government debt ratio had stayed low for a long time because the government hated the idea of borrowing money. But in 2008, amid the global financial crisis, China launched a 4 trillion RMB economic stimulus package. Then the rapid expansion of China's debt began.

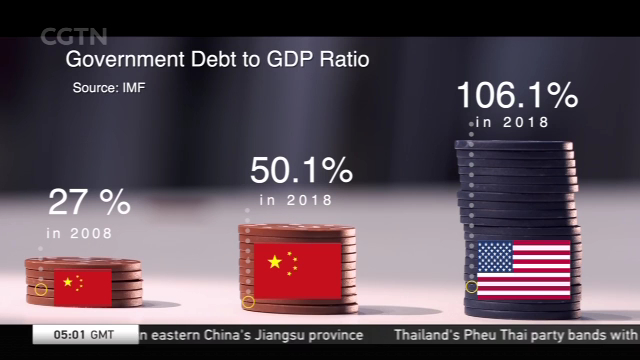

So if one chip stands for 5 percent, according to the IMF, in the past decade, China's government debt ratio increased from 27 percent to 50.1 percent. The rapidly expanding debts raised lots of concerns over China's economy. But in the meantime, this is how America's debt increased in the past ten years. And this is the situation for Japan.

PROF. YAN SE GUANGHUA MANAGEMENT SCHOOL, PEKING UNIVERSITY "If we just think about this number, if we do a global comparison, this is not worrying at all."

GE YUNFEI TIANJIN "It has proven successful for China to sink a huge amount of investment into infrastructure construction like high-speed rail, bridges, and airports to drive economic growth. But soaring debts have put a heavy burden on its future development."

On the other side of Tianjin, is one of China's versions of Manhattan, the Yujiapu Financial District. In the past decade, a massive investment of 200 billion RMB or 30 billion US dollars turned the marshland into a concrete jungle of skyscrapers. But in a slowing economy, it's hard to fill those buildings with people and businesses.

JEREMY STEVENS CHIEF CHINA ECONOMIST, STANDARD BANK "You've got some provinces that are heavily reliant on state-led fixed as investment or a real estate market that maybe doesn't have the supply and demand fundamentals to build it and consume the houses that have been built."

The debt ratio in China's real estate sector reached an all-time high at nearly 80% in 2018.

Seeing the danger, the Chinese government has aggressively tried to curb the over-heated market of the past few years, with measures like putting price caps on properties. According to Xu Xiaole, an industry insider who used to work at China's National Bureau of Statistics, the regulation works.

Curbing housing prices is part of a national deleveraging effort. China's macro leverage ratio peaked in 2017 but decreased at 1.5 percentage points in 2018, marking the first drop in a decade.

JEREMY STEVENS CHIEF CHINA ECONOMIST, STANDARD BANK "I think that that's something that the foreign community hasn't really recognized that sea change in China over the last three years and how decisions are made."

And there is one more thing that cannot be ignored when talking about China's economy.

PROF. YAN SE GUANGHUA MANAGEMENT SCHOOL, PEKING UNIVERSITY "The Chinese government has very strong coordination capacity. So they are able to mobilize resources to deal with any potential debt crisis."

As the financial risks come down, China still needs to find new driving forces to boost its economy.

The answer lies in the world's largest middle class, and their stunning consuming power. In the next episode, I'll go to the world's smartest supermarket, and talk to the new forces in China's car manufacturing to check what leverage does China have to win the future. Ge Yunfei, CGTN.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3