Business

22:59, 08-Nov-2017

China's financial stability and development committee assembles, clarifies goals

CGTN's April Ma

A special cross-ministry committee that will increase regulatory oversight and promote financial stability and development in China has officially been formed and conducted its first meeting on Wednesday.

The decision to establish this financial committee that would be directly under the State Council, China's cabinet, was first revealed in mid-July, during the National Financial Work Conference, which convenes once every five years.

Vice Premier Ma Kai will be taking the helm, according to reports by Xinhua that referred to him as the director of the special group.

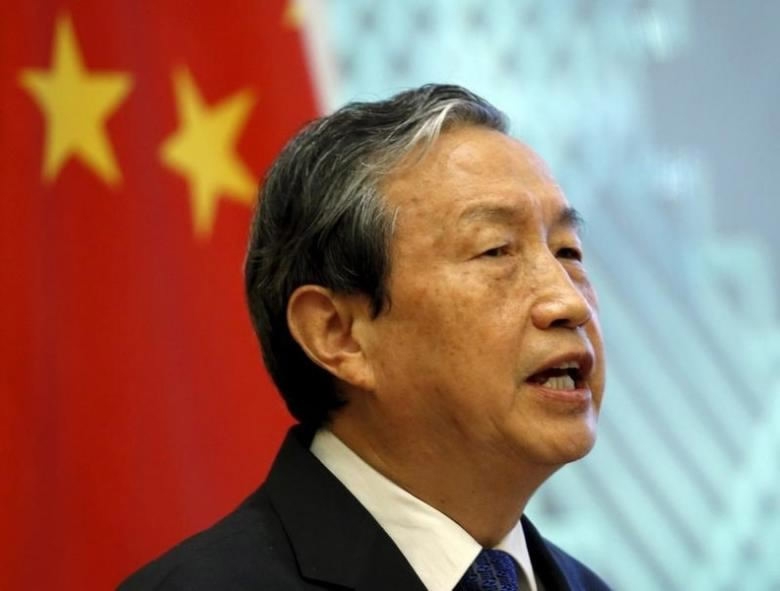

China's Vice Premier Ma Kai, and director of the Financial Stability and Development Committee /Reuters Photo.

China's Vice Premier Ma Kai, and director of the Financial Stability and Development Committee /Reuters Photo.

Categorized as an "Advisory and Coordinating Organ," the special group joins the ranks of the Central Leading Group for the United Front, the Central Leading Group for Comprehensively Deepening Reforms and the State Security Committee, all of which were established under President Xi's leadership, as well as dozens of others created before under different contexts to tackle specific issues and coordinate when there may be an overlap between ministries.

Its formal aim, as specified during the initial assembly, is to implement financial decisions and plans as assigned by the State Council and the Party, deliberate on key reform plans in the sector, coordinate between financial, industrial and fiscal polices, and actively analyze and be prepared for potential international financial risks.

The committee will also be responsible for devising plans to prevent systemic risks and upholding financial stability, providing guidance and supervision for local financial reforms, as well as scrutinizing the actions of financial regulators and local governments.

Until now, limited official information had been provided about its structure, leadership, membership and priorities.

In the past few months, ministers and other high-ranking financial officials have thrown light on its goals.

Its purpose would be to sharpen oversights on shadow banking, asset management firms, Internet financing and opaque financial services, Central Governor Zhou Xiaochuan earlier stated.

One of the reasons China needs such an existence is because financial oversight in China is not coordinated, said Lu Lei, who heads the financial stability department at the People’s Bank of China (PBOC), in an interview published by People's daily in July.

“Risks in China’s financial market can be controlled, but nonperforming loan risks, liquidity risks, shadow banking risks...property bubble risks (and others) are increasing," said Lu, who then described the situation of the financial sector as "utter chaos."

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3