Business

12:11, 08-Jan-2018

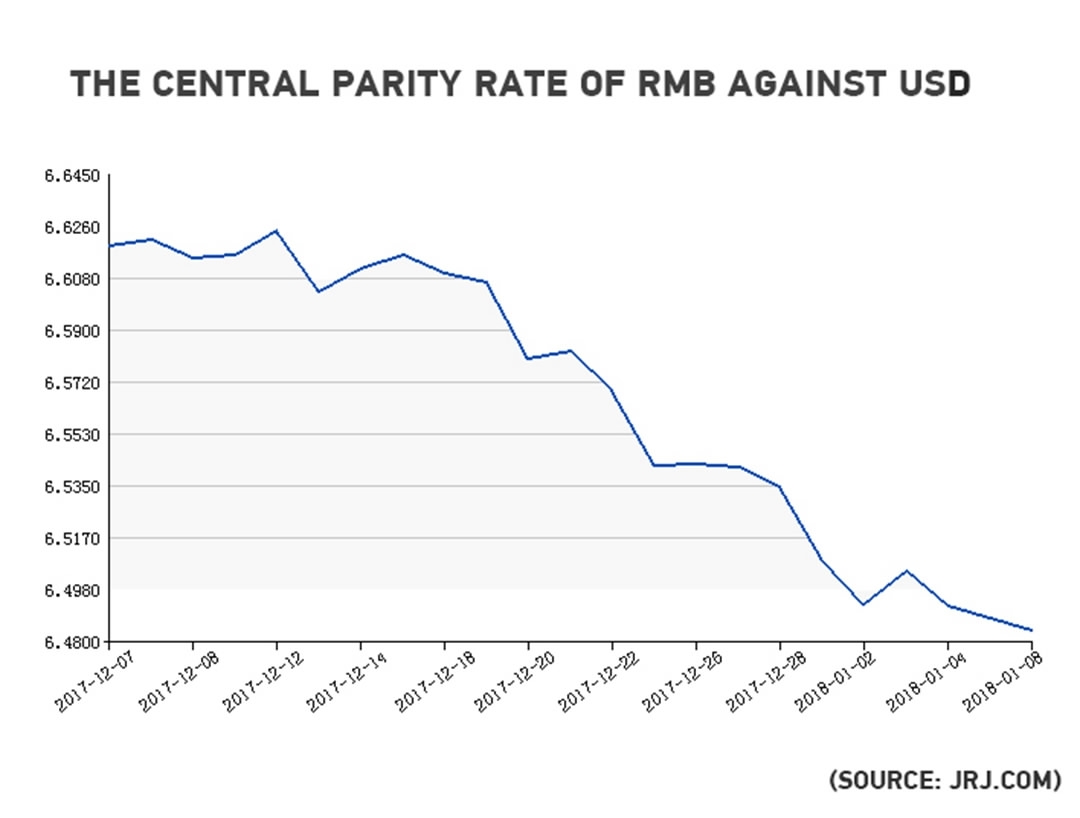

RMB strengthens to 6.4832 against USD, the highest since May 2016

CGTN

The central parity rate of the Chinese currency yuan (RMB) strengthened 83 basis points to 6.4832 against the US dollar on Monday, the highest since May 2016, according to the China Foreign Exchange Trade System.

Behind the trend of the yuan exchange rate against the USD in 2017 is China’s good economic fundamentals and optimistic market expectations, said experts. The yuan exchange rate is expected to be basically stable under the impetus of economic restructuring and marketization.

The 6.5 yuan exchange rate against the USD is an important juncture, according to China’s Securities Times (STCN). The excessive expectations on the yuan appreciation will not only hit China’s foreign trade, but also stimulate speculation in foreign exchange market.

The yuan exchange rate should be properly devalued, while capital controls should be strictly strengthened, to ensure the independence of monetary policy and stabilize exports, suggested Zhu Baoliang, chief economist of the State Information Center.

Considering the adjustment of global central banks on monetary policy, the yuan exchange rate will fluctuate in two ways, with both appreciation and devaluation, said Wen Bin, chief researcher at China Minsheng Bank.

VCG Photo

VCG Photo

In China's spot foreign exchange market, the yuan is allowed to rise or fall by two percent each trading day from the central parity rate, which is based on a weighted average of prices offered by market makers before the opening of the interbank market.

Forex reserves rise for 11 months

China's foreign exchange reserves rose for the 11th month in a row to 3.14 trillion US dollars at the end of December, the highest level since September 2016, data from the People's Bank of China showed Sunday.

The State Administration of Foreign Exchange attributed the continued increase to stronger non-dollar denominated currencies and higher asset prices, while cross-border capital flows and transactions remained stable.

Looking ahead, the forex regulator said given the increasing stability and resilience of the economy, as well as further reform in the financial markets, China will keep its forex reserves and international balance of payments balanced and stable in 2018.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3