Business

14:06, 14-Feb-2018

Ant Financial to raise $5 bln before IPO: sources

By CGTN's Yao Nian

China’s payment giant Ant Financial Services Group is said to raise about 5 billion US dollars in a new funding round that could value it at over 100 billion US dollars, according to sources familiar with the matter.

The move may be a signal for its highly expected initial public offering (IPO).

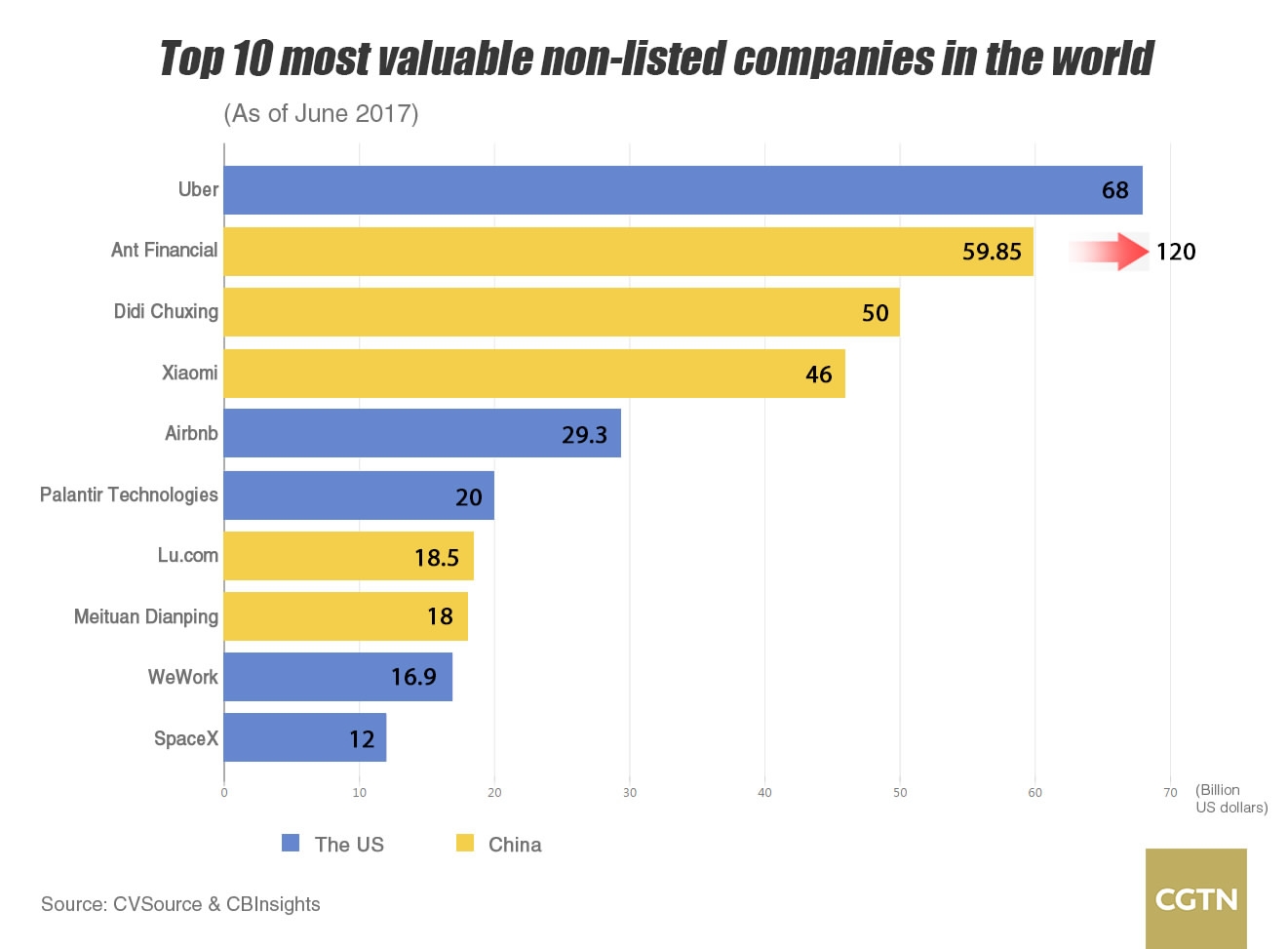

The new equity placement may be launched as early as this month, the sources said. If it can pull in as much as anticipated, the fintech company would become the most valuable non-listing firm, or unicorn, in the world.

The latest fundraising is viewed as a pre-IPO round, said the sources, which is an increasingly common step taken by famous Chinese companies to establish valuations and enlarge their investor base before they make a public offering.

The market has anticipated the affiliate of China’s e-commerce giant Alibaba to be listed in two exchanges – Shanghai and Hong Kong or the New York. However, the sources said no timetable or location for an IPO has yet been confirmed.

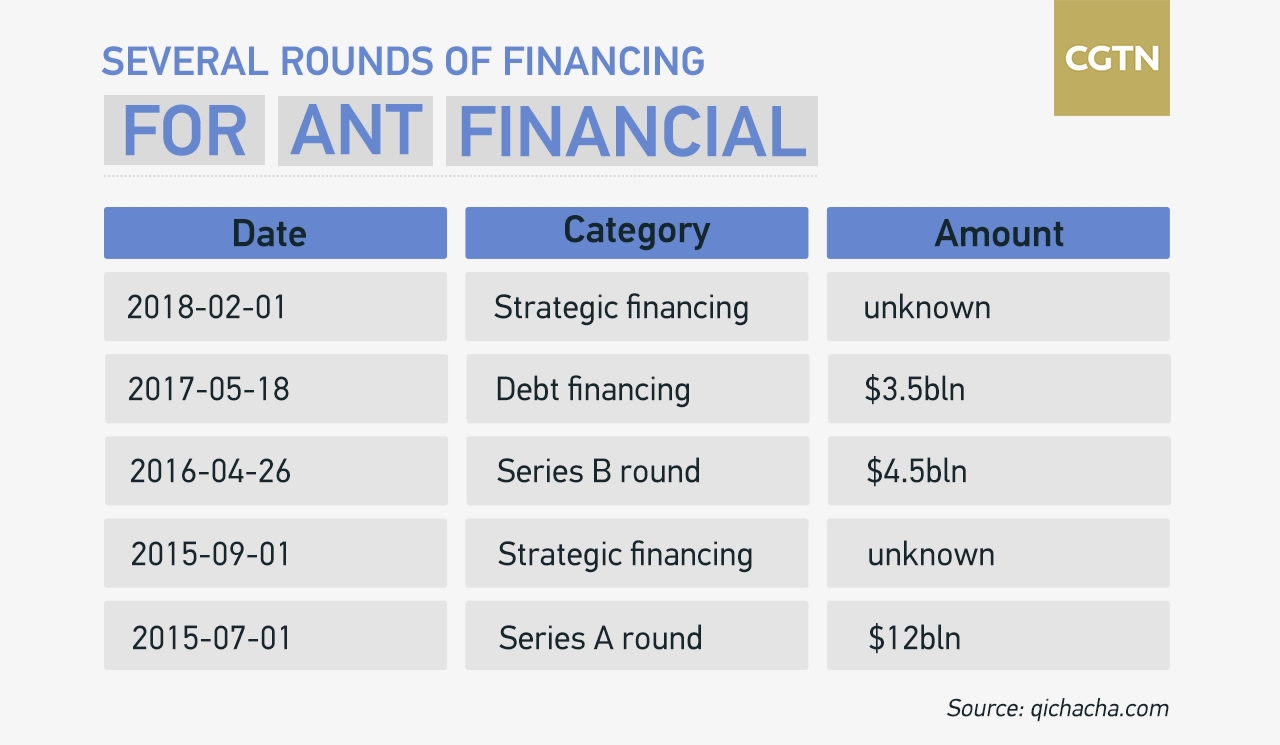

Several rounds of funding

Ant has conducted multiple rounds of funding since 2015, with total financing of over 10 billion US dollars. Its previous fundraising in 2016 has valued it at about 60 billion US dollars. The valuation will be doubled, if the latest round of funding is achieved as expected.

At the beginning of this month, Alibaba and Ant jointly announced a swap plan where Alibaba will take a 33 percent stake in Ant and will give up its share of 37.5 percent of Ant’s pre-tax profit.

“The deal effectively cleared the way for Ant to go public in future,” said Zhao Xianghai, the chief financial analyst at Essence Securities. The move can improve Ant’s financial situation by significantly reducing the firm’s cash outflows and enhancing its overall capacity against risks.

The fintech firm first started Alipay, which was set up in 2004 as the Chinese version of PayPal to help local buyers shop online. It was formally established later in October 2014. Alibaba’s latest financial filings showed Ant’s pre-tax profit tripled from 2016 to 2.1 billion US dollars in 2017.

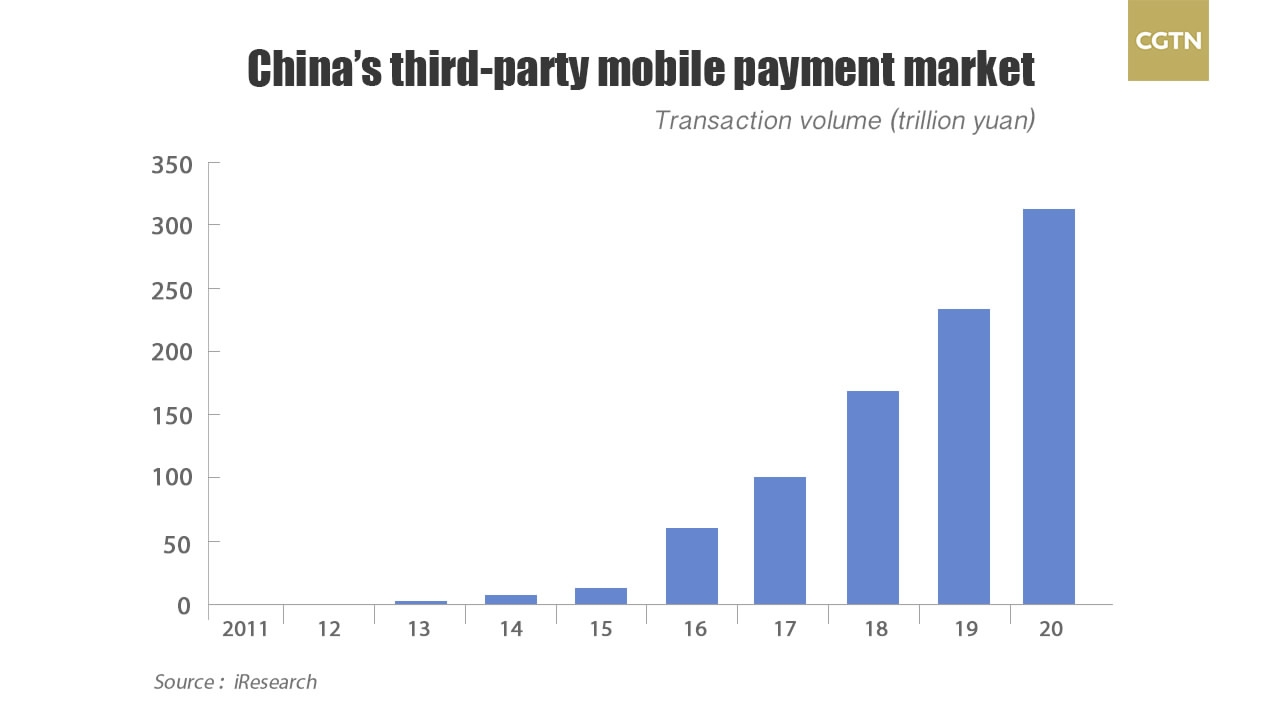

Alibaba is competing with Tencent for China’s third-party mobile payments market worth of 15.5 trillion US dollars, which dwarfs that of the US and other developed markets, according to Financial Times. The market will grow to about 25 trillion US dollars, data from iResearch showed.

The most valuable unicorn

If the latest offering is completed as anticipated, the valuation of Ant Financial will surpass that of Uber, and Ant will become the world’s most valuable “unicorn” – a term that was coined in 2013 and refers to a startup company valued at over 1 billion US dollars.

As of June 2017, there were 252 unicorns in the world, among which ride-hailing firm Uber ranked first with valuation at 68 billion US dollars, and Ant is the second. Ant was followed by Chinese Didi Chuxing, whose valuation stood at 50 billion US dollars.

Although Uber received a new round of funding from a consortium led by Softbank last month, its investment was based on the previous valuation of 68 billion US dollars.

By the end of 2017, Didi also announced the completion of a new round of funding at 4 billion US dollars, and its valuation changed to 56 billion US dollars, still less than the valuation of Ant.

Location alternatives for IPO

“Ant Financial has not yet discussed the listing plan, so I don’t know whether it could be in Hong Kong, Asia (or elsewhere),” said Alibaba Group CFO Wu Wei at a financial statement meeting in early February.

In early January, Alibaba Group chairman Jack Ma said, “We will seriously consider the market in Hong Kong, and we hope to participate in the Hong Kong financial market and make it truly the world's second financial center after New York.”

Some bankers said Ant might seek two listings, one in Shanghai, and the other in Hong Kong or New York.

China’s securities regulator proposed to reform the system of issuance and listing and increase support for new technology, new industry, new format and mode of business at its 2018 working conference.

Analysts believe this shows a significant signal: to reform the current issuance system and to solve the issue that BATJ enterprises cannot be listed at A-shares market, to enhance the core competitiveness of China's capital market.

A-shares will work to have a group of their own "Unicorn" tech companies, and the return of some overseas listed tech giants will also be possible.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3