21:34, 20-Feb-2018

Online Shopping: Southeast Asian nations poised to tax e-commerce

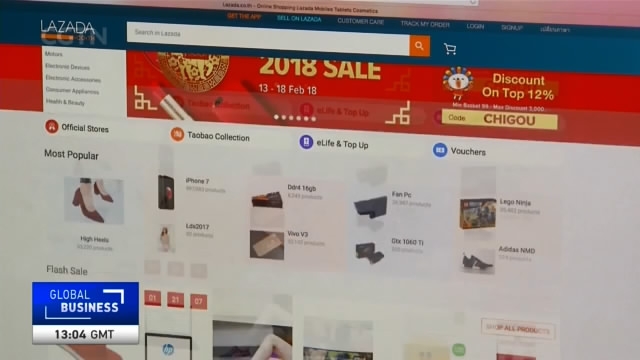

A number of countries in Southeast Asia are poised to introduce taxes on goods bought online - many of which are currently exempt. Governments say they’re missing out on large amounts of revenue as e-commerce takes over from High Street shopping. From Bangkok, Martin Lowe reports.

MARTIN LOWE BANGKOK "This is how more and more of us are doing our shopping these days – online. But here in Thailand there are different rules for different sectors. Thai websites and traditional bricks and mortar stores have to charge their customers sales tax – foreign websites, in a lot of cases, do not."

That's not a level playing field, says the Thai government, which wants to bring in new e-commerce laws making everyone pay the same. It estimates it's losing up to a hundred million dollars a year in tax revenue.

PAUL GAMBLES, MANAGING PARTNER MBMG INVESTMENTS, BANGKOK "In theory, it should actually increase prices which is bad for consumers but what we are seeing at the moment is creating a squeeze on Thai businesses – so it means profits that are being generated are being held outside Thailand - and there's no economic benefit to the country, so in the short term it's bad for consumers in the long-term it's a very important step for the country."

Thailand isn't alone – similar laws to protect domestic e-business against foreign traders are being considered by Singapore and Malaysia; they've already been introduced in Indonesia, as well as many other countries around the world. One leading online retailer says legislation's urgently needed to safeguard national interests.

PAWOOT PONGVITAYAPANU, PRESIDENT THAI E-COMMERCE ASSOCIATION "This is about local business, this is about all the mom and pop shops everywhere in the country. I'm talking about not only in Thailand. I'm talking with many friends in ASEAN countries: Malaysia, Vietnam, Indonesia – they're also really concerned about this thing that's happening because nowadays a lot of products are coming from overseas."

It's also part of global moves to clamp down on big companies avoiding tax by registering their businesses in countries with low tax rates or tax concessions.

PAUL GAMBLES, MANAGING PARTNER MBMG INVESTMENTS, BANGKOK "In Thailand a lot of the development has been at a local end of things with local retailers or even individuals who are advertising their products on the likes of Facebook or Instagram and then selling them through Line and I think those guys almost need a little bit of protection from Amazon getting away with no VAT and tax free and all the rest of it, it only seems fair."

Economists say it's a case of legislation catching up with technology that should result in greater transparency and fairness for all. Martin Lowe, CGTN, Bangkok.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3