Google said Thursday it supports a global agreement on taxation that could allocate more taxes from multinationals to countries where companies sell goods and services.

"We support the movement toward a new comprehensive, international framework for how multinational companies are taxed," Google said in a statement.

The existing rules have "always attributed more profits to the countries where products and services are produced, rather than where they are consumed," the statement said.

The announcement from Google comes with Group of 20 (G20) leaders discussing plans for a global tax system that aims to help some countries get more revenue from tech firms.

At the same time, France is moving toward imposing its own tax on digital giants based on revenue instead of profits amid opposition from Washington.

Google said the change would probably mean Silicon Valley tech giants would pay less in the United States and more in other countries, in a departure from the longstanding practice of paying most taxes in a company's home country.

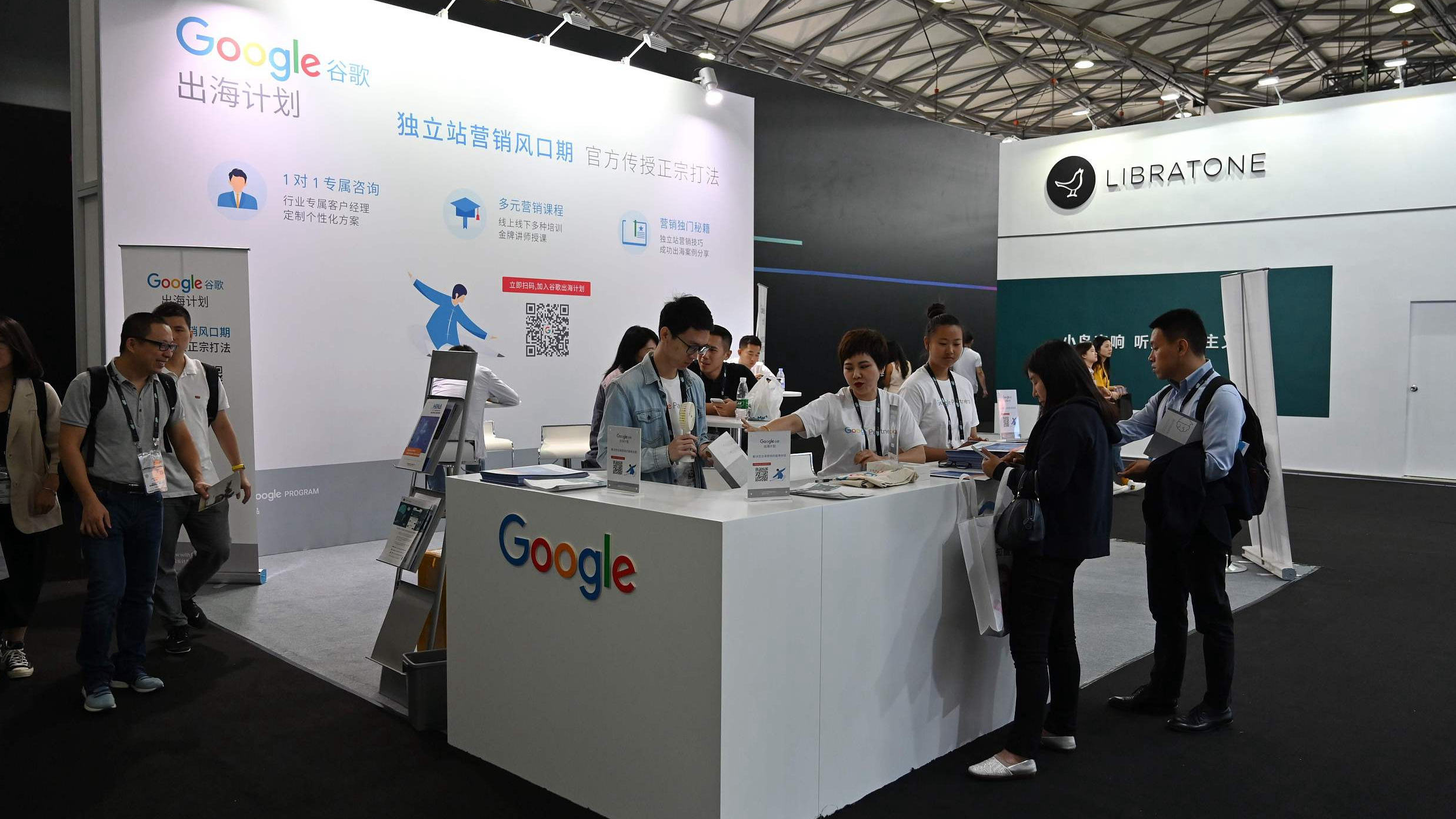

People gather at a Google stand during the Consumer Electronics Show, CES Asia 2019 in Shanghai on June 11, 2019. /VCG Photo

Google said its overall global tax rate has been around 23 percent for the past 10 years, in line with the 23.7 percent average rate across the members of the Organization for Economic Cooperation and Development, and that most of this is paid in the United States.

Google said a global agreement could avoid squabbles on the best way to allocate taxes from digital giants.

"Without a new, comprehensive and multilateral agreement, countries might simply impose discriminatory unilateral taxes on foreign firms in various sectors," said Karan Bhatia, Google's vice president for public affairs and public policy.

"Indeed, we already see such problems in some of the specific proposals that have been put forward. That kind of race to the bottom would create new barriers to trade, slow cross-border investment, and hamper economic growth."

A new treaty, he said, "will restore confidence in the international tax system and promote more cross-border trade and investment."

(With input from AFP)

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3