CreditEase CEO Tang Ning believes when the investment environment is cold, people will find more and more attractive opportunities to invest.

"Your investment return is extra higher," he said in an interview with CGTN at the 2019 Summer Davos Forum in Dalian.

"When the market is hot, everything is easy, prices are high, (but) when the time is not so favorable, only those entrepreneurs and organizations who are passionate about what they do still hang on there," Tang said.

Now, more Chinese people realize the importance of long-term investment, he said, since the entire country will focus more on technological innovations and this will make a conducive market to let venture capital firms enjoy tech benefits.

"Technology startups need 10 years' patient capital," he said.

Tang Ning, CEO of CreditEase answers questions from CGTN. /CGTN Photo

Talking about asset allocation in China, Tang said Chinese often misunderstand the length of long-term investment.

European and U.S. investors are quite comfortable with holding a portfolio for 20 or 30 years, he said, "but this is very new for Chinese investors."

When it comes to doing asset allocation, or planning for the retirement, it means 20, 30 years of buying and holding the investment portfolio, Tang said.

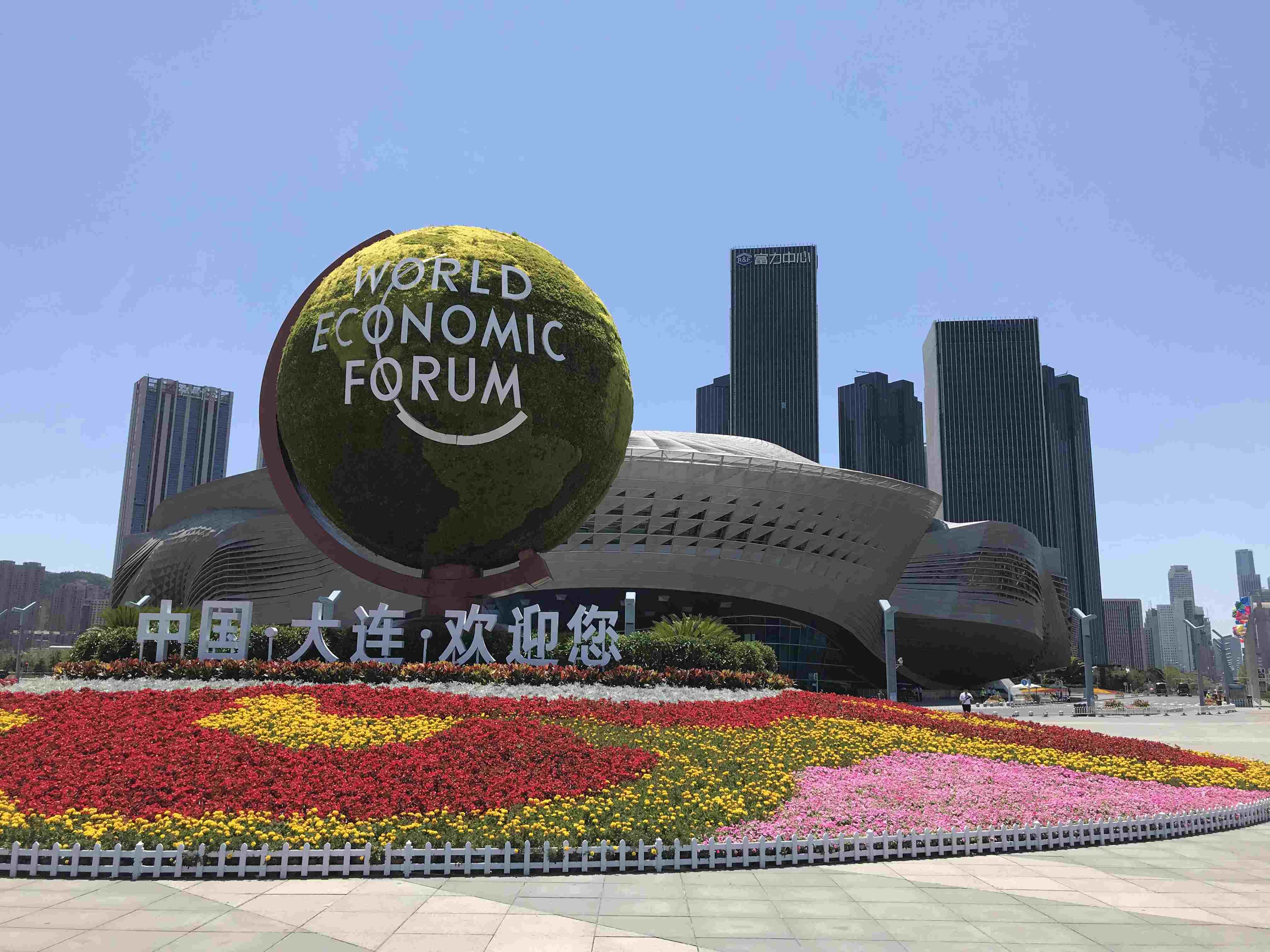

The Annual Meeting of the New Champions 2019, also known as Summer Davos, held in Dalian City, northeast China's Liaoning Province. /CGTN Photo

Tang also believes more and more people's portfolio will go into equities and capital markets in China. "The fixed income (from the deposit) portion is getting smaller and smaller."

A report from the Boston Consulting Group shows that the annual compound growth rate of China's wealth management sector stood at 20 percent from 2007 to 2017, with investable financial assets totaling 142 trillion yuan (22.35 trillion U.S. dollars).

(Video by CGTN's Qi Jianqiang)

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3