Editor’s note: Zhao Yuanzhen is an opinion editor with CGTN Digital, the article reflects the author’s opinion and not necessarily the views of CGTN.

“The outlook for the U.S. economy remains favorable, and this action is designed to support that outlook,” stated Chair of the Federal Reserve Jerome H. Powell. The action Powell is referring to is the Fed's decision to cut interest rates for the first time since the 2008 economic crisis.

But unlike the previous cut, which was intended to pull the American economy out of the mire, this cut is widely regarded as an “insurance cut” to keep boosting America’s economy and help mitigate the risk of a global economic recession and the uncertainties of trade policies.

America’s boom market has lasted more 10 years after 2009. However, there are increasingly more public comments on the end of the boom and talks of economic recession. Jim Rogers, the legendary investor who created one of the most successful hedge funds, has said the next bear market will be the “worst one.”

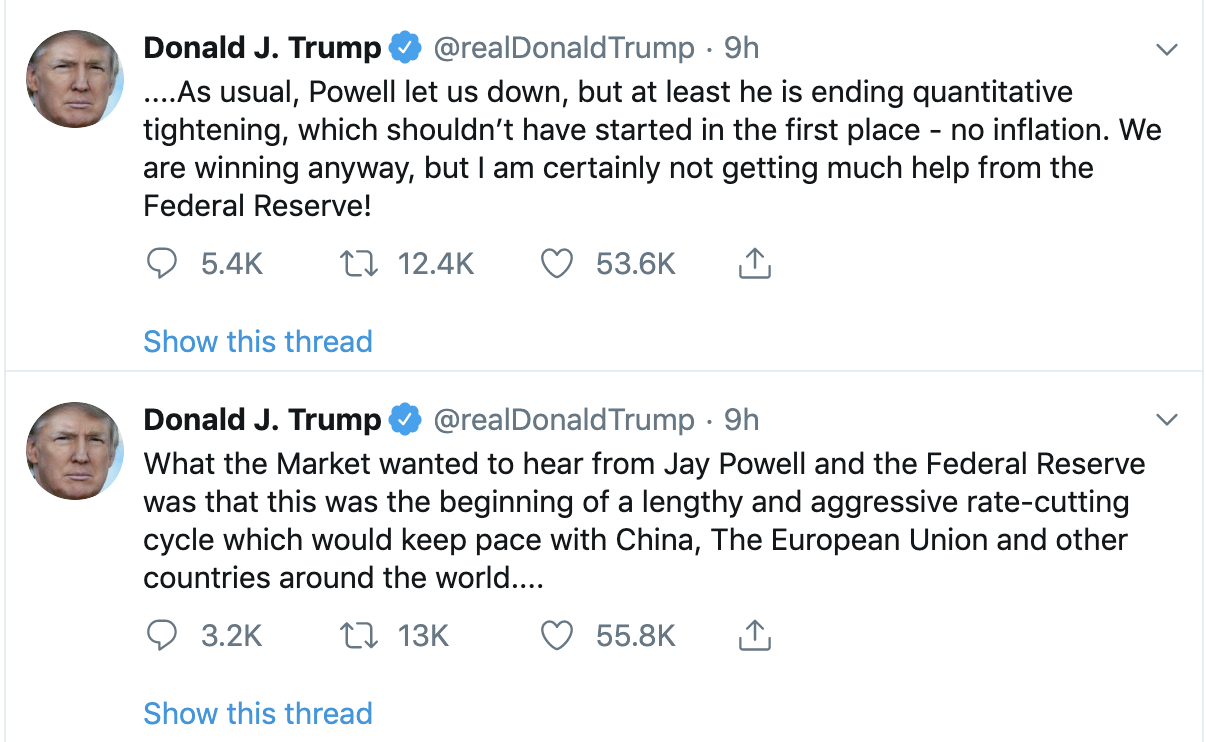

Thus, the market has been hoping the Fed would turn to a loose monetary policy to avoid a crash. The rate cut failed to impress U.S. President Donald Trump who was hoping for a much bigger cut than a quarter-point. He has been at the forefront of criticizing the Fed for reacting “way too early and way too much.”

Screenshot via Twitter

So, is America’s economy really on the brink of collapse? Right now, the numbers seem to suggest that the overall prospects do not look bad. The second-quarter GDP growth is 2.1 percent. Although lower than the last quarter, it still higher than expected. Consumer and government spending have contributed to a large part of the growth, with a relatively weak investment. Also, the labor market still looks strong, despite the lowest unemployment rate in 50 years.

Wang Jianhui, general manager of the research and development at Capital Securities, sees this precautionary cut as evidence that the Fed's evaluation system has changed from an employment and consumer price index (CPI) focus to other elements like financial market and trade policies.

In fact, “the importance of finance and trade policies have been on the rise for the Fed,” said Wang. “The rate cut this time is to meet the challenges of economic uncertainty, which [are] brought up by trade policy uncertainty.”

During the news conference, Powell also acknowledged the impact of Trump’s trade war, noting that “with trade, it is a factor that we have to assess in kind of a new way.”

Traders work on the floor at the New York Stock Exchange (NYSE) in New York, U.S., July 31, 2019. /VCG Photo

The uncertainty brought by Trump’s trade fight should not be underestimated. As investors seek to mitigate the risks, capital is being poured into the safer U.S. treasury bonds. This has triggered the inverted yield curve, one of the most reliable indicators that an economic recession is on its way.

In the meantime, although the unemployment rate is low, the creation of non-farm jobs is still fluctuating. In June, IHS Markit's Purchasing Managers’ Index fell to 50.1, the lowest level since 2009. It is also approaching the dangerous line of 50, which indicates that manufacturing activities are contracting and the economy has stopped expanding. All these signals have been worrying investors and propelling the market expectation of a rate cut.

Perhaps the most important question now is, can the rate cuts deliver?

“In the short term the cuts will lower the fund-raising cost for enterprises and stabilize investment expectation, which could counter the downside of global trade uncertainties, ” said Wang. “Other economic entities would also likely to follow up the rate cuts. But the influence of it is not clear now, as the impact on inflation and the economic bubble could not be underestimated.”

With a trade deal between China and the U.S. still elusive and Trump still putting up trade fights, it is clear that although the trade issue is not the Fed’s responsibility to solve, it has to deal with the challenges of global trade risk, perhaps more than it thought.

(If you want to contribute and have specific expertise, please contact us at opinions@cgtn.com)

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3