U.S. customers shop for Valentines Day cards in a shop in Union Station the day before Valentines Day in Washington, USA on February 13, 2018. /VCG Photo

The latest tariffs U.S. President Donald Trump plans to impose on Chinese goods would cost U.S. households an average of 200 U.S. dollars a year, some economists estimate, and would start to bite consumers and retailers just as the holiday shopping season begins.

That cost would come on top of the roughly 830 U.S. dollars imposed per household from Trump's existing tariffs, according to a New York Federal Reserve analysis.

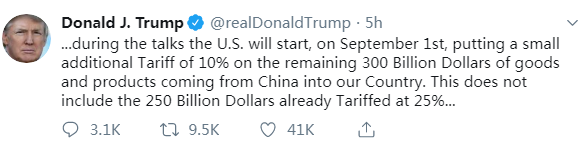

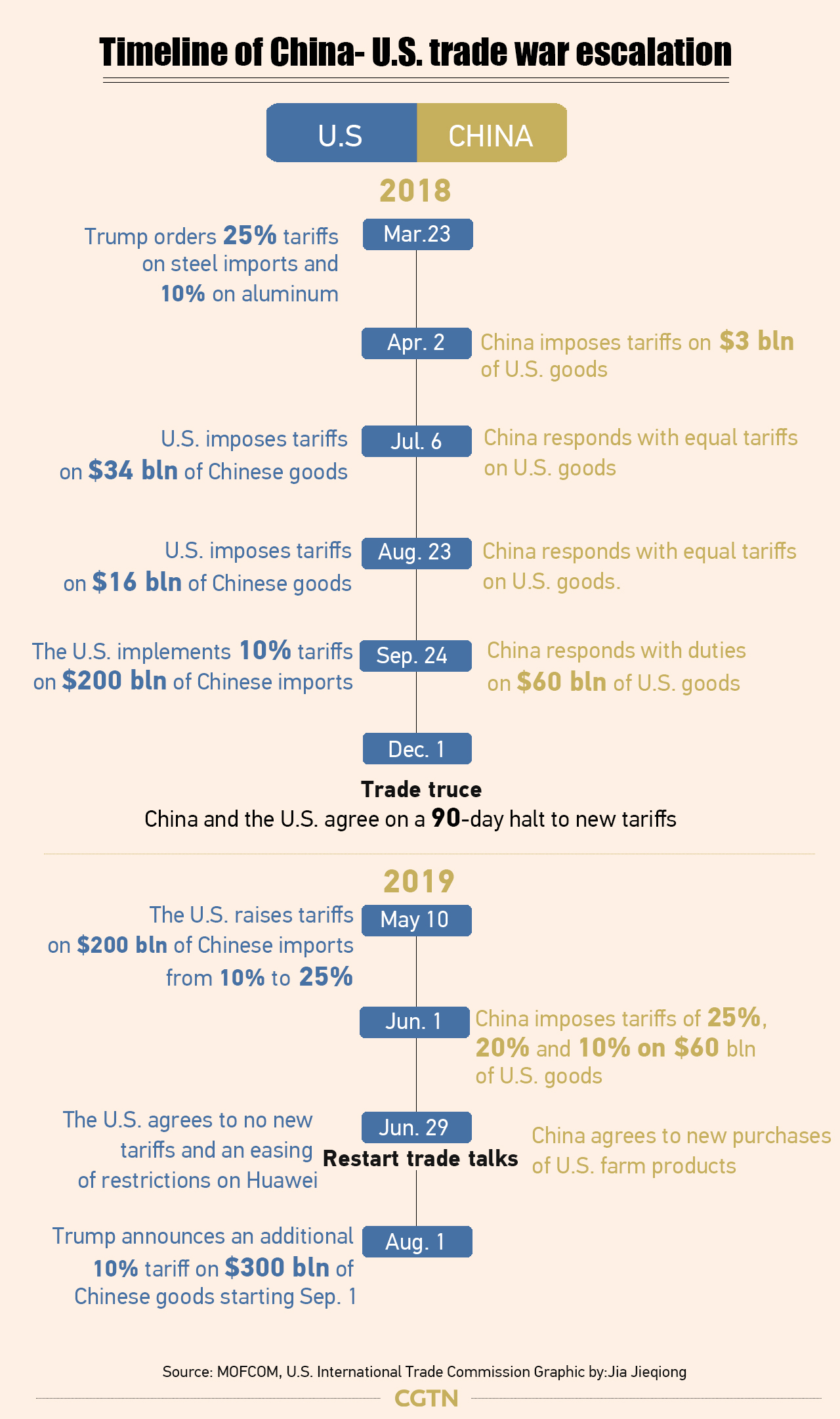

Trump plans to tax 300 billion U.S. dollars of Chinese imports at 10 percent starting in September with the goal of accelerating trade talks with Beijing to favor the United States. The new tariffs would be an addition to the 25 percent tariffs Trump has imposed on 250 billion U.S. dollars in Chinese products. Those are mostly industrial goods. By contrast, the new tariffs would target products used by American consumers, like shoes, clothing and cellphones.

US retailers blast tariffs on China, expect consumer price hikes

By Friday, Trump's new planned tariffs had triggered worries, especially among retailers, about the consequences. Retail stores, many of which have been struggling, would have to make the painful choice of either absorbing the higher costs from the new tariffs or imposing them on price-conscious customers.

Several American retail associations say they're disappointed at Trump's tariff announcement, and warned the US government of consequences.

The National Retail Federation, which includes Walmart and Amazon among its members, calls the decision a "flawed strategy." It says the tariff strategy is "already slowing U.S. economic growth, creating uncertainty and discouraging investment."

And the American Apparel and Footwear Association says the tariffs would be "hugely disruptive," adding they'll hit U.S. consumers much harder than Chinese manufacturers.

For retailers, there is a sense of pressure already, because higher prices would hit hard around the time that the critical holiday shopping season will begin.

iPhone sales would be hurt if consumers respond to the tariffs by keeping their existing devices to avoid higher prices. Wedbush Securities analyst, Daniel Ives, estimates that Apple will sell six million to eight million fewer iPhones in the U.S. if it includes the tariff in the sale price.

Peter Bragdon, executive vice president at Columbia Sportswear, said his company had been diversifying away from China and now makes products in more than 20 countries. He said he thinks companies like Columbia Sportswear will fare better than the smaller outdoor rivals.

"The larger companies that have the experience are going to be able to weather really bad public policy," he said.

China has signaled the likelihood of imposing counter-tariffs on U.S. goods, which would hit American exporters. The stock market sold off sharply on Friday, in part over concerns about the effect on corporate profits.

Trump administration denied the impact on U.S. consumers

In 2018, 42 percent of all U.S. sold apparel was made in China, according to the American Apparel & Footwear Association, a trade association. And, 69 percent of that number relates to footwear alone.

"This creates a cash crunch, a lot of confusion and uncertainty," said Steve Lamar, executive vice president of theassociation. "It couldn’t come at a worse time."

The Trump administration has publicly denied that consumers would be significantly harmed by the tariffs.

Larry Kudlow, director of the U.S. National Economic Council, is positive about the tariff impact on U.S. consumers.

Taken together, the tariffs would more than wipe out the savings a middle-class household received from Trump's 2017 income tax cuts. The average tax filer earning between 50,000 and 75,000 U.S. dollars paid 841 U.S. dollars less in taxes last year, according to Congress' Joint Committee on Taxation.

(With input from AP)

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3