Editor's note: Kong Qingjiang is the dean of the School of International Law under China University of Political Science and Law. The article reflects the author's opinions and not necessarily the views of CGTN.

On Monday, in a press release, the U.S. Treasury Secretary Steven Mnuchin had called China a currency manipulator. What's interesting is the wording of the statement, which said that the determination was made "under the auspices of President Trump."

It reminds observers of China-U.S. trade relations that during his presidential campaign, Donald Trump time and again accused China of being a currency manipulator and threatened to impose 45 percent tariffs upon Chinese goods on "day one" of his presidency. Most observers did not take his words seriously for he seemed to have little chance then of becoming the U.S. president.

To the surprise of many, he turned out to be the black horse in the presidential campaign. Although President Trump did not do so on his promised day one, he instructed his Treasury Secretary Mnuchin to probe into China's currency on a few occasions. Mnuchin, who is generally thought to be the mildest cabinet member in the Trump administration in dealing with China, has refrained from labeling China a currency manipulator until his latest surprising announcement.

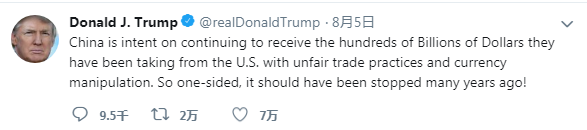

Screenshot of Trump's tweet

Just a few days ago, the president toughened his attitude towards China's currency affairs. He tweeted the latest decline in the Chinese yuan, which apparently referred to the fact that the yuan tumbled on August 5 to the weakest level in 11 years, called it "currency manipulation" and indicated he'd like the U.S. authorities to act to counter the Chinese action. This was, at least in his eyes, an indicator of China's unyielding response towards Trump's August 1 announcement of his decision to impose 10-percent tariffs on 300 billion U.S. dollars' worth of Chinese imports from September 1.

It was not difficult to find that the president's association of the decline of the yuan in the market with currency manipulation by the Chinese government was followed by his Treasury Secretary's designation of China as a currency manipulator. To many observers, a correlation was there among the decline of China's yuan, the president's comments thereupon and the U.S. Treasury Secretary's labeling China as a currency manipulator, particularly given the fact that just months ago, the Treasury Secretary declined to do so in the Treasury Department's latest semi-annual foreign exchange policy report to the U.S. Congress.

VCG Photo

The currency manipulator epithet provides the president with saturation of his long-held and persistent wish to reign in China with the financial instrument. However, it is dubious whether China's currency decline itself can be duly and legally designated as currency manipulation even under the qualitative parameters pronounced by the Department of Treasury. As a matter of fact, the People's Bank of China, China's central bank, has responded by arguing that the U.S. labeling of China is an arbitrary unilateral and protectionist practice.

According to U.S. law, the U.S. president would be able to impose tariffs on Chinese goods as high as 45 percent with the labeling, among others. Even though it remains unclear at this moment whether the U.S. label on China would finally lead to the U.S. imposition of unprecedentedly high tariffs upon Chinese goods, one thing is clear that this will be used as a leverage by President Trump in his attempts to force most concessions out of China, and that the actual use of the financial instrument would amount to a full-blown trade war which would have an effect of disengaging the two economies.

Observers of the China-U.S. trade relations need to be alert against any further move by the Trump administration, and consider whether imposing the "legitimatized" high tariffs is a test of the U.S. willingness to maintain a minimal trade link between the two countries or its eagerness to sever the fragile link.

(If you want to contribute and have specific expertise, please contact us at opinions@cgtn.com.)

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3