02:26

China's Foreign Investment Law goes into effect on the first day of 2020. The new law aims to further expand the scope of opening-up and better protect the legitimate rights and interests of foreign investors.

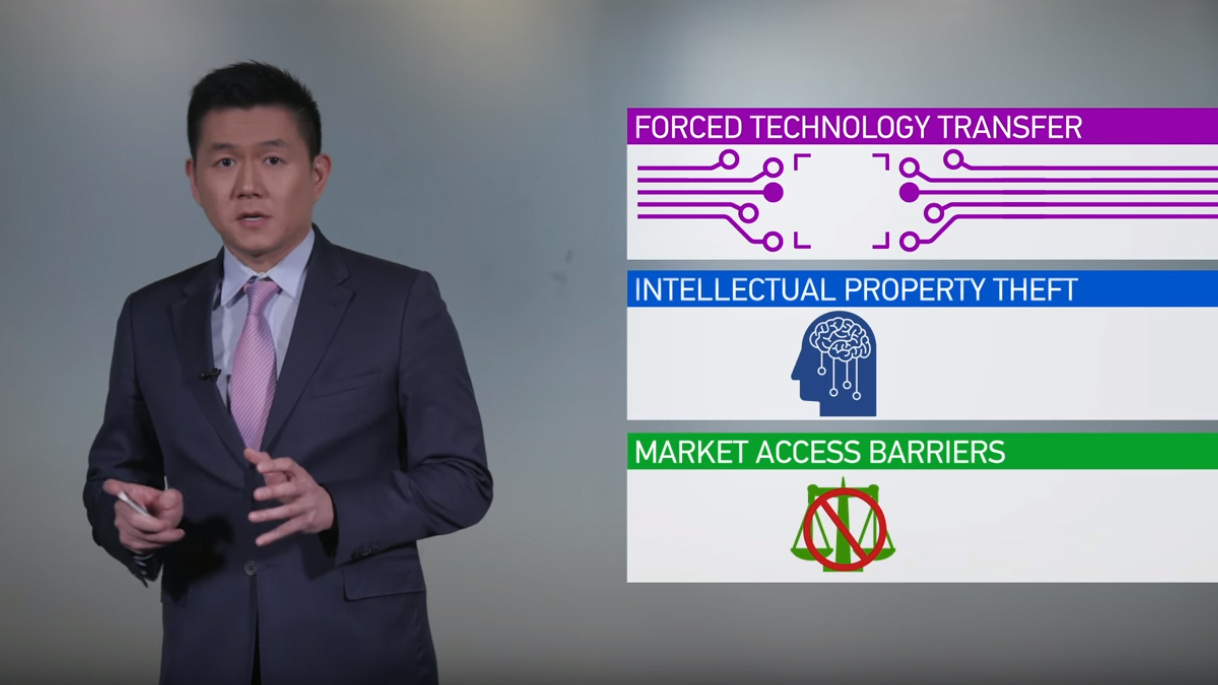

Consisting of 41 articles in six sections, stressing investment promotion, protection, management, and legal responsibility, the law intends to give foreign businesses broader market access, it protects intellectual property, prohibits forced technology transfer, and guarantees a "level playing field" for both foreign and domestic companies.

Before being passed at the second session of the 13th National People's Congress (NPC) in March, 2019, the new law was drafted in 2015 and went through two readings by the NPC Standing Committee.

Premier Li Keqiang signed a State Council decree to publish the regulation on implementing the law on the last day of 2019.

02:02

Foreign investment into China has risen substantially over recent years, and existing laws on foreign investment are no longer able to meet the needs of the new era.

The new law replaces the existing laws on Chinese-foreign equity joint ventures, wholly foreign-owned enterprises and Chinese-foreign contractual joint ventures, with a transit period of five years.

"It promotes the legitimate rights and interests of foreign investors, especially the protection of intellectual property rights, and solves the pain points that have long plagued foreign-funded enterprises with regulations. It will greatly enhance companies' sense of gains," Zong Changqing, director of the Foreign Investment Department at Ministry of Commerce (MOFCOM), commented.

Some key articles that have caught business people's eyes. The law emphasizes on ensuring equal treatment for foreign investors, which applies to all business sectors outside of the negative lists.

The law also protects intellectual property rights for foreign investors, pointing out that any forced technology transfers through administrative measures would be illegal.

And in terms of starting a business in China, foreign investors can simply file online, instead of going through the approval system. Meanwhile, the law for the first time allows Chinese people to invest in foreign companies as individuals.

Li Yong, senior fellow at China Association of International Trade said the new law could ease the concern over insufficient implementation.

"The law has made it clear that there should be one standard across the country.”

In the process of interacting with local authorities, foreign investors also have responsibility to tell local authorities if there is any action not in line with the law, the expert added.

Li expected restrictions to be less in the future, which will make investing in China "more transparent and more relaxed."

04:06

Climbing inflow of foreign direct investment

China has seen a steady inflow of foreign direct investment (FDI) as the country is opening up its market to foreign investors and enterprises.

In the first 11 months of 2019, the number of foreign-funded projects with investment of at least 100 million U.S. dollars reached 722, up 15.5 percent year-on-year, according to the MOFCOM.

Earlier data from the ministry showed a total of 36,747 new foreign-funded enterprises were established during the January-November period, while foreign direct investment into the Chinese Mainland expanded six percent year-on-year to 845.9 billion yuan.

Investment cooperation from the Belt and Road countries is continuing. Han Yong, the deputy director of the Cooperation Department at MOFCOM, said: "Investment in countries along the route amounted to 12.8 billion U.S. dollars, an increase of 0.5 percent in total foreign investment, and the cumulative investment has exceeded 100 billion U.S. dollars."

The reforms have already been tested in around a dozen Pilot Free Trade Zones (FTZs).

The government will further enhance foreign investment accessibility by shortening the negative list of FTZs, and exploring the feasibility of establishing a negative list management system of cross-border service trade in the FTZs, according to the ministry.

Foreign investors bet on Chinese market

"We obviously want to take the opportunity of the opening up of the market, to explore and to give Chinese consumers the best we can offer," said Laetitia Garnier, CEO of H&H Group.

The president of Novartis Pharma China, Ingrid Zhang said their new product is getting approved much faster.

"We are confident the Chinese government will continue to improve the environment to foster and protect innovation."

But the Chief Asia-Pacific Economist of French Investment Bank Natixis, Alicia Herrero said "China's opening up takes time for foreign banks to be there in the market" since "cost of doing business for foreign banks is high."

"We need both ways, we need China to open truly and foreign institutions to seize the opportunity and get in truly."

01:50

German drive and automation technologies provider, Lenze, which entered China in 1997, said they are very concerned about the stability, fairness and openness of policies.

"As foreign investors, we want to make sure there are laws and regulations for foreign companies to follow and to protect their rights on a legal basis," said Sean Xie, president East Asia and General Manager China at Lenze.

"IP protection is one of the biggest worries among foreign firms in China. They are afraid that their technologies may be stolen or copied. The new law will protect it on a legal level. It is very detailed and comprehensive. I think it will reduce foreign firms' worries to some degree, and boost their confidence and hopes for doing business here," Xie said.

Affirming China's efforts in improving foreign companies' access to the country in recent years, Carlo Diego D' Andrea, Shanghai Chairman of European Union Chamber of Commerce in China, said: "On the other hand, there are many indirect barriers, when the companies arrive doing business on the territory. We hope it will boost equal treatment between Chinese and European companies."

(CGTN's Wang Guan, Lin Nan and Global Business also contributed to the story.)