Editor's Note: Jimmy Zhu is a chief strategist at Singapore-based Fullerton Research. The article reflects the author's opinion, and not necessarily the views of CGTN.

China's trade figures for the first two months of 2020 suggest that external demand would become more challenging due to the spreading of the new coronavirus globally. Given that domestic economic activities have gradually picked up in recent weeks, traders may take the yuan as one of the safe-haven assets at this moment. Meanwhile, the European Central Bank (ECB) may cut rates on March 12, after trade data showed euro zone's economy will further deteriorate in coming months.

Chinese exports slid 17.2 percent in dollar terms in the first two months of this year, while imports dropped 4.0 percent year-on-year. It's the first time that Chinese customs authorities combined January and February trade data together, instead of releasing the figures separately due to the seasonal effect of the Lunar New Year period. Trade data shows that recovery in China's production may have a quicker pace than elsewhere.

A 4.0-percent drop in imports is relatively mild, and much better than market expectations. One reason for that is that the nation's production may have already gradually recovered since mid-February (see detailed analysis here). Some of the details in the imports data released earlier further confirm the picture of "domestic recovery." The volume of imports in key raw materials used in the industrial sectors registered substantial growth. Imports of crude oil grew 5.2 percent in the first two months, imports of steel products grew 2.1 percent, and imports of copper were up 7.2 percent over the same period.

One of the surprises in the trade data was the trade balance moving into a deficit territory, which could become the norm in coming months. The trade balance left a 7.09-billion-U.S.-dollar deficit in the first two months from a surplus of 47.2 billion U.S. dollars in December last year. The chart below explains the reasons behind the trade deficit, as imports and exports usually reflect the domestic and external demands respectively.

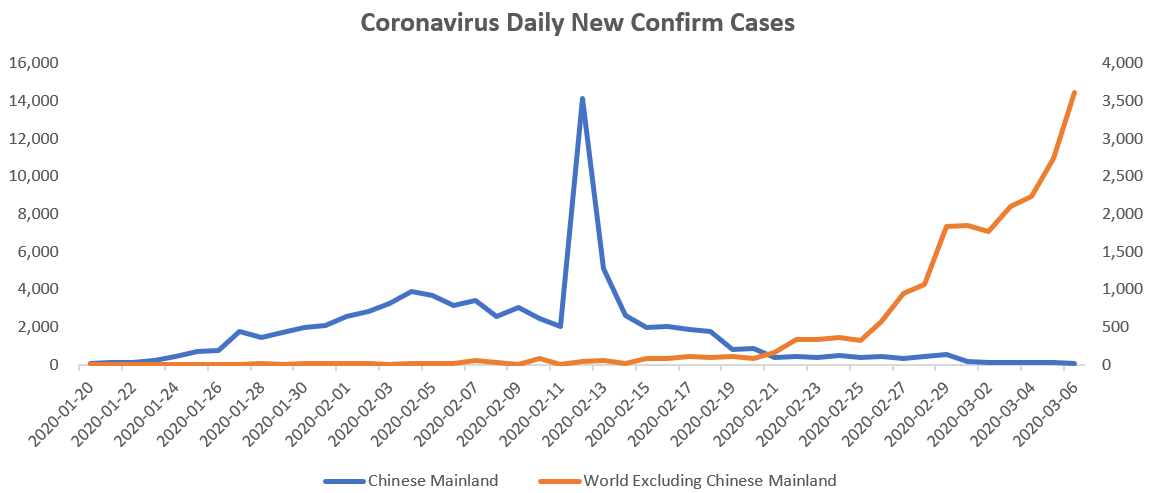

Source: WHO, Fullerton Research

Source: WHO, Fullerton Research

The coronavirus outbreak on the Chinese mainland picked up speed in late January but started easing since mid-February as the number of new infections began to drop in the country. The rapid growth in the numbers of new infections and stringent quarantine measures occurred in the first half of February. This is a period when most of the factories are regularly closed due to the Chinese New Year holiday. The chart above shows that the new infection cases peaked on February 12, many factories may have restarted production since then, and this is the reason why imports only encountered a moderate contraction in the first two months of the year. It's also worth mentioning that the imports from the U.S. rose 2.5 percent in January and February even with a 4.0-percent decline in China's total imports. This may help continue easing the trade tensions between the world's two largest economies.

Trade balance effect on Chinese yuan

Based on textbook rules, trade deficits in one country are usually considered as negative on its currency. The balance of trade impacts foreign exchange rates as supply and demand can lead to an appreciation or depreciation of currencies. For example, a country with a low demand for its goods tends to import more than it exports, decreasing demand for its currency. However, this rule doesn't apply for the yuan at this moment.

The trade deficit in China in the first two months of the year may be mainly due to the fact that the impact of the virus on the Chinese economic activities may have eased as new infection cases overseas grew rapidly. Such divergent trends may extend into March based on the current developments. Thus, production levels in many of China's trading partners are likely to further drop due to possible quarantine measures and restrictions.

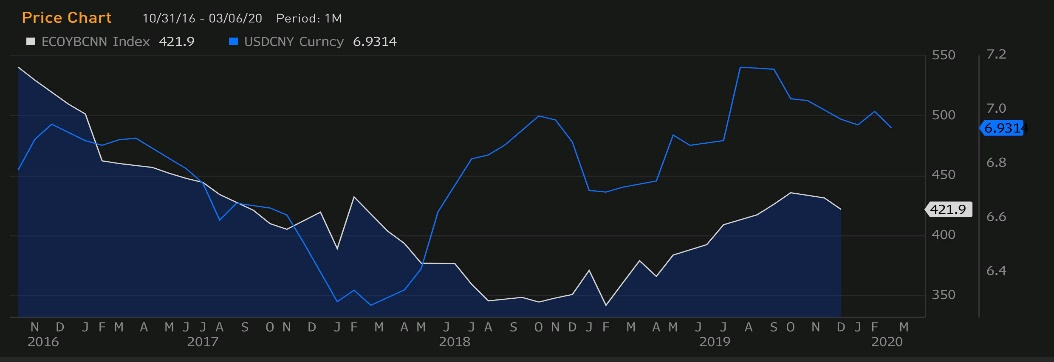

The chart below shows that China's trade balance has been moving in tandem with USD/CNY, meaning that the yuan tends to strengthen when the trade surplus narrows or deficit widens. When imports' value exceeds that of exports, it reflects that domestic demands are relatively stronger than external ones. Onshore yuan closed at 6.9314 versus the dollar on Friday, versus 7.0035 from a month ago.

China trade balance (white) vs. USD/CNY (blue). Source: Bloomberg

China trade balance (white) vs. USD/CNY (blue). Source: Bloomberg

China trade data hints ECB to take action soon

One the other hand, China's growth in exports may continue to decline in the coming months as the outbreak continues to spread around the world and because of wider disruption to global supply chains. Among all the countries China exports to, those in the euro zone are most concerned. China's exports to Germany, France and Italy slid 24.1 percent, 15.7 percent and 18.5 percent respectively, showing that demand in these countries has been significantly decreasing. Imports from these nations also scored double-digit declines.

Recent information shows that infections outside China started to accelerate from late February, which means that industrial demands are likely to worsen in March. Growth in these top economies highly depends on exports, which are expected to be widely affected if more factories are forced to close.

The ECB will make its rate decision on March 12. After the Fed took the emergency step by cutting the interest rate for the first time since 2008, the greenback and the U.S. 10-year government bond yield significantly dropped. This leaves European companies at a relative disadvantage, as a higher euro puts European exporters at a disadvantage. Meanwhile, spread between the U.S.-Germany 10-year government bonds yield has now narrowed to 147 bps, which increases the room for the ECB to further lower the rates in March in an effort to lower the borrowing cost for the companies in the euro zone.