01:09

China stocks posted their biggest fall in more than five months on Thursday, as investors cooled down their buying spree on signs of policy tightening after the country's economic growth in the second quarter beat expectations.

The Shanghai Composite index closed down 4.5 percent at 3,210.10, while the blue-chip CSI300 index was down 4.81 percent, their largest drops since February 3.

The tech-heavy start-up board ChiNext Composite index slumped 5.9 percent, also its worst session since February 3.

Investors are taking profit from the bull run in the last two weeks that has priced in a rebound in China's economy, analysts said. Foreign investors are also turning to sell Chinese stocks on worries of deteriorating China-U.S. relations, they added.

Foreign investors cashed out of Chinese stocks at a record pace on Tuesday by selling a net 17.4 billion yuan (2.49 U.S. dollars) through trading link-ups between Hong Kong and the mainland, as worries about a possible decoupling of China-U.S. relation deepened.

Read more:

Expert: U.S. has completely abandoned neutrality on South China Sea

China says U.S. plan to bar CPC members from entry 'pathetic'

China's GDP grew 3.2 percent in the second quarter, beating expectation, as COVID-19 eases and policymakers announced economic packages.

"Policy will remain supportive, but the pace of loosening may moderate given the strong credit expansion of the past months and the recent market surge," said Nathan Chow, economist at DBS Bank in Singapore.

00:27

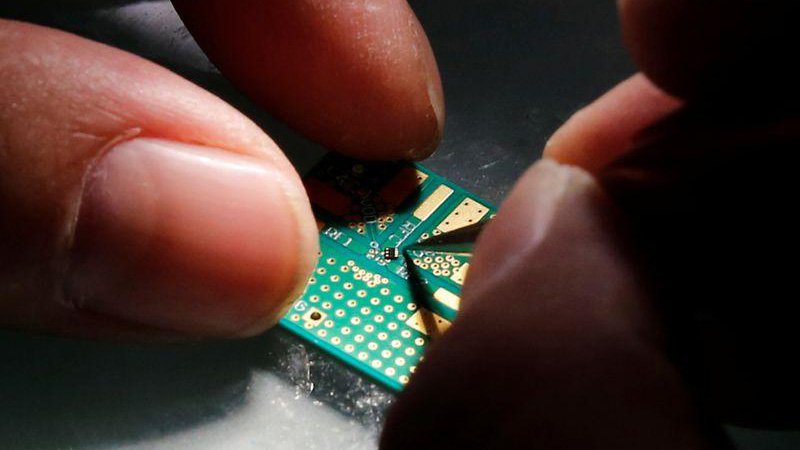

Shares in Semiconductor Manufacturing International Corp more than tripled as they debuted on the Shanghai STAR market on Thursday.

However, broad tech stocks retreated as investors pocketed gains following the strong rally in recent weeks, with the CSI all share semiconductors and semiconductor equipment index tumbling 9 percent.

(With input from Reuters)