Li Auto shows its flagship Li ONE extended-range electric sport utility vehicles at a showroom in Beijing. /Reuters

Li Auto shows its flagship Li ONE extended-range electric sport utility vehicles at a showroom in Beijing. /Reuters

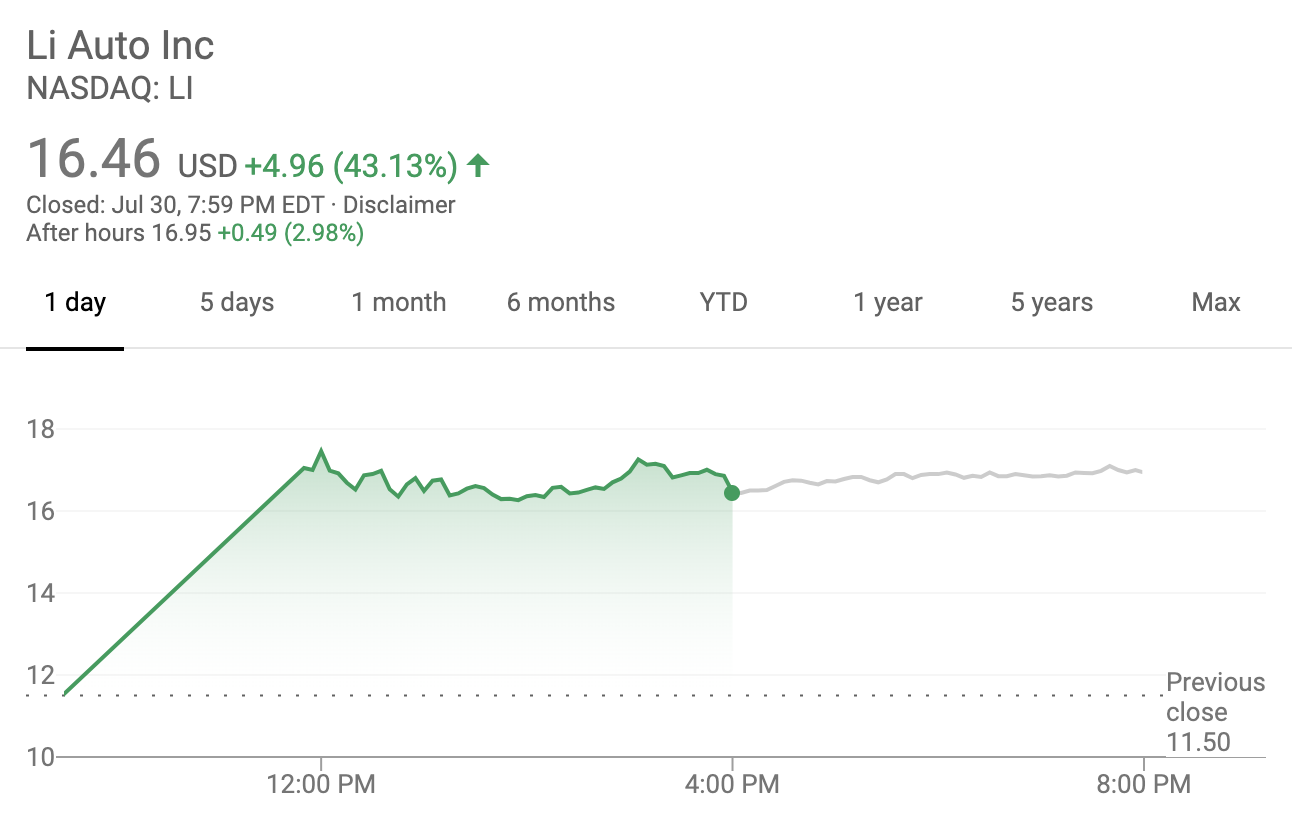

Li Auto Inc's stock soared 43.13 percent following its debut on Nasdaq on Thursday, after the Chinese electric vehicle maker sold shares to investors in its 1.1-billion-U.S.-dollar initial public offering (IPO) for a higher-than-expected price.

The offering of 95 million American depositary shares (ADS) was priced at 11.50 U.S. dollars per share. The stock opened at 15.50 U.S. dollars and extended gains to rise as much as 17.50 U.S. dollars, adding to the growing list of strong debuts this year.

The New York IPO of Li Auto, backed by food delivery giant Meituan Dianping and TikTok owner ByteDance, comes at a time when U.S.-listed Chinese companies are facing tightened scrutiny and strict audit requirements from U.S. regulators, as tensions escalate between the two countries.

Sentiment toward Chinese firms among U.S. investors has also been hit by the fallout from Luckin Coffee Inc, a Chinese coffee chain, which was listed on Nasdaq and earlier this year disclosed that some of its employees fabricated sales accounts.

CGTN screenshot from Google.

CGTN screenshot from Google.

The IPO of the five-year-old Beijing-based automaker, two years after Chinese peer Nio Inc went public in New York, is one of the biggest U.S. listings by a Chinese company this year. Investors value the company at around 10 billion U.S. dollars.

Unlike rival Tesla and Nio's pure battery electric vehicles, Li Auto's sport-utility vehicle model Li ONE allows drivers to charge their cars with electricity or gasoline, a technology called extended range electric vehicle (EREV).

"There is demand for EREV, which alleviates range anxiety issues for customers," said Mingming Huang, founder of the six-year-old Future Capital Discovery Fund, which was the first investor in Li Auto when the company started in 2015.

Huang also told Reuters that Li Auto would not rule out the possibility of having a different powertrain in future models. Li Auto sold 9,666 vehicles in the first six months this year.

Goldman Sachs, Morgan Stanley, UBS and CICC were among the underwriters for the IPO.

Source(s): Reuters