Editor's note: COVID-19: Economic Analysis is a series of articles comprising experts' views on developing micro and macroeconomic situations around the globe amid the COVID-19 pandemic.

U.S. retail companies have entered into an unprepared and unstoppable bankruptcy blackhole as dozens of retailers subsequently announced business failures since the COVID-19 pandemic ravaged the country in early 2020.

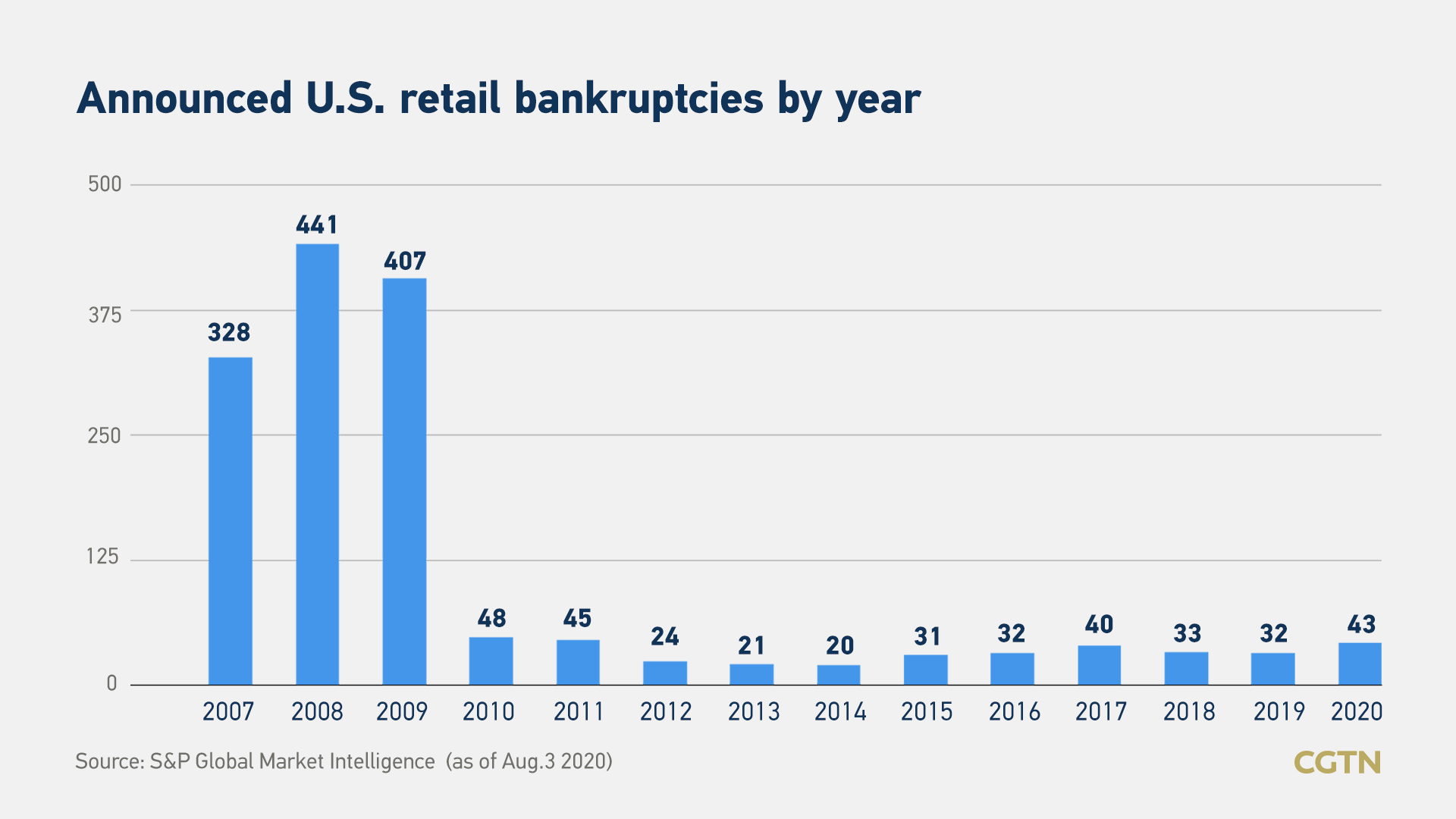

As of August 3, a total of 43 U.S. retailers have filed for bankruptcy, the highest number in over a decade. The precedent peak was 48 bankruptcies in 2010, data from S&P Global Market Intelligence showed.

The pandemic this time has lead to an economic tornado similar to that in 12 years ago. The 2008 financial crisis witnessed the largest wave of bankruptcy, with 441 retailers announcing business failures, according to S&P Global.

Venerable U.S. retailer Lord & Taylor, owner of Men's Wearhouse, Le Tote, and Jos. A. Bank all filed for bankruptcy on August 2, extending the list of brick-and-mortar retailers who surrender to the COVID-19 crisis.

But is the pandemic the only cause for their bankruptcies? The answer is surely 'No'. Bad management and slow speed of transition seem to be the deeper reasons.

Recent years have long witnessed the poor management of the U.S. brick-and-mortar retail stores, so their closures are not surprising. The COVID-19 outbreak this year has acted as a fuse to accelerate the development of e-commerce and promote the change of consumers' buying habits from offline to online, Stella Liu, Consumer Analyst at ICBC International told CGTN.

"The retail industry has serious differentiation in business operations. Although traditional retail channels including department stores, pharmacies, and supermarket still take the lead in market share, their sales growth is slow, especially the traditional department store," said Stella.

"For some retailers with slow transitions and ineffective market strategies, the default risk in the market for leveraged loans is high. The risk will accumulate and spread to the upstream, downstream and the entire industry."

For traditional retailers, their transformation from offline to online is not fast, and it's the same case with Chinese retailers. They cannot sense consumers' preferences and trends, said Liu Chunsheng, an associate professor at the Central University of Finance and Economics in China as well as deputy dean of Blue Source Capital Research Institute.

"The important thing is to lead consumer trends and to create consumer demand. They cannot use big data to 'portray' consumers," said Liu.

In recent years, the vacancy rate of shopping and department stores that rely on physical retail stores has continued to rise. During the coronavirus pandemic, the retail companies defaulted on rents frequently, said Stella.

Differentiation in retail sector

The differentiated development of retailers leads to an imbalance market space. The market share of the top 10 U.S. retail companies have continued to grow, which limits the development space of small and medium-sized retail companies, a report released by the National Retail Federation in July showed.

"Those smaller retailers are also negatively affected by the market and economic downturn, so the impact will be even greater. In the end, they will be winnowed out due to the mergers and acquisitions of market denominators," said Stella.

Some retailers who still want to save their businesses are saving every penny to survive the crisis through measures like layoffs, store cuts and bond sale.

People wait to enter Macy's Herald Square ahead of early opening for the Black Friday sales in Manhattan, New York City, U.S., November 28, 2019.

American department store Macy's, for example, in June announced it would lay off about 3,900 employees to save about 365 million U.S. dollars in fiscal 2020. The chain store reported a 45-percent drop in sales in the first quarter, and net income was a loss of 630 million U.S. dollars compared to last year's gain of 137 million U.S. dollars.

Macy's Herald Square in Manhattan, New York City, U.S., November 28, 2019. /Reuters

Macy's Herald Square in Manhattan, New York City, U.S., November 28, 2019. /Reuters

Stella said these measures taken by retailers to save businesses only played a role in improving cash flow and slowing down the speed of bankruptcy in the short term. They are not the key to solving the problem of enterprises falling into business difficulties.

The U.S. retail stores face both challenges and opportunities. The pandemic will continue to quicken the development of online shopping. Those traditional retailers with insufficient efforts to tap into e-commerce field will face adverse impact.

Also, the pandemic will accelerate the integration of the U.S. retail industry. As small and medium-sized market participants gradually withdraw, leading companies will further seize market share.

So retailers should actively get involved into online business operations, and enhance the consumer experience in physical stores at the same time. The cooperation between convenience stores and mass merchants should be promoted to echo the trend of market development, said Stella.

'Longer delay, larger risks'

The U.S. handled the pandemic badly, as it doesn't have unified ideas. With a weak foundation of pandemic control and prevention, the pressure on the fight against the disease for the rest of the year will be larger, which will surely affect the retail industry, said Liu.

"Companies cannot resume work and production, so consumers' income will be affected, which will directly affect their expenditure," said Liu.

The U.S. economy shrank at a record 32.9 percent in the second quarter. If the U.S. cannot properly control the spread of the pandemic in the third and fourth quarter of the year, its pressure on economic and consumption recovery will mount.

"The longer the delay, the greater the risk of economic downturn; the deeper the decline of the economy, the slower the rise of its economy."

COVID-19, coupled with the seasonal flu during the period, the impact will be unmeasurable, Liu added.