Global economies have suffered the largest decline in decades, as countries release their second quarter economic data, covering the peak of the COVID-19 epidemic outbreak.

Economies face mixed prospects for recovery in the second half of the year with differences in economic policies and measures to improve the global pandemic.

Global retail, catering, air transportation, tourism and foreign trade sectors have all been severely affected by the epidemic and shutdown measures.

In Asia, Thailand's gross domestic product (GDP) shrank by 12.2 percent year on year in the second quarter of this year, the most serious contraction since the Asian financial crisis in 1997.

The Thai economy is highly dependent on international trade and tourism. In the second quarter, the number of international tourist visits was almost zero, and the tourism industry suffered heavy losses, due to the global spread of the epidemic and control measures.

Singapore's second quarter GDP which also relies on foreign trade and tourism, shrank by 13.2 percent year on year and 42.9 percent quarter on quarter. Its economy has shrunk for two consecutive quarters, falling into a technical recession, which is its first recession since 2009.

Malaysia's GDP in the second quarter fell by 17.1 percent year on year, the largest drop in a single quarter since the fourth quarter of 1998. Restrictive measures taken in response to the epidemic have limited production and consumption activities, resulting in shocks to demand and supply, as well as public and private investment.

Meanwhile, the Indonesian economy shrank by 5.32 percent year on year in the second quarter, the first year-on-year contraction since 1999.

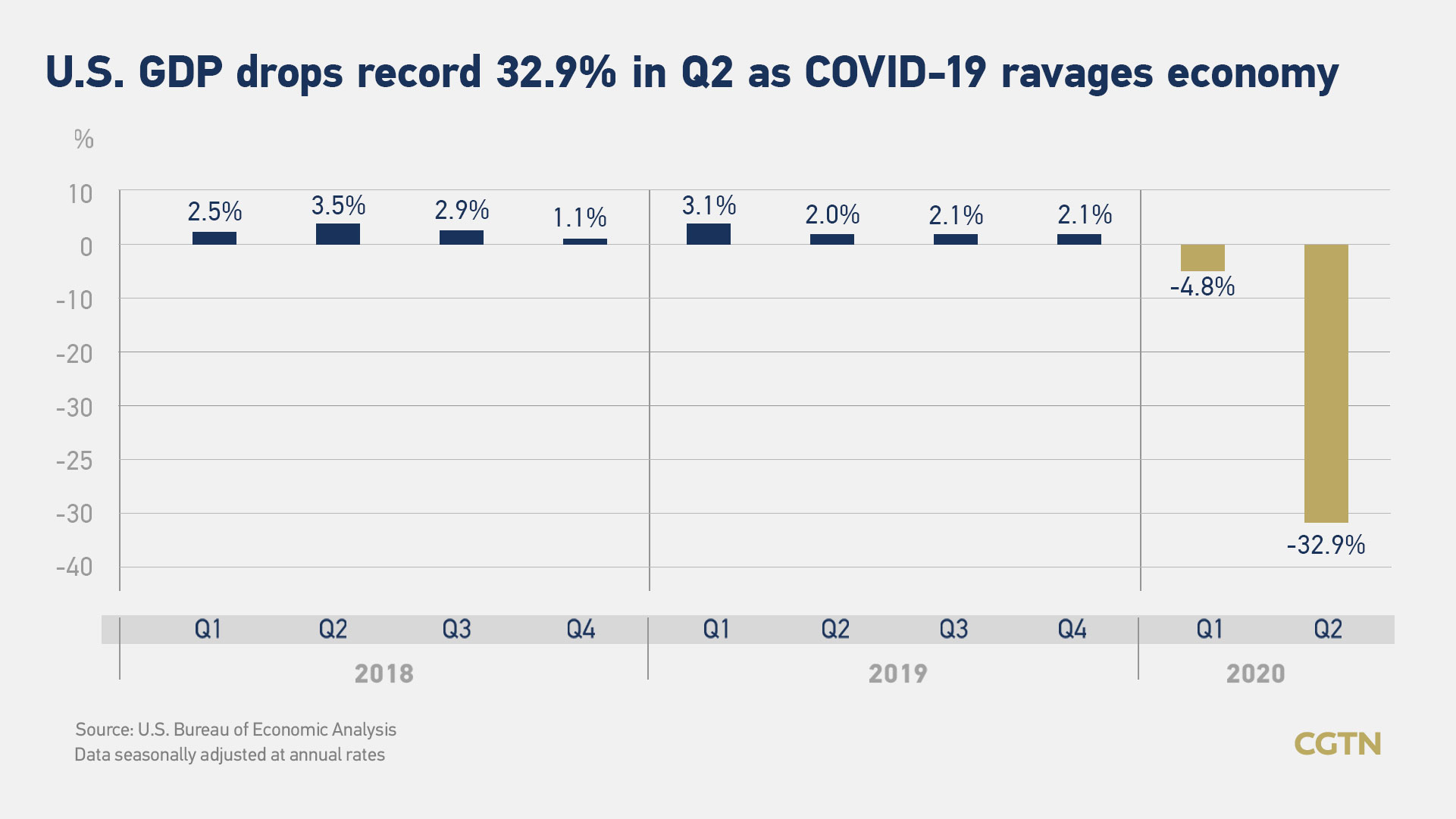

The economic data for the U.S. and European economies were equally bad. The U.S. saw the second-quarter GDP shrunk by 32.9 percent, much higher than five percent in the first quarter, which was the largest decline since 1947 on record.

The GDP of EU and Eurozone economies in the second quarter of this year decreased by 11.9 percent and 12.1 percent respectively from the previous quarter, and by 14.4 percent and 15 percent year on year separately, the largest drop since 1995.

The UK's GDP shrank again from April to June by 20.4 percent compared to last quarter, the worst record since 1955. Its GDP contracted by 2.2 percent in the first quarter, and its economy has been in recession for two consecutive months of contraction.

Israel's economy in the second quarter fell at 28.7 percent, the largest quarter-on-quarter decline in more than 40 years. Colombia's GDP in the second quarter dropped 15.7 percent year on year, the largest decline on record.

Increased economic support

Countries have actively adopted measures suitable for their national conditions to provide economic relief. In the second half of the year, under the expectation that the economy will be bottoming out, economic support from many countries is also increasing.

Germany is considering extending the government's subsidies for short-term workers to 24 months, which is reportedly supported by the economic ministers of the federal states. The resulting additional financial costs are approximately 10 billion euros (11.8 billion U.S. dollars).

Singapore announced Monday relief measures for fighting the epidemic in the next phase, totaling eight billion Singapore dollars (5.9 billion U.S. dollars). Israel also passed an economic rescue plan of 8.5 billion new shekels (2.5 billion U.S. dollars) last week to boost transportation, housing and high tech industries.

Mix prospects for recovery

Some economies are expected to bottom out in the second quarter and gradually recover from the second half of the year. However, the recovery in various countries also depends on the epidemic control measures and stimulus plans.

First-time jobless claims in the U.S. totaled 963,000 as of August, which represented a decline of 228,000 from the previous week's total. However, the number is much higher than the level before the epidemic, which further increased the market's concerns about the recovery prospect.

Neel Kashkari, president of the Federal Reserve Bank of Minneapolis, stated that the country's current epidemic control measures is not effective, as the epidemic continues to spread rapidly in the country, and that stricter lockdown measures should be implemented nationwide to control it.

In contrast, the economic sentiment indicator, which is a composite indicator produced by the European Commission to track GDP growth at member states, rose significantly in July, mainly due to the substantial increase in confidence in the industrial, service and retail industries, and the stability of consumer confidence.

The Eurozone Manufacturing Purchasing Managers Index (PMI) was revised higher to 51.8 in July compared to June's reading of 47.4, pointing to the first month of expansion in the bloc's manufacturing sector since February 2019.

Chris Williamson, chief business economist at IHS Markit, a London–based global information provider, said that the Eurozone manufacturing industry had a good start in the third quarter and manufacturing output is expected to increase further in August.

China's economy returned to modest growth at 3.2 percent in the second quarter of 2020 compared to a year earlier and reverted from the first contraction on record in the first quarter this year. The AFP poll forecast that China will be the only major economy to experience positive growth this year.

The growth is unexpected as the world's economic growth between April and June is arguably the worst in the past few decades, according to Nomura Securities.

"China's economy has staged an impressive comeback since mid-March, driven by pent-up demand, a catch-up in production, a surge in medical product exports and stimulus in both China and other major economies that has supported demand for goods made in China," said Lu Ting, chief China economist from Nomura.

Nomura expected sequential quarter-on-quarter growth to drop to 2.5 percent in the third quarter and 1.7 percent in the fourth quarter, and year-on-year real GDP growth to rise modestly to 4.3 percent in the third quarter and 4.5 percent in the fourth quarter.

Read more:

China's Q2 GDP growth recovers to 3.2% after steep slump, beats forecast