02:20

While the global auto industry is in the doldrums, Tesla, the world's most valuable electric car maker, with its shares surging past the 2,000 U.S. dollar mark on Thursday, has maintained four consecutive quarters of growth amid the coronavirus pandemic.

The performance has not only beaten Wall Street's expectations, but also surprised most industry watchers. With its total market share reaching 372 billion U.S. dollars, the startup's value is more than some established car makers combined.

Change happens so fast that traditional car companies barely have time to think about. But experts have pointed out a new direction after Tesla revolutionized the industry with its electric models.

"The next battleground for auto industry will be the internet-based smart vehicles. In a sense, the one who can take the lead in manufacturing intelligent cars will win the opportunity in the new round of competition," Chen Taiqing, president of China EV100, a private electric vehicle association of over 200 leading Chinese electric mobility industries, said at the Global Intelligent Vehicle Summit on Saturday.

"In the future, internet-based and all-connected electric vehicles will be the flagship products car companies have to face the challenges brought by the energy, information, and transportation revolution," Chen added.

China aims to become a "car superpower" over the coming decades, with the plan to own several top 10 electric carmakers by 2020 and to spearhead the use of smart connected vehicles by 2025, according to guidelines published by the Ministry of Industry and Information Technology in 2018.

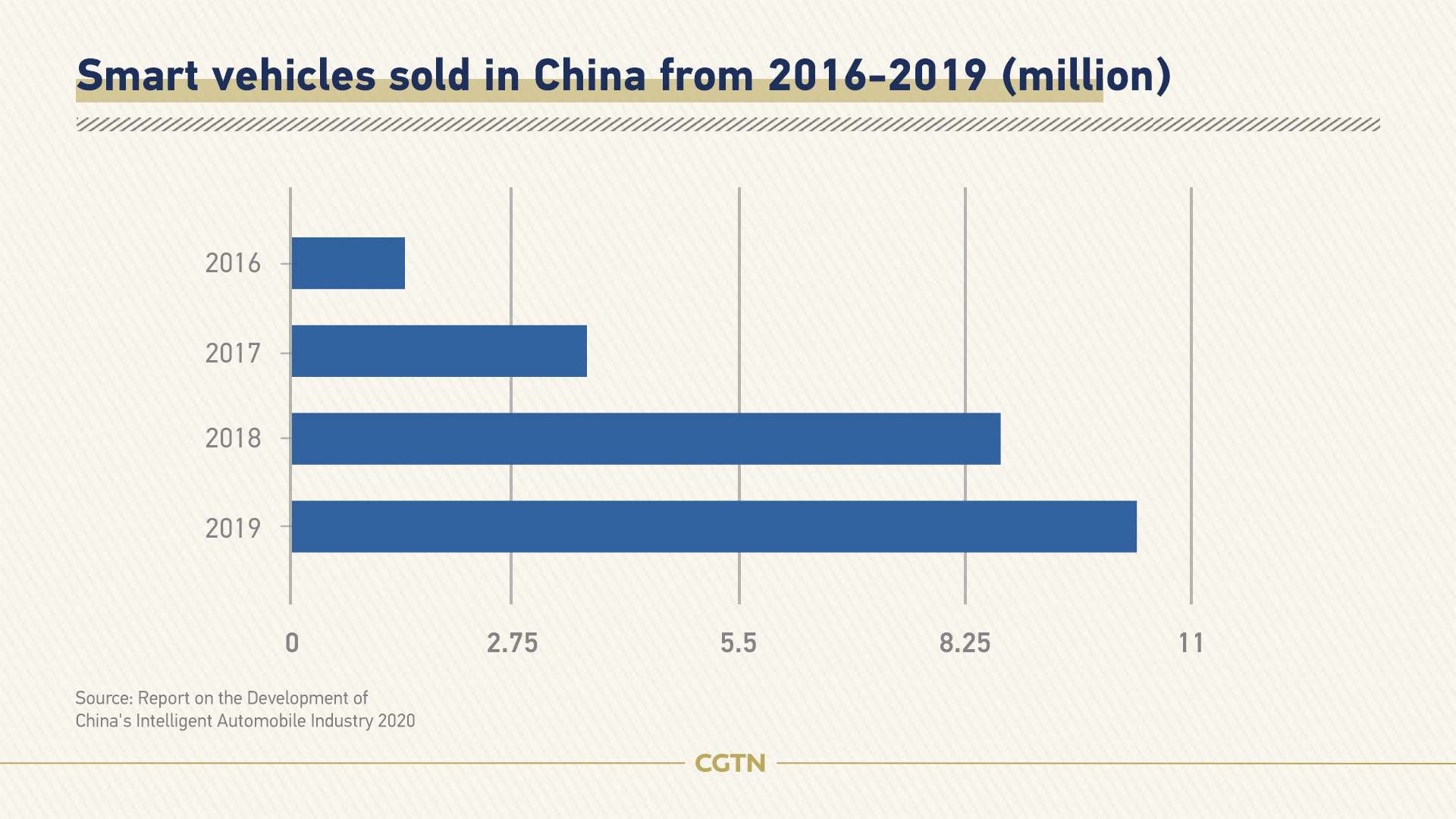

Data shows that China's smart vehicle sales have climbed from 1.46 million in 2016 to 10.33 million in 2019, an over 600 percent increase in just four years. Besides, about 91.5 percent of respondents said they have a strong intent to buy an intelligent connected vehicle as their next purchase, according to a survey conducted by research firm JD Power last year.

Opportunities and challenges ahead

Although China remains the biggest market for auto sales and production, core technologies and some auto parts still lag behind some western countries, Chen said.

"Internationalization, electrification, intelligent connection and fully autonomous driving technology have upended the auto parts industry," he added.

From battery and charging stations needed for electric vehicles to chips, sensors, and other hardware involved in autonomous driving, to cloud-based control centers and algorithm-powered intelligent software, the industry has embraced countless new members and technologies.

Chen stressed that there is plenty of room for Chinese new entrants to innovate in those fields, especially at a time when technological barriers have not been established.

01:00

A McKinsey report said that China has the potential to become the world's largest market for autonomous vehicles as well. It predicted that the sector may generate 1.1 trillion U.S. dollars from mobility services and 0.9 trillion U.S. dollars from sales of autonomous vehicles through 2040.

"We're seeing more auto companies cooperating with tech giants to digitize their operations and expand their offerings," said Xing Lei, chief editor of the China Automotive Review.

"As autonomous driving develops, the relationship between traditional automakers and tech companies evolving. Tech companies will not have their own auto brands immediately," said Xing.

Read more: Is the Chinese electric car market experiencing a winner-takes-all moment?