Editor's Note: Wang Tao is the chief China economist at UBS Investment Bank. The article reflects the author's opinion and not necessarily the views of CGTN.

The fifth plenary session of the 19th Central Committee of the Communist Party of China (CPC) is scheduled to be held in October 2020, in which the outline of the 14th Five-Year Plan (2021-25) will be reviewed and approved. The final version of the 14th FYP will be released at next year's National People's Congress in March 2021. What are likely to be key macro themes to watch for investors?

The 13th FYP has laid foundation for a new start

The U.S.-China trade war in the past two years and the COVID-19 pandemic brought a significant negative impact on China's economy and made achieving the 13th FYP objectives difficult. Nevertheless, most of the objectives, including those on urbanization and the environment, will likely be achieved at the end of 2020, except GDP growth and household income growth. Despite a shortfall of growth this year due to COVID-19, China's GDP per capita will likely reach 10,400 U.S. dollars in 2020, compared to 8,000 dollars five years ago. Moreover, China's middle-class population already exceeds 400 million (defined as those with annual household income between 100,000 and 500,000 yuan, according to the National Bureau of Statistics), and poverty (especially in rural areas) has declined significantly. The 13th FYP also saw the implementation of supply side reforms which reduced excessive capacities in industries, and deleveraging measures which led to tighter shadow credit regulations, faster disposal of bad loans and stabilization of debt/GDP ratio, though the latter will likely be undercut by this year's COVID-19 hit and credit stimulus.

Compared with five years ago, China is now facing more challenges, especially from the external front. The pandemic has led to a global economic recession, squeezed macro policy rooms in most economies, and amplified forces against globalization. The U.S.-China tension has been escalating across the board following the bilateral trade war since 2018 and the COVID-19 shock this year, leading to even more strict U.S. tech restrictions on China and increasing decoupling pressures. As a result of both these forces, supply chain restructuring is likely to be accelerated in the coming years. Domestically, aging demographics, elevated macro leverage, technology bottlenecks and low efficiency in some areas remain as key headwinds for China's long-term growth. We estimate that tougher tech restrictions may take out as much as 0.5ppts per annum from China's potential growth in the next 10 years, although China should remain the top contributor to global GDP growth and an attractive destination for investors.

What are key macro themes to expect?

Slower GDP growth, more focus on rebalancing and quality of growth

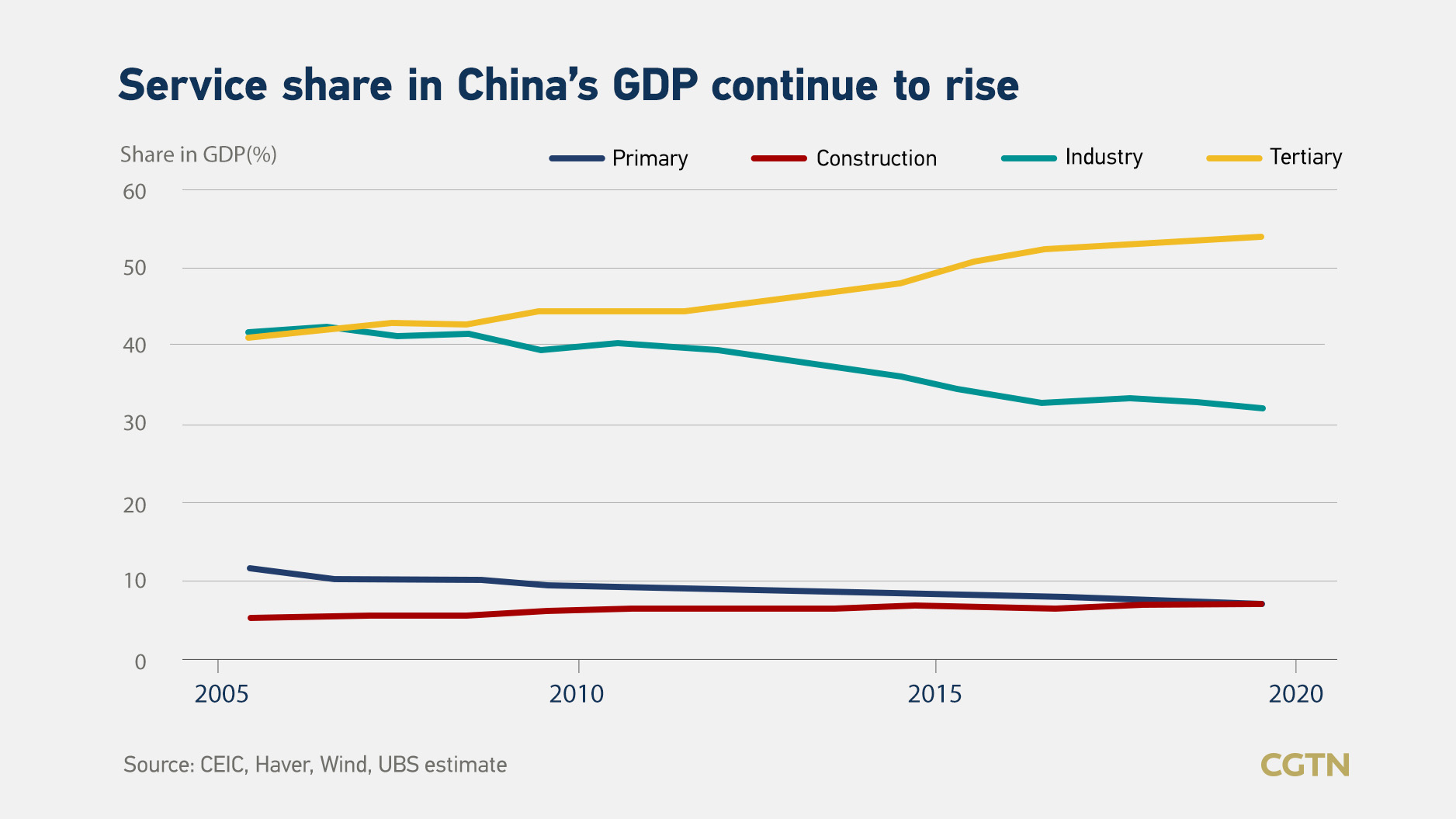

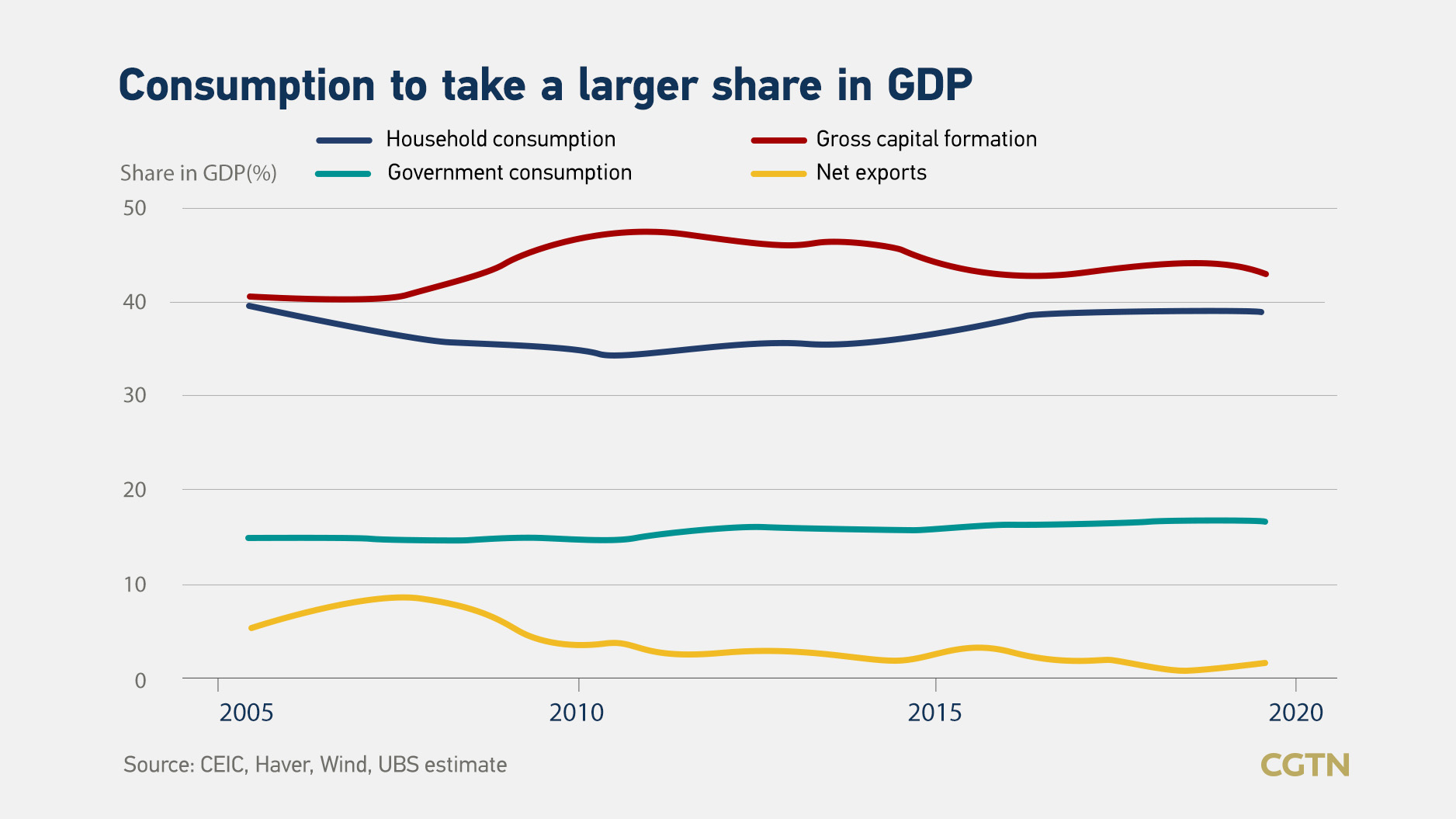

Compared with the ">6.5%" average annual growth target set in the 13th FYP, we expect the government to either not set an explicit growth target or set a lower and more flexible (e.g., around 5%) growth target. Despite an expected rebound to 7.6% in 2021, we expect China's growth to average only 5% in the next five years, as an aging population, lower savings rate, supply chain shifts and tougher tech restrictions are expected to weigh on the country's potential growth. As such, we expect the 14th FYP to emphasize fostering structural changes domestically and improve the quality of growth, along the lines highlighted by the recent "dual circulation" theme. This means that the 14th FYP will likely set ambitious targets for urbanization (likely another 5ppts increase of hukou urbanization rate), new urban employment growth (possibly another 50 million in 2021-25), increase in shares of consumption and services, improvement in the social safety net, and an increase in education and R&D spending.

'Dual circulation' to focus on boosting domestic demand

In light of the challenging external macro environment and lower potential growth, the new FYP is likely to follow the theme of "dual circulation" with a new emphasis on "domestic circulation" to guide development in the next five years. The theme adds new urgency to many existing government policies on boosting domestic demand in the coming years, including fostering urbanization, continued infrastructure investment, measures to support SME employment and improve social safety net, and hence, consumption. It would also require further deepening of structural reforms, or supply side reforms, to help reshape domestic supply of goods and services to satisfy domestic demand, as well as to improve productivity and sustainability. It does not mean China will shut down its doors to the world as it will likely open up further despite the rising external challenges.

Reforms in hukou, land, SOE areas to unleash growth potential

After a notable 5ppt increase of the hukou urbanization ratio to 45% in 2020, we expect the government to set a higher target further at 50% by 2025, indicating an increase of over 80 million urban hukou residents during 2021-2025. It requires more relaxation of hukou restrictions in large cities and equal access to public services, which could help increase labor mobility, support urban consumption and boost productivity growth (from low to high efficiency sectors). Meanwhile, the ongoing land reform is set to allow more rural land entering the market directly and accelerate the development of the land exchange market. It could release more land supply at lower cost and improve the allocation efficiency of the land market. Both hukou and land reforms could offer some modest support for the property market. In addition, China is now committing to a 3-year SOE reform plan (2020-22), which would include more mixed-ownership reform, divesting of state capital from competitive sectors, and increasing competition. These reforms could help level the playing field for private and foreign enterprises and improve SOEs' efficiency and competitiveness.

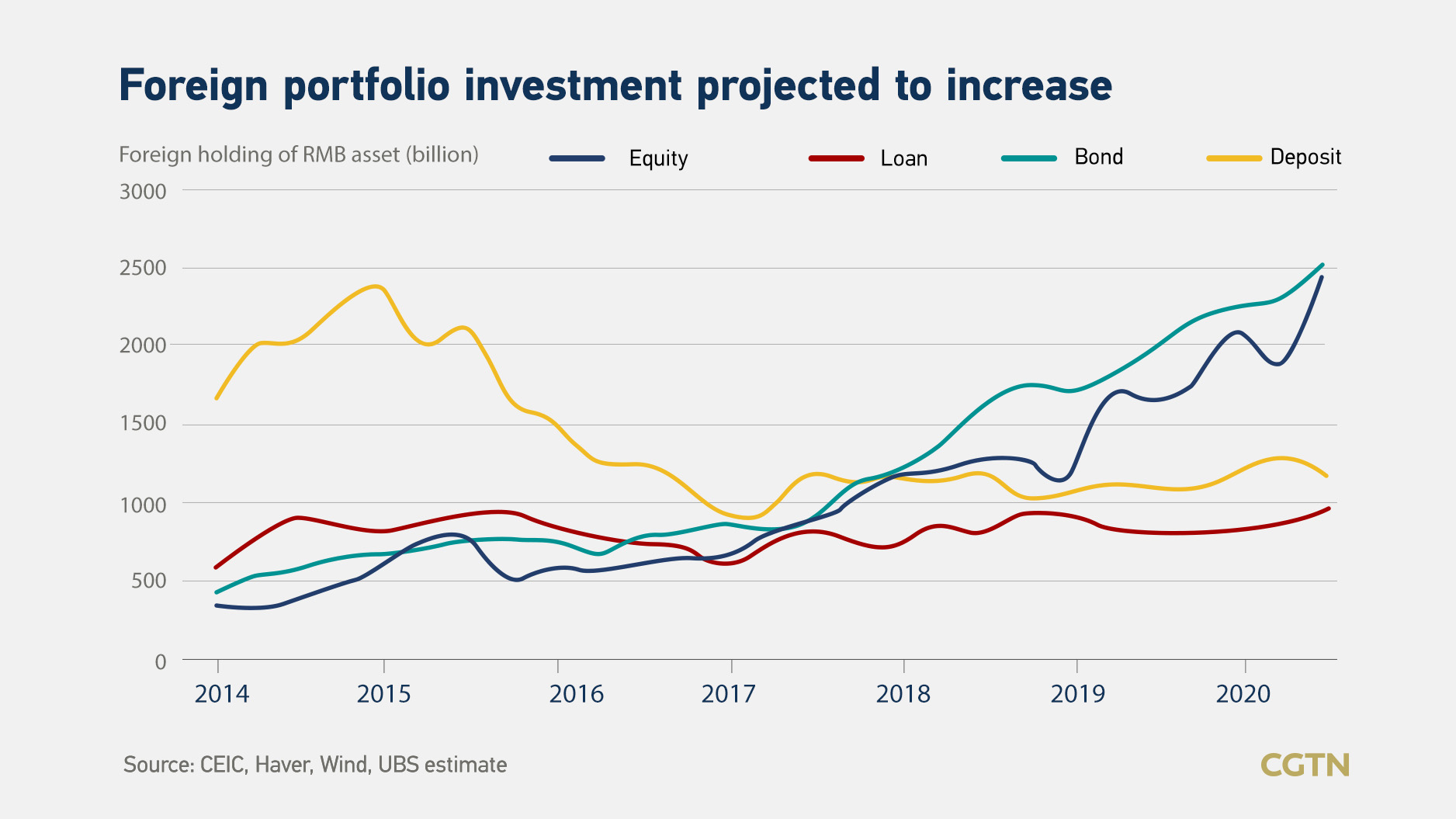

Opening-up to be ramped up in light of headwinds

As a key part of China's "dual circulation" strategy, we are convinced that China will further push forward opening-up in the new FYP rather than seeking seclusion. China has accelerated opening up in recent years, including rolling out a new foreign investment law to level the playing field for foreign investors with the "negative list" scheme, removing foreign ownership caps on financial institutions, abolishing quota restrictions of QFII and RQFII, and implementation of stock and bond connect schemes. Looking ahead, we expect China to further open domestic markets for foreign investors in most sectors, reduce the coverage of negative list significantly, and lower import tariffs and non-tariff barriers in the coming 5 years. These measures, along with China's large and rapidly growing market, and decent yield spreads, should help to attract foreign direct investment and portfolio investment flows in the coming years, following the significant increase recently.

Sustained infrastructure investment and rising consumer power

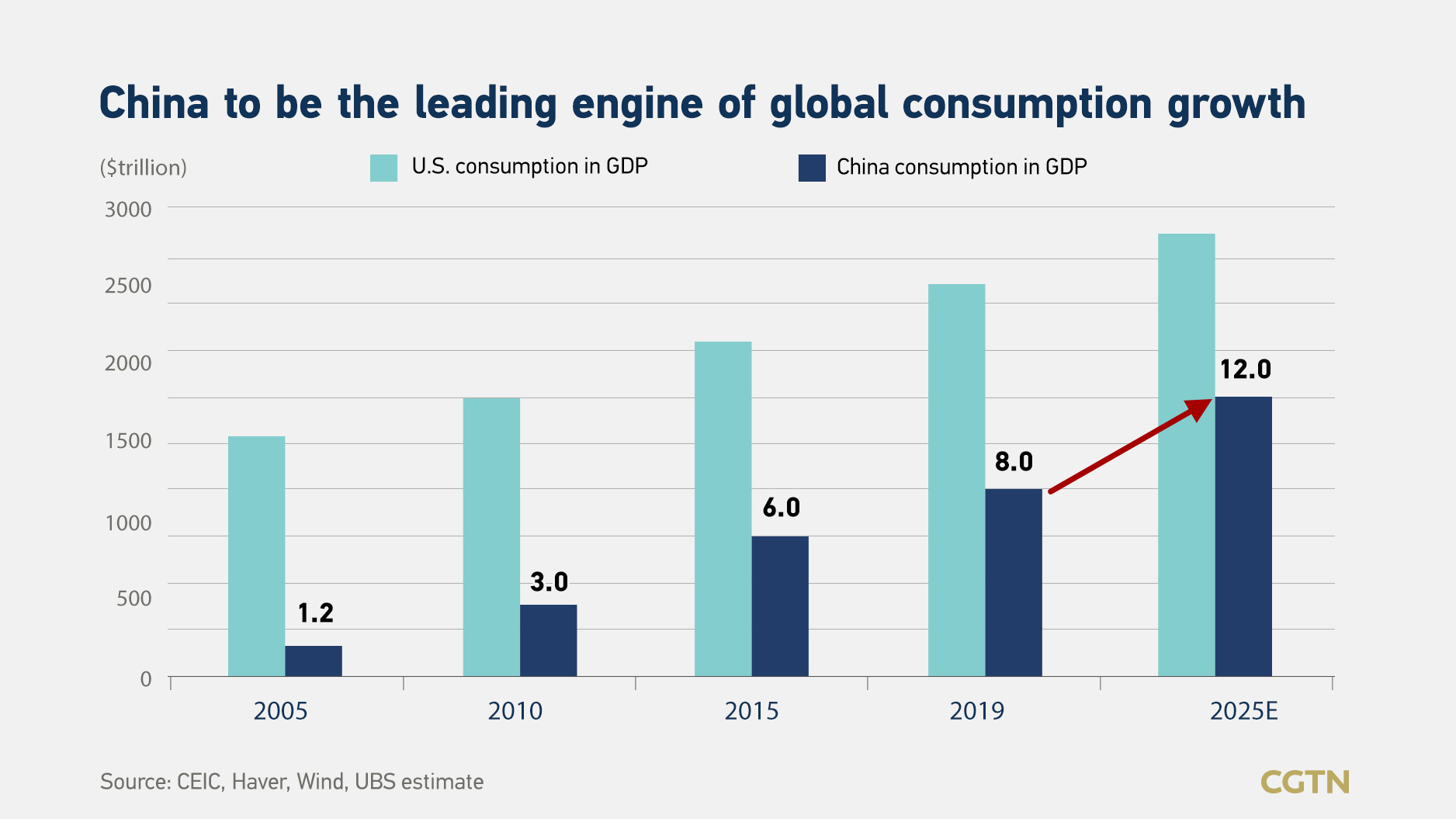

In the context of "domestic circulation," investors may find opportunities in pushing for new urbanization, in particular in developing metropolitan areas and city clusters, and further relaxing hukou restrictions. For the former, China will likely continue to invest in infrastructure projects albeit at a much slower pace than the previous decade, especially transportation projects, urban public facilities and construction in underdeveloped regions. For the latter, hukou reform and people-oriented urbanization suggest new investment in public services and facilities and more urban consumption. China will likely continue to be the leading engine of global consumption growth in the next 5 years with an expanding middle class, as China's total consumption is expected to reach 12 trillion dollars in 2025, almost 4 trillion larger than in 2020. Meanwhile, China's consumption upgrading will likely continue towards more services, better quality, more health-related spending, more experience and self-improvement, and more online shopping.

Technology and innovation to be a top priority

China is likely to target its R&D share in GDP from 2.5% in 2020 ($350-400bn) to around 3% in 2025 ($600-650bn), and further increase spending in education and vocational training. In light of decoupling pressures and tech restrictions, China may allocate more resources to fundamental research, frontier research and technology bottleneck areas (e.g. chips & semiconductors, software, precision machinery, fine chemicals, advanced robotics, new materials, aerospace & aviation technology), better protect IP rights, and offer more market incentives to researchers. In addition, China's significant talent pool (~8 million college graduates per year, of which >4 million with STEM majors), large market size and a relaxed regulatory environment should help underpin technology progress and accelerate the application of R&D outcome.

Digitalization a key area

We expect the government to further support digitalization and related implications in the next FYP. Covid-19 has accelerated digitalization. We expect China's online sales penetration will continue to rise further from 21% in 2019 and 25% YTD 2020, while online provision of other services including remote working, education, health care and financial services will also grow rapidly. We expect the government to help facilitate Chinese corporates to transform their business model with more digital services such as smart retail and smart manufacturing, by increasing the provision of "new infrastructure," including data centers, 5G networks, AI, internet of things (IoT), etc. Although the annual investment of officially defined "new infrastructure" is still small for now (around 1 trillion yuan, equivalent to 5% of total infrastructure FAI), we expect the 14th FYP to increase related investment more rapidly than the "old infrastructure" in the next 5 years.

Environmental protection and green economy

China should be able to successfully achieve most of its commitments in the 13th FYP. With its persistent long-term ambition of developing the green economy, we expect China to set a higher standard of environmental protection and pollution emission in the new FYP, including 18% for non-fossil energy share in total energy consumption (vs 15.3% in 2019 and 15% target set for 2020), further reduction of energy use per unit of GDP and CO2 and SO2 emission, higher share of days with good air quality, among others. Demands for related equipment, services and investment are likely to continue growing at a faster pace. During 2016-2019, China's FAI in the environmental protection sector enjoyed a much higher average annual growth of 36% than others. We expect sector FAI to double the investment size from 2019 to over 1.5 trillion yuan by 2025.

Risk control stays crucial

Similar to previous FYPs, China may not explicitly outline its plan to contain economic and financial risks in the 14th FYP. That said, we think the government is likely to put risk control into underlying consideration in the FYP drawing-up. In particular, deleveraging, containing the property bubble, and social stability are likely the top areas for risk control.

Deleveraging: We expect China's non-financial debt/GDP to rise sharply by 25ppt to almost 300% of GDP in 2020 due to credit stimulus and sliding nominal GDP growth this year, before stabilizing in 2021. Although we don't think China faces systematic debt risks due to several special features, indeed China's macro leverage is exceptionally high compared with most economies, especially for its corporate sector debt and implicit LG debt. We think China may ramp up its efforts again after 2021 to slow the pace of overall leverage increase and push forward deleveraging in selected sectors, especially highly geared corporate and developers.

Containing property bubble: Property activities have rebounded sharply post-COVID-19 outbreak, together with continued rise of housing prices. China has learned bitter lessons from previous property stimulus and tightened property policies at margins recently. That said, China also cannot afford a sharp property downturn given the latter's significant importance to the economy. We expect property policy to stay differentiated and vigilant to prevent any major property overheating or sharp fallout in the coming years, while property activities may soften gradually in light of an unfavorable property supply-demand fundamentals.

Social stability: The aging trend is set to accelerate in the coming years, with the share of elder age group (>65 years) jumping from 12% in 2020 to 14% in 2025 and 17% in 2030, compared with only 8-9% during 2010-2015. China's spending on elder care and social insurance liabilities will likely increase dramatically, which requires further reform of the pension system, including more transfer of SOE shares to social security funds. Regional and rural-urban income inequalities have been increasing pressures on social stability, and the government may continue to improve the social safety net and increase fiscal transfer to prevent the disparity issue from deteriorating sharply.