Traders work inside posts, on the first day of in-person trading since the closure during the COVID-19 pandemic on the floor at the New York Stock Exchange (NYSE) in New York, U.S., May 26, 2020. /Reuters

Traders work inside posts, on the first day of in-person trading since the closure during the COVID-19 pandemic on the floor at the New York Stock Exchange (NYSE) in New York, U.S., May 26, 2020. /Reuters

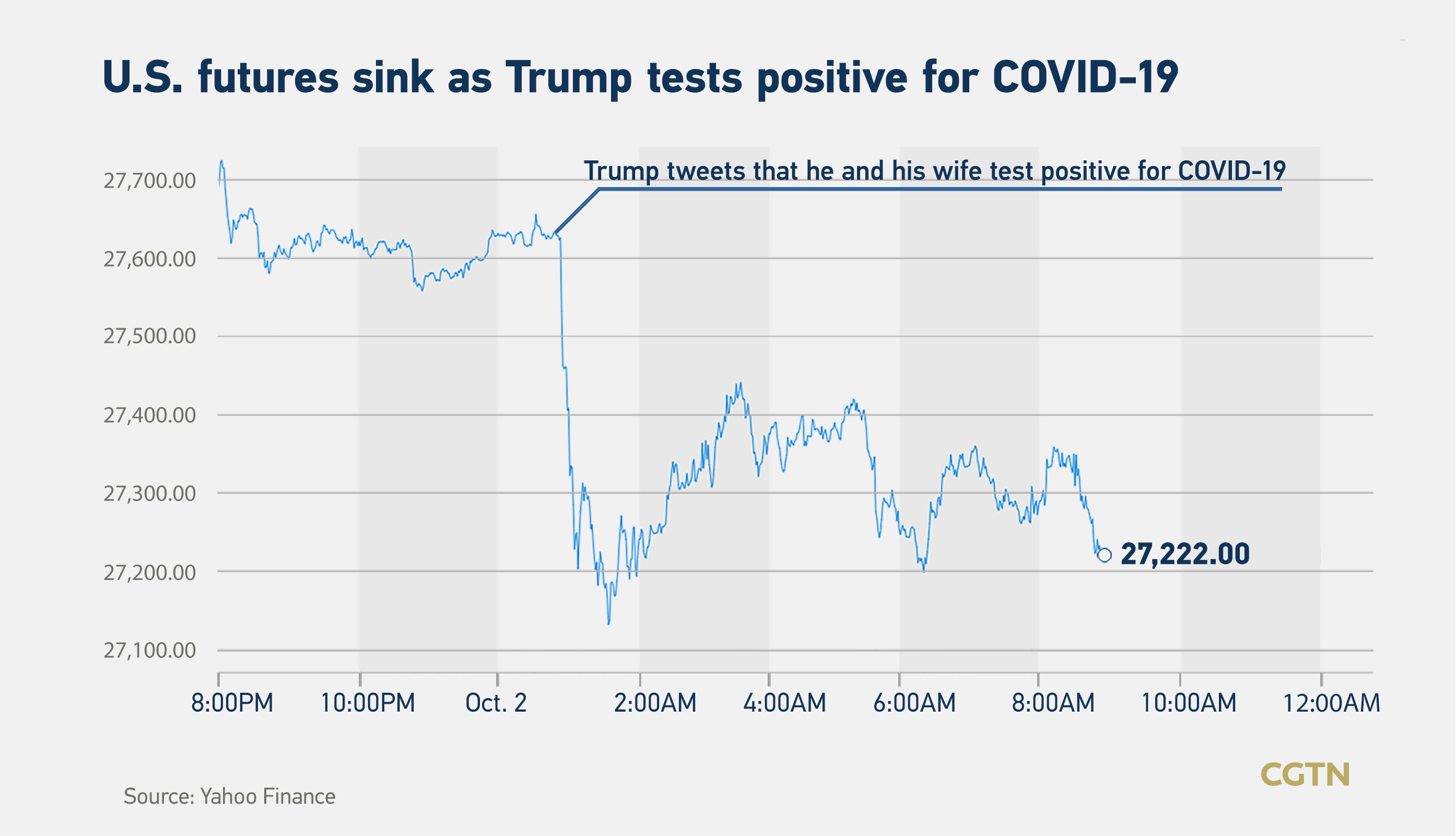

A wave of risk aversion swept markets on Friday after U.S. President Donald Trump said he and his wife had tested positive for COVID-19 and will isolate, weeks ahead of the elections.

Shortly before 0500 GMT, Trump said on Twitter that he and his wife had been tested for coronavirus after Hope Hicks, a senior advisor who recently traveled with the president, tested positive.

He later tweeted he and the first lady had tested positive: "We will begin our quarantine and recovery process immediately," he said.

Live updates: Trump tests positive for coronavirus

U.S. stock futures fell on the news and Treasury yields dipped.

Analysts said the initial risk-off moves were a knee-jerk reaction. As European markets opened, the move in U.S. stock futures pulled back slightly.

At 0735 GMT, S&P 500 futures were down one percent. Futures for the tech-heavy Nasdaq fell 1.2 percent.

European shares slid. The pan-European STOXX 600 fell 0.5 percent, although pulling back from early losses of as much as 1.1 percent.

The MSCI world equity index, which tracks shares in 49 countries, was down 0.2 percent at 0736 GMT.

Graphic by CGTN's Xu Qianyun

Graphic by CGTN's Xu Qianyun

Trump's exposure could cause a new wave of market volatility as investors braced for the presidential election in November. How long the risk-averse moves will last depends on the extent of the infection within the White House, said Francois Savary, chief investment officer at Swiss wealth manager Prime Partners.

"We may have to wait until the end of the weekend for more clarity on the situation," he said. "The reaction has been a bit excessive with U.S. stock futures. It doesn't mean the U.S. administration is not able to function."

"It will weigh on market today and early next week but will not induce a long-lasting correction if the infection is contained to Trump," he added.

(With input from Reuters)