Editor's Note: Jimmy Zhu is chief strategist at Fullerton Research. The article reflects the author's opinion, and not necessarily the views of CGTN.

China's GDP figure for the third quarter brought the nation's growth into positive territory in the first nine months of the year and the quick recovery is likely to continue to attract more foreign inflows into its capital market. Furthermore, factory and consumption-related data released on Monday also confirms that the economic recovery would extend into the fourth quarter.

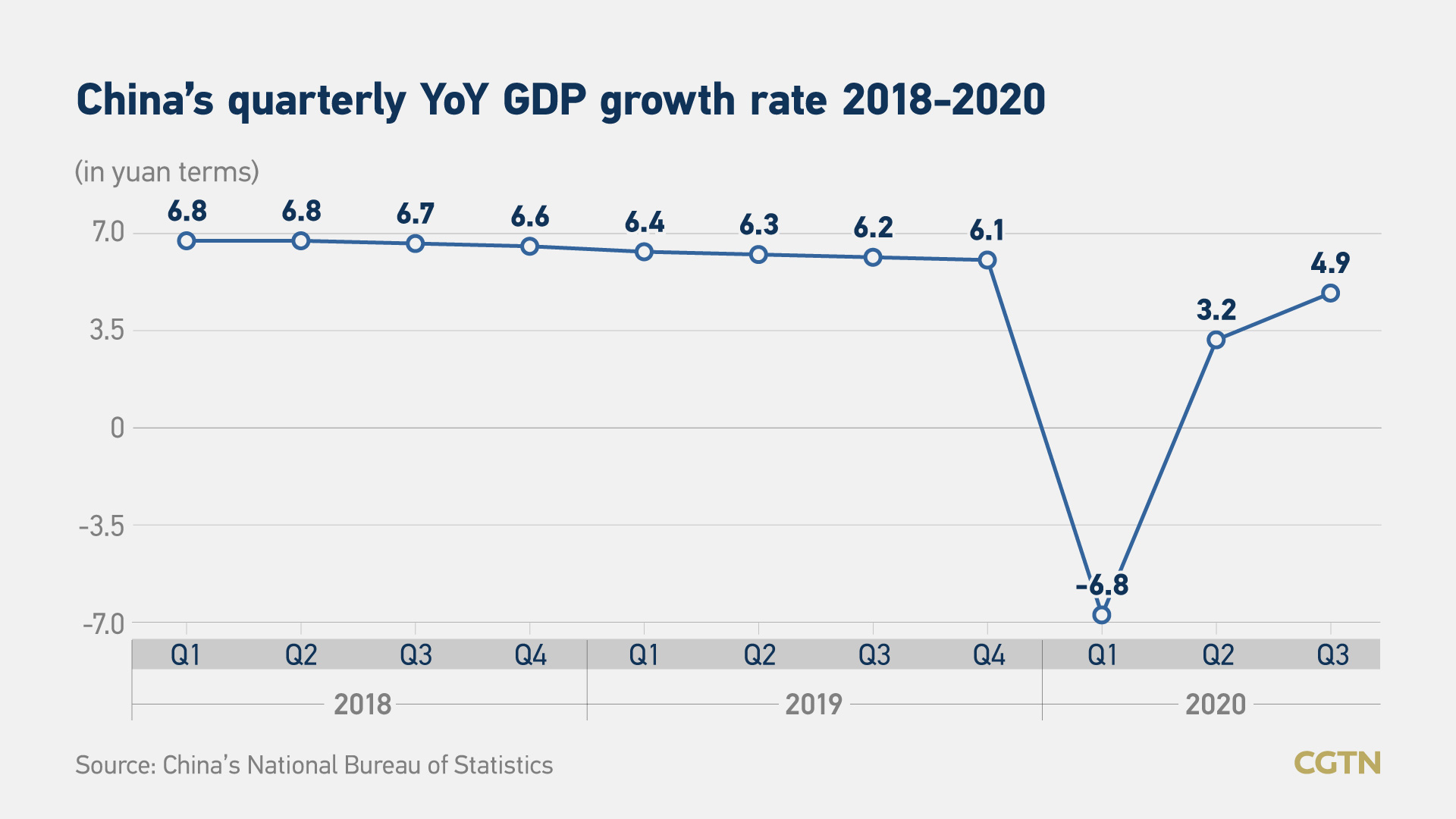

The Chinese economy expanded by 4.9 percent in the third quarter from a year ago, faster than the 3.2-percent expansion in the second quarter, but it was below the earlier consensus of 5.5 percent. GDP growth in the third quarter helped the domestic economy return to growth territory in the first nine months of the year – a 0.7-percent expansion after the economy dipped by 6.8 percent in the first quarter.

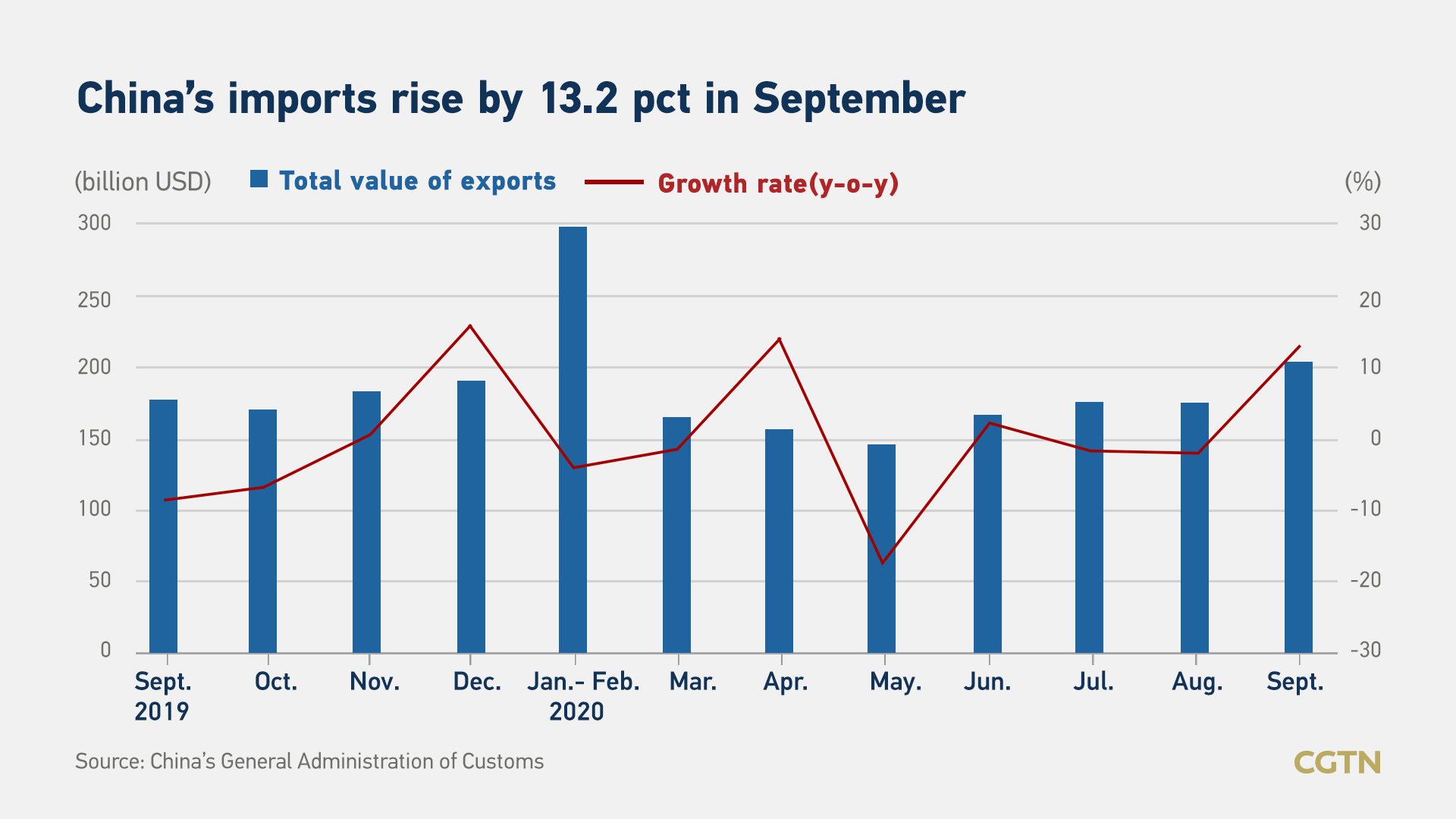

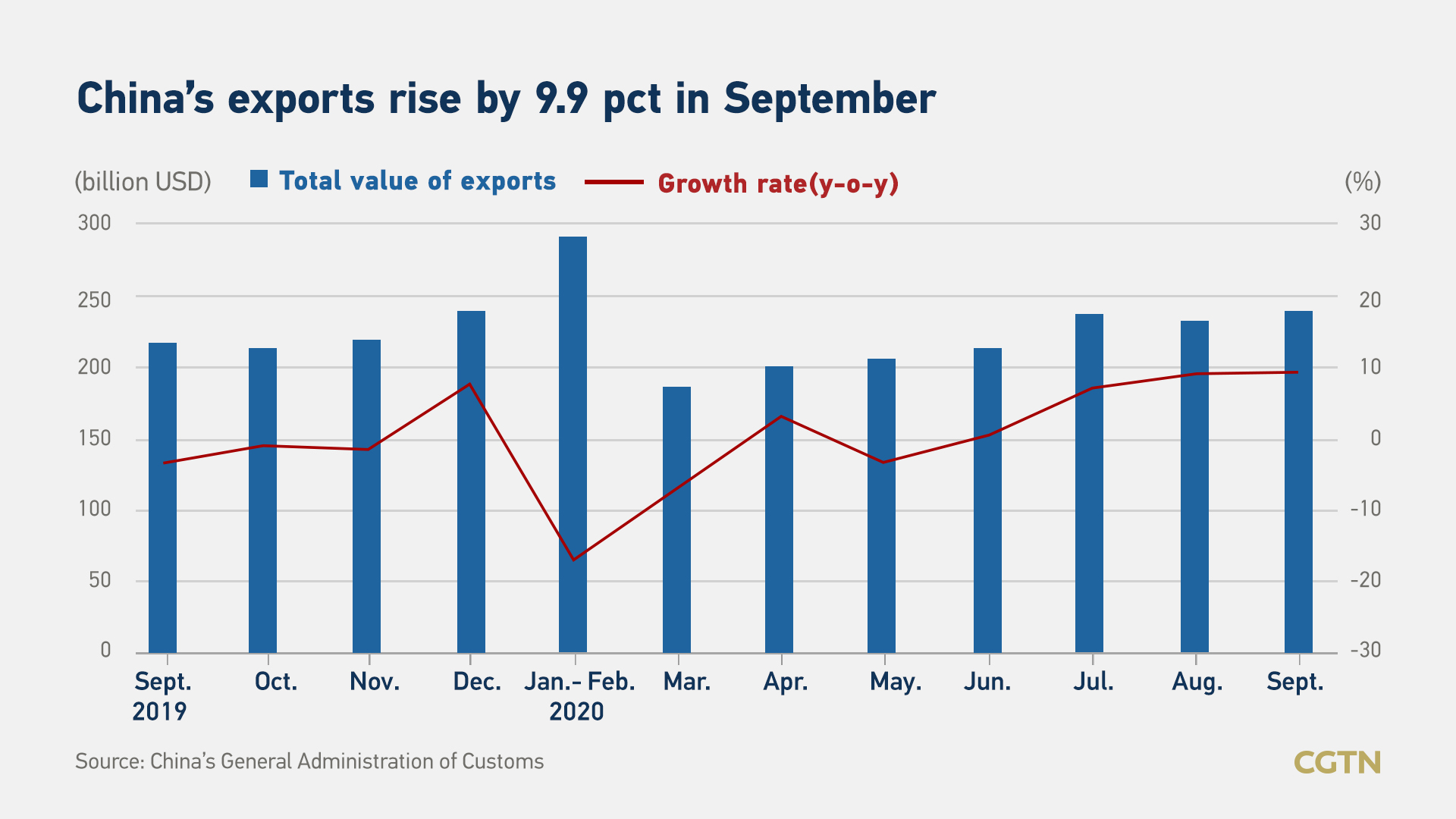

The below-estimate fourth quarter GDP figure may be partially dragged by the shrinking trade balance in September, but that is not a bad event for the Chinese economy in the near term. In September, China's imports grew by 13.2 percent from a year ago, versus a 9.9 percent growth in exports. The faster pace of inbound shipment activities suggests the recovery in domestic demand is ongoing. Moving forward, the contribution of net exports to Chinese GDP could remain challenging as a resurgent COVID-19 in some major economies may trigger more lockdowns and cause demands in those countries to slow down.

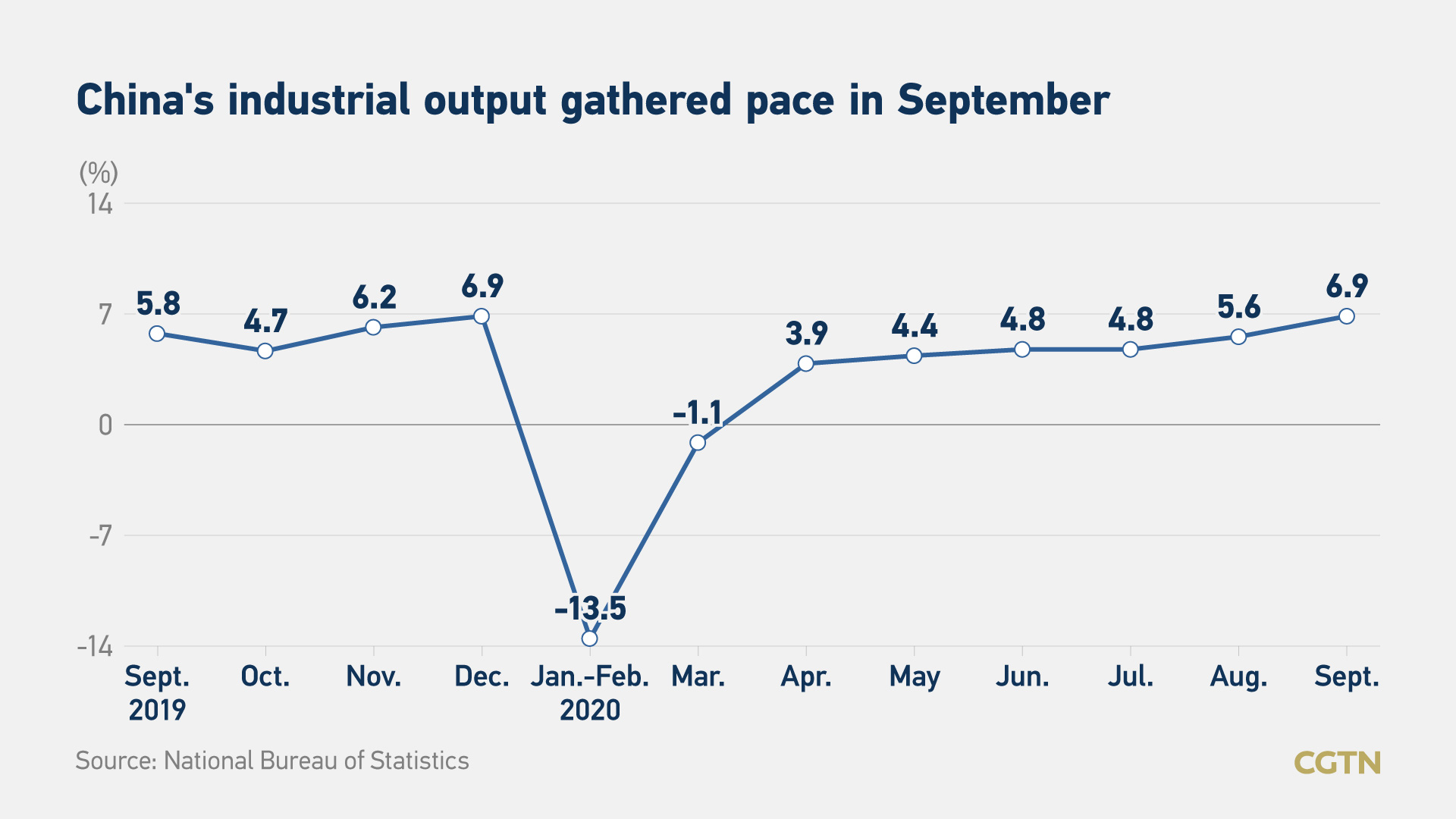

Still, the Chinese economic data for September released earlier showed further encouraging signs that the recovery will be extended into the fourth quarter. Industrial production grew by 6.9 percent last month, which was the fastest expansion since December 2019. Over the past years, industrial production and the domestic GDP's correlation reached 0.8 percent, and that suggests the GDP growth in the fourth quarter may further accelerate if the output is maintained at the current pace of expansion.

Consumption-related data offers another surprise to the upside. Retail sales last month grew by 3.3 percent from one year ago, rebounding sharply from a 0.5-percent growth in August. Improving retail sales hold the key to the ongoing economic recovery. Not only is it increasing contribution to the entire GDP, but it shows that consumers' confidence keeps rising and they are more willing to spend than in earlier months. For example, car sales jumped by 8.2 percent last month, the biggest increase since 2018.

In the final three months of the year, the benchmark lending rates are expected to stay unchanged and no major fiscal stimulus is expected to further spur growth. Instead, the authorities' focus will be on channeling credit to small and medium-sized enterprises more effectively and provide them with more support to encourage innovation in the manufacturing and technology sectors with high-quality growth.

Market reaction and outlook

Still, the financial market seems to be paying more attention to the headline GDP figure. The Shanghai Composite Index rose before the release of GDP data, but closed 0.7 percent lower, and a similar pattern was reflected in the yuan market. The price reaction does not necessarily mean investors are disappointed by the growth figures, because the stock market has been pricing in the sound economic data in the past few weeks. Shanghai stocks gained by around 3 percent in the past two weeks.

On the other hand, September's economic data nearly ruled out any major stimulus toward the end of the year, including the PBOC's monetary easing. One of the benchmark interbank money market rates, the 7-day repo rate, jumped by 6bps Monday, as traders expect the domestic monetary stance will shift toward a more neutral stance.

Last week, the IMF predicted that China will be the only major economy to grow this year, by 1.9 percent, followed by 8.2 percent in 2021.

In contrast to many advanced economies whose interest rates are still close to zero, China's rates have risen to the pre-pandemic era. Its 10-year government bond yield ticked up to 3.2 percent, the highest since December. The rising yield has made yuan-denominated assets more attractive, inducing more foreign inflows into onshore markets.

Thus, the declines in local stocks on Monday could be considered a "knee-jerk" reaction, as the domestic economic recovery, foreign inflows and the soft dollar are likely to continue supporting the onshore financial markets.