04:39

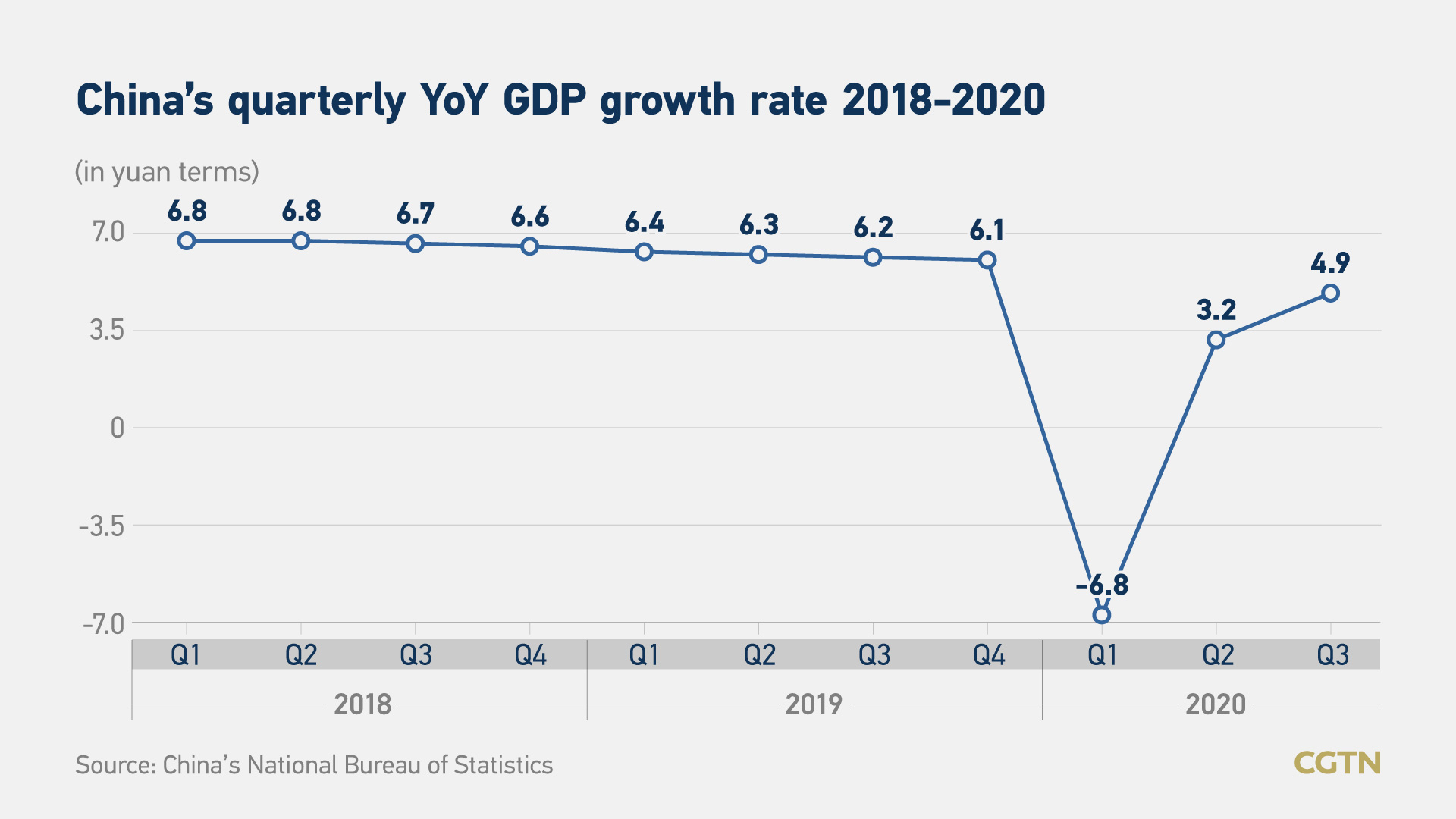

China's economic recovery gathered pace in the third quarter of 2020, with GDP growth in July-September registering at 4.9 percent from a year earlier, boosted by investment and exports, official data showed Monday.

The growth beat the second quarter's 3.2 percent, which reversed the first contraction on record at 6.8 percent in the first quarter. In the first half year, the economy declined by 1.6 percent, but it rebounded to a 0.7-percent rise in the first three quarters.

"The Q3 GDP growth accelerated from the first half, driven by infrastructure and real estate investment as well as a strong performance in export," Wang Dan, chief economist with Hang Seng Bank China told CGTN.

The reading was slower than the median 5.2-percent forecast by AFP's survey and Reuters' poll, and missed expectation of 5.3-percent growth by Bloomberg.

"In our view, the number missed the consensus forecast, partly because high volatility made forecasting difficult," Nomura's Chief China Economist Lu Ting said in an email to CGTN. He emphasized missing forecast does not mean China's economic recovery is hindered.

Lu said, "China's quick recovery was a product of its stringent lockdowns, massive testing, population tracking, a large economy that can afford to be somewhat insulated, and fiscal stimulus via credit expansion."

"Strong export growth, a further recovery from the pandemic, the lagged impact of fiscal stimulus and credit growth and pent-up demand following the summer floods all contributed to the robust activity data in September," Lu further explained.

ICBC International said behind the positive economic growth is the rebound in investment and consumption, as both of the fixed asset investment in the first three quarters and retail sales in the third quarter turned positive for the first time this year.

The National Bureau of Statistics (NBS) said in a release that, "Generally speaking, the overall national economy continued the steady recovery and significant results have been delivered in coordinating epidemic prevention and development."

In the first three quarters, the country's added value of major industrial enterprises grew 1.2 percent from a year earlier. Industrial output increased 6.9 percent in September on an annual basis, 1.3 percentage points higher than the rise in August, much stronger than Nomura's expectation at 5.7 percent.

"We expect growth of industrial production to moderate back to around 6 percent year-on-year in coming months, as the restocking period is likely over and as pent-up demand eases," Nomura said.

Growth of retail sales quickened to 3.3 percent year-on-year in September, versus a 0.5-percent growth in August. It beat market consensus of 1.6 percent, and closed to Nomura's forecast of 3 percent. However, retail sales in January-September contracted 7.2 percent from a year ago.

The breakdown shows that growth in retail sales and revenue from catering services improved in September to 4.1 percent and -2.9 percent respectively year-on-year, from 1.5 percent and -7 percent in August, according to Nomura.

Sales growth of oil and oil products rose to -11.8 percent year-on-year in September from -14.5 percent in August, thanks to the gradual relaxation of social distancing rules that have supported the recovery in transportation and tourism industries, despite a fall in global oil price inflation, Nomura said.

Nomura expected retail sales growth to gradually recover further in coming months barring a second wave of COVID-19 in China.

Wang said consumption remained a drag, as retail sales only returned to positive growth since August, and its impact will be more prominent in the fourth quarter.

"We believe that with the further relaxation of travel restrictions and the improvement of residents' income, some consumption areas that have been relatively lagging in recovery should continue to pick up in the fourth quarter," said Wang Tao, chief China economist at UBS.

ICBC International echoed that consumption will be further boosted in the fourth quarter, as more consumption scenarios and demand for offline services are expected to accelerate after China's Golden Week holiday, and residents' consumption capacity is expected to be steadily restored thanks to the monthly increase in new urban employment and the continuous rise in residents' income.

More than 630 million trips were made domestically during Golden Week from October 1 to 7, generating 466.6 billion yuan ($69.5 billion) in revenue.

Fixed-asset investment rose 0.8 percent year-on-year in the first nine months, following a 0.3 percent dip in January-August.

"The third quarter saw some mini-second waves of coronavirus outbreak in a few cities, but they were quickly contained. Private investment thus accelerated, as the market reinforced confidence that China has the pandemic under control," Wang told CGTN.

Nomura expected infrastructure investment to accelerate, as the government could ramp up its spending of the proceeds from bond issuance in previous months, while manufacturing investment may remain subdued amid elevated uncertainties surrounding U.S.-China relations.

The official urban surveyed unemployment rate edged lower to 5.4 percent in September. From January to August, 7.81 million urban jobs have been created.

"We are well-positioned to achieve the target of creating 9 million new urban jobs for the entire year," Chinese premier Li Keqiang said at the State Council's executive meeting on October 10.

Read more:

China to boost employment with multi-pronged measures

China recorded robust growth in foreign trade in September, with exports and imports in U.S. dollar terms rising 9.9 percent and 13.2 percent respectively from a year earlier, as demand from trading partners recovered strongly after the lift of coronavirus restrictions.

China's official manufacturing PMI increased to 51.5 in September, with the new export orders sub-index rising above the 50.0-mark for the first time since the COVID-19 outbreak. The Caixin services PMI for the month was further raised to 54.8, the highest reading since June and staying in expansionary territory.

China's retail inflation rose by 1.7 percent from a year earlier in September, contracting by 0.7 percentage points from August, due to moderating prices of vegetables and pork. The country's factory gate price edged down to 2.1 percent in annual terms for the eight straight months in September.

Prediction for full-year growth

"The Chinese economy remains resilient with great potential. Continued recovery is anticipated, which will benefit the global recovery," Yi Gang, China's central bank governor, said during an online international banking seminar of G30. Yi said the economy is set to expand by about 2 percent this year.

AFP's survey showed China's full-year growth is expected to be 2.3 percent, slightly above the IMF's revised prediction for the country's GDP at 1.9 percent. The IMF said China would be the only major economy to expand this year, as it forecast a global contraction of 4.4 percent.

Read more:

China to be the only economy with positive growth in 2020, says IMF report

The economy is expected to continue to pick up in the fourth quarter with GDP growth at 5.5 percent, according to UBS. The investment bank downgraded this year's GDP growth forecast to 2.1 percent.

As for China's economic growth in the next quarter, Qu Qiang, assistant director of the International Monetary Institute at Renmin University, predicted a very stable growth.

"The economy, especially the retail and small businesses actually are getting back on track in a very good manner. And there've been one or two cases of COVID-19 in certain cities, but local governments have become very skillful and familiar with all the contingency plans; they know how to handle the issue without interfering with the overall economy," Qu told CGTN.

Lu forecasted GDP growth of 5.7 percent for the fourth quarter and 2.1 percent for the whole year. "We expect a further, albeit gradual, recovery of the services sector, a steady improvement in retail sales and elevated growth in fixed asset investment, especially as it relates to infrastructure," he said.

What's next policy approach ?

Wang expected the policy stimulus to remain largely conservative in the fourth quarter, and continue to follow a targeted approach focusing on small firms and low-income groups. "China will achieve positive growth in 2020 with the current momentum," Wang told CGTN.

"Beijing will neither add more easing measures nor start tightening in the near term. On fiscal policy, we expect Beijing to carry out what it planned in late May on the scheduled budget and government bond issuance, while on monetary and credit policies, we believe the period of quickly accelerating credit growth is over, but it will likely remain at current levels of around 13 percent in coming months," Nomura said.

According to Qu, in the past, China used to be an export economy as everybody knows. But COVID-19 hit the global economy very hard. So, sometimes it is not reliable to just rely on foreign demand. It is also important to explore domestic demand.

He said although China is the world's factory, "most of China's GDP comes from domestic consumption, about 30 to 40 percent, and consumption, as well as domestic investments and infrastructure, is going to play a larger role."

"I think in the future, China will strike a balance between both domestic and overseas markets. On the one hand, China will pay huge attention to foreign markets and help foreign countries to have a better life. Also, it is important to realize the importance of the domestic market. Since foreign players are focusing on this market, so we ourselves should be better players in this market," Qu said.

What's more, a lot of Chinese giant retail players with a focus on foreign markets are now converting to domestic markets. They improve the quality of products and customize goods to suit the Chinese people's demand, according to Qu. "In that case, they are not shrinking exports but expanding domestic production."

"We should also be aware that the international environment is still complicated and severe with considerable instabilities and uncertainties, and that we are under great pressure of forestalling epidemic transmissions from abroad and its resurgence at home. The economy is still in the process of recovery and the foundation for sustained recovery needs to be consolidated," the NBS said.

Lu stressed headwinds remain. "China is not free from the risk of a second wave of COVID-19, pent-up demand will likely lose some steam, medical product exports may have peaked, Beijing is determined to cool down property markets, some social distancing measures within China are likely to extend into the second half of the year and rising U.S.-China tensions could dent China's exports and manufacturing investment," he explained.

Wang pointed out that parts of the U.S. and Europe have already seen a strong comeback of the second wave pandemic. "This will hinder their industrial recovery. Thus we anticipate their import from China to continue to rise, bolstering China's growth for the remainder of the year as well as a strong yuan," she added.

(CGTN's Huo Li and Global Business also contributed to the story.)