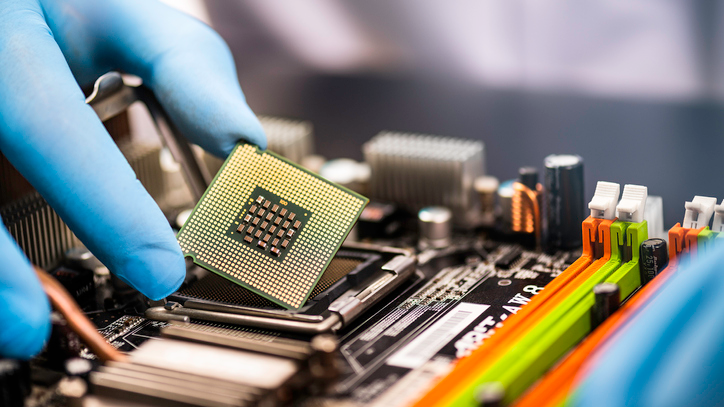

A semiconductor chip. /Getty

A semiconductor chip. /Getty

Editor's note: Djoomart Otorbaev is the former prime minister of the Kyrgyz Republic, a distinguished professor of the Belt and Road School of Beijing Normal University, and a member of Nizami Ganjavi International Center. This is the second piece of his series on global shortage of semiconductor chips. The article reflects the author's views, and not necessarily those of CGTN.

In a previous article I wrote that international corporations are faced with an unexpected problem – a shortage of semiconductor chips required to produce new models of cars, computers, televisions, home appliances, game consoles and mobile phones. As a result, chip makers are stepping up investment in their development.

On April 1, Taiwan Semiconductor Manufacturing Co. Ltd. (TSMC) revealed a plan to invest $100 billion over the next three years to increase production capacity at its factories. The announcement came just days after Intel announced a $20 billion investment plan to expand its capability.

The shortage has shocked the entire supply chain – consumers are running out of chips, chip-makers are running out of hardware and hardware makers are running out of raw materials. Under normal circumstances, restarting chip production can take up to two years. Among the reasons why it is difficult to cover the lack of chips quickly are the following:

– The pandemic's response is increasing the costs associated with logistics and ensuring a safe work environment for employees;

– Excessive capacity utilization limits the potential for rapid volume increases. At present, in a few segments of this industry, free capacities are almost exhausted;

– Trade tensions between China and the U.S. led to restrictions on the supply of equipment and materials;

– The rise in production costs for new generations of chips leads to tougher competition. As a result, more and more companies are dropping out of the contest.

According to the latest forecast by J.P. Morgan, it will take a minimum of three to four quarters for supply to catch up with demand and then another quarter or two to restore customer inventory and distribution channels to their normal levels.

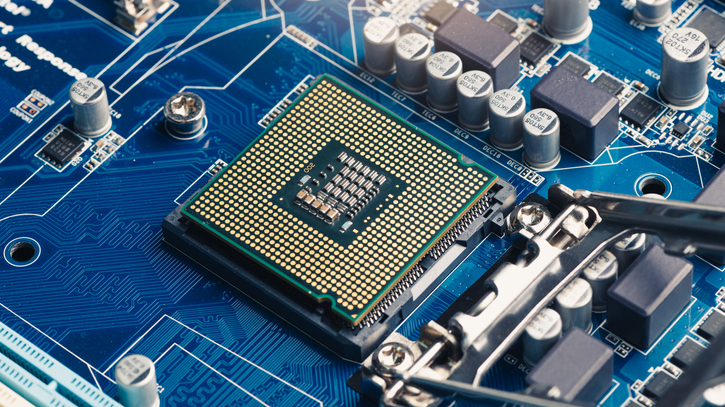

A CPU chip in the motherboard's socket. /Getty

A CPU chip in the motherboard's socket. /Getty

As for the market size, according to forecasts by Infineon Technologies, in the next two years, the global semiconductor market will grow by at least 11 percent per year to $490 and $550 billion in 2021 and 2022, respectively. The market will be controlled by a limited number of powerful players that have formed over the decades. Their products' demand will grow, which means that the industry's multi-billion-dollar investments will continue to pay off.

Among examples of promising industries that consume advanced microchips are Internet of Things (IoT), artificial intelligence (AI), electric vehicles (EV) and cloud computing (CC), which, according to various forecasts, may show double-digit compound annual growth rate (CAGR) for many years. The mobile device sector can also claim explosive growth, given the prospects for the proliferation of 5G networks and the not-so-distant future – 6G.

Experts assess the growth in the use of chips as overly optimistic. However, the increased demand for electronics during the pandemic coincided with a sharp drop in chips' size. This made them extremely difficult to manufacture, ultimately affecting the entire semiconductor production and supply chain's stability.

On March 31, Chinese chip manufacturer Shanghai Tianshu Zhixin Semiconductor Co. announced the development of 7-nanometer chips that can compete with products from global industry leaders. Considering the late start of the entire initiative and the lack of experience in modern microcircuits, this can be regarded as a remarkable success.

Recognizing the strategic role of the development and production of cutting-edge chips, the leading world powers, primarily China and the U.S., provide their developers and manufacturers with direct government support. In 2021, the U.S. administration plans to offer government subsidies of $50 billion to domestic producers. In 2019, China allocated $73.5 billion in assistance to chip manufacturers.

The pandemic has dramatically changed people's habits and created new normality in the lives of societies and states. The introduction of new technologies into modern life has accelerated even more. It is the production of semiconductor chips that have taken the forefront of the modern fight for technological superiority.

Now not only specialized companies are developing and producing new chips, non-core companies such as Apple, Microsoft and Huawei have also begun to develop large-scale initiatives to release their original chips.

Competition in the global semiconductor microprocessor market is becoming unprecedented. This contention involves both government and powerful private corporations. In this tough competition, there should be only one winner – humanity.

(If you want to contribute and have specific expertise, please contact us at opinions@cgtn.com.)