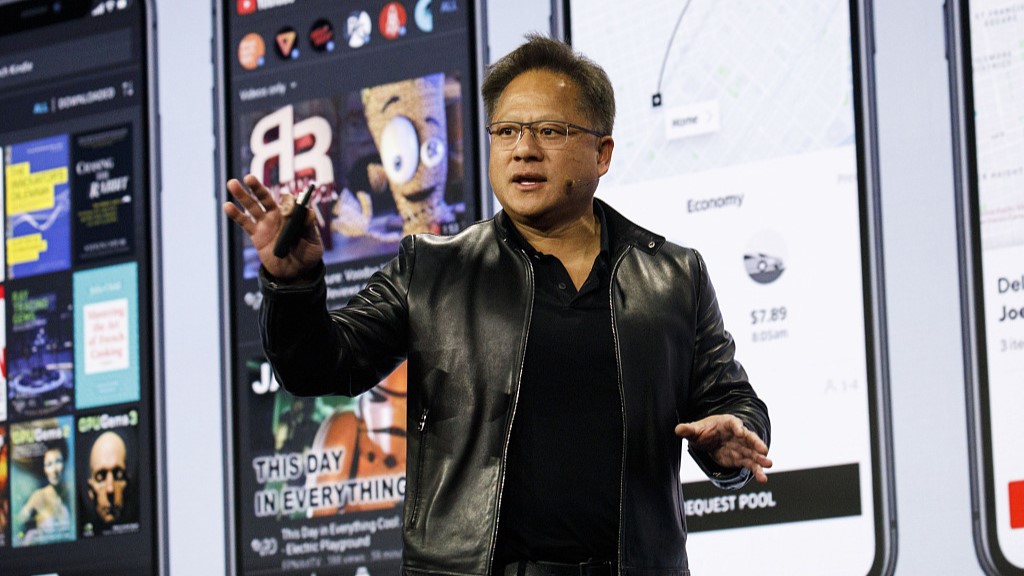

A file photo of Jensen Huang, chief executive officer of Nvidia Corp. /CFP

A file photo of Jensen Huang, chief executive officer of Nvidia Corp. /CFP

The escalating chip war against China from the U.S. could cause "enormous damage" to the American tech industry, said semiconductor giant Nvidia's CEO Jensen Huang in an interview with the Financial Times published on Wednesday.

Noting that China made up roughly one-third of the U.S. tech industry's market, Huang said there is no substitution for it.

"If we are deprived of the Chinese market, we don't have a contingency for that. There is no other China, there is only one China," Huang said in the interview.

Losing the Chinese market, he said, would mean that U.S. semiconductor manufacturing facilities would be running at overcapacity and there would be "enormous damage to American companies."

As the world's most valuable listed semiconductor company, Nvidia specializes in graphics chips that have long been coveted by gamers but have become engines for the kind of complex computing power required in artificial intelligence (AI) processing.

Nvidia specializes in producing graphics chips. /CFP

Nvidia specializes in producing graphics chips. /CFP

Since August last year, the U.S. has banned Nvidia from exporting two advanced computing chips to China. The ban covers the company's A100 and flagship H100 chips, which are powerful enough to facilitate AI processing.

The company flagged a $400 million loss resulting from the restriction at the time.

Huang said the ban resulted in the company having "our hands tied behind our back" when it came to trading advanced chips with China, one of its top markets.

Huang noted that Chinese companies are making chips locally since they are cut off from the U.S.-made ones.

The recent growing excitement surrounding AI has been boosting demand for chips, with Nvidia having seen its market capitalization more than double this year.

Shares in the company soared more than 25 percent Wednesday after an earnings report showed the AI trend is fueling demand for its sophisticated chips.

Nvidia said it expected revenue of about $11 billion in the current quarter, which seemed to drive investor enthusiasm for its shares.

(With input from AFP)