Opinion

12:07, 25-Jan-2019

Opinion: Why Trump is wrong about his trade war on China

Ken Moak

Editor's note: Ken Moak, who taught economic theory, public policy and globalization at the university level for 33 years, co-authored a book titled "China's Economic Rise and Its Global Impact" in 2015. The article reflects the author's opinion, and not necessarily the views of CGTN.

China's National Bureau of Statistics (NBS) shows the country's economy slowing down to 6.6 percent in 2018, being the lowest in 28 years, prompting U.S. President Donald Trump to claim that his trade war with the "communist" country worked. He boasted that China is desperate to reach a trade agreement with the U.S. His statement also insinuated that China is playing "games" with the U.S., delaying his demands for total "capitulation."

But the fact of the matter, it is the U.S. that is playing "games", moving "goal posts" and terminating treaties whenever it feels like it.

While China is not perfect, it did make some big concessions: buying one trillion U.S. dollars of American goods over the next six years, willing to negotiate on technology transfer and other issues.

More importantly, Trump's boasting of China hurting by his trade war is "fake news".

Numbers seem to tell a different story

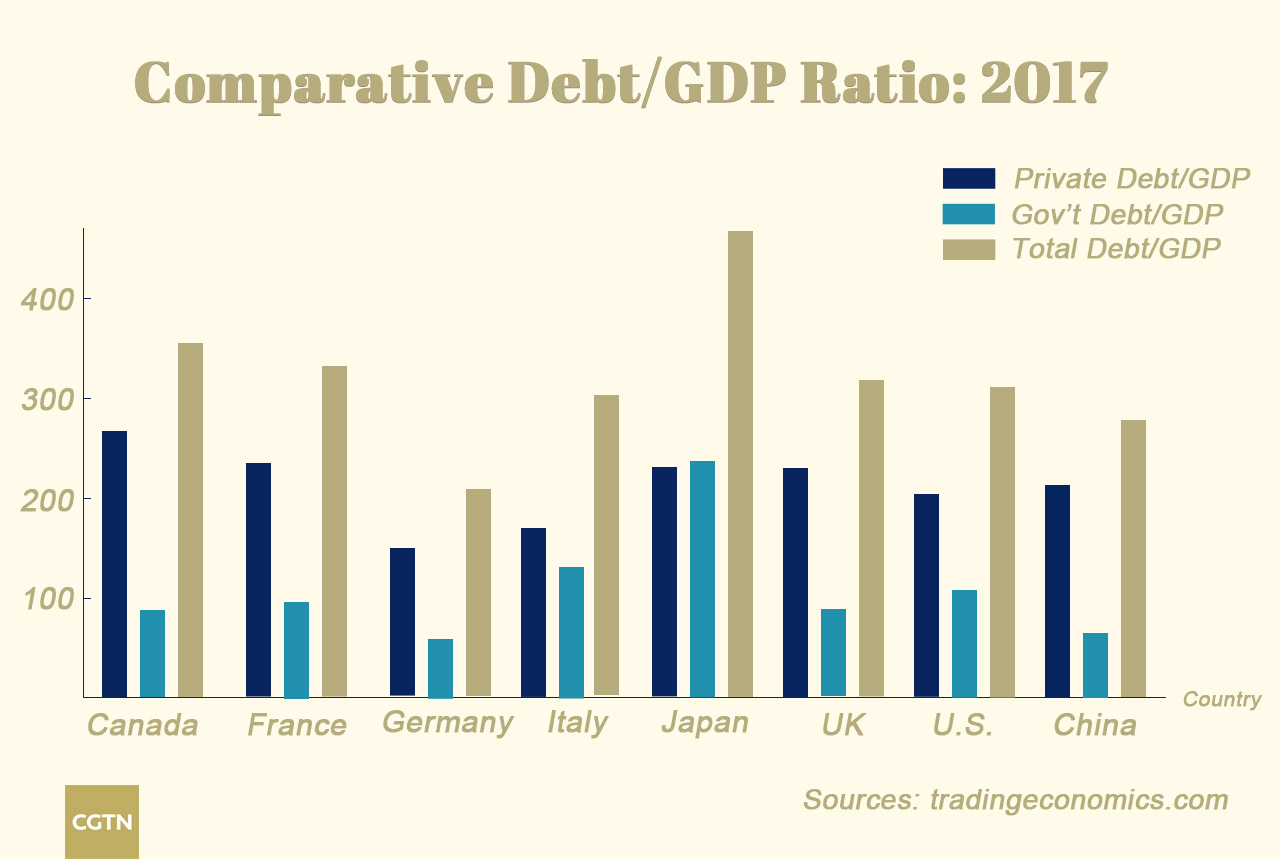

Economic data on China, U.S., and G7 economies tell a different story, as illustrated below.

CGTN Photo

CGTN Photo

With the exception of Germany, China seems to be in better financial shape than all other G7 countries. Although China's household debt to GDP increased significantly since 2008, Bank of International Settlement figures showed that it was still far lower than any G7 economies, ranging from 57.4 percent in Japan to over 100 percent in Canada. Low debts and high savings afford Chinese consumers with tremendous purchasing power.

Unlike the U.S. and most of its G7 allies, relatively low Chinese government debt GDP ratio, estimated at between 16 and 65 percent, means China can mount huge stimulus packages to reverse downward trends as it did in 2008.

Though state-owned enterprises (SOE) debt also rose by over eight percent year-on-year in 2018, it is largely owed to state-owned banks (SOB). Accounting for 80 percent of the total corporate debt, this borrowing-lending arrangement is more of an accounting issue than a debt burden. Further, a financial bubble could only happen if all SOEs default on payments, a very unlikely scenario particularly when SOE profits increased by 12.9 percent to almost 500 billion U.S. dollars in 2018.

What's more, China's indebtedness is largely internal and only accounting for 15 percent of its GDP, suggesting volatility in the international financial system would have little impact on China.

The People's Bank of China headquarters in Beijing, January 7, 2019. /VCG Photo

The People's Bank of China headquarters in Beijing, January 7, 2019. /VCG Photo

Other economic data also suggest that China's economy has performed better than those of the G7, including the U.S. For example, China's 2018 wages rose by 6.5 percent as compared to 2.7 percent in the U.S. and less than one percent in the EU. According to the U.S. Department of Labor, U.S. real wages were, in fact, negative because inflation was 2.9 percent.

China's NBS shows China's per capita consumption rose by 6.2 percent year-on-year in 2018, favorably compared to only around one percent in the U.S. and its G7 allies. Since consumption accounts for over 70 percent of GDP, G7 nations might not be able to climb out of the economic hole dug by the U.S.-originated 2008 financial crisis.

Moreover, China has accumulated a huge financial war chest, affording it to deal with any potential economic and financial crisis. According to official government statistics, the country has over 26 trillion U.S. dollars in bank deposits, almost 3.1 trillion U.S. dollars in foreign reserves and profitable SOE and SOB profits close to 480 billion U.S. dollars in 2018. Holding over one trillion U.S. dollars in Treasury Bills, China remains America's biggest creditor.

A comment

China wants an agreement to end the trade war, but not for the reason Trump espouses. It just wants to end the "madness" that is hurting the U.S., China and the countries that are integrated into the global supply chain.

Escalating the trade war by imposing tariffs on all Chinese products, in fact, might damage the U.S. economy more than China's. Over 65 percent of "imports" from China are produced by U.S. firms in the Asian country. The immediate goods are needed to produce the final product in the U.S., thus taxing them would increase production costs, eroding competitiveness. And raising prices on consumer goods would lead to inflation which in turn could force the Federal Reserve to raise interest rates.

Traders work on the floor of the New York Stock Exchange (NYSE) at the closing bell, January 17, 2019. /VCG Photo

Traders work on the floor of the New York Stock Exchange (NYSE) at the closing bell, January 17, 2019. /VCG Photo

Indeed, China might be in a stronger position than the U.S. to withstand the trade war in the longer term. China has a huge population of 1.4 billion of which over 400 million are in the middle class, defined as anyone earning between 14,000-72,000 U.S. dollars per year. The middle-class population is expected to grow, according to U.S.-based consultancies such as McKinsey and Co. and Boston Consultants.

Further, China's Belt and Road Initiative has racked up over five trillion U.S. dollar of two-way trade since its inception. Trade between China and the over 80 countries participating in the BRI increased by 13 percent in 2018, according to the China General Customs Commission. Since more countries, including U.S. allies, are expected to join the BRI, China could become less dependent on the United States.

The combined population of China and the BRI exceeds over 40 percent that of the world, giving Chinese industries a huge market and massive economies of scale. To that end, China's economy could emerge stronger in the long-run.

Trump's assertion that China desperately needs an agreement to end the trade war is "fake news", probably meant to boost his sagging popularity. According to the latest Pew and Gallup Polls, the majority of Americans disapprove the way he handled the trade war and ran the country. With the 2020 presidential election just around the corner, Trump might be desperate to end the trade war because it is hurting the U.S. economy and by extension dimming his re-election prospects.

(If you want to contribute and have specific expertise, please contact us at opinions@cgtn.com)

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3