China’s top insurance industry regulator has been placed under investigation for corruption, the country’s anti-graft authority said Sunday.

In a statement, the Central Commission for Discipline Inspection of the Communist Party of China said Xiang Junbo, chair of the China Insurance Regulatory Commission (CIRC), was suspected of serious violations of the Party’s code of conduct.

Xiang, 60, is also the CIRC’s party chief. He was last seen in public on Thursday attending a CIRC official ceremony hosted together with the China Earthquake Administration (CEA).

Xiang Junbo (L), chairman of the CIRC and Zheng Guoguang, director of the CEA, at the signing ceremony of the strategic cooperation agreement between CIRC and CEA in Beijing on April 6, 2017. /Sina Finance Photo

At the event, he said both organizations would work together to improve earthquake insurance policies in China.

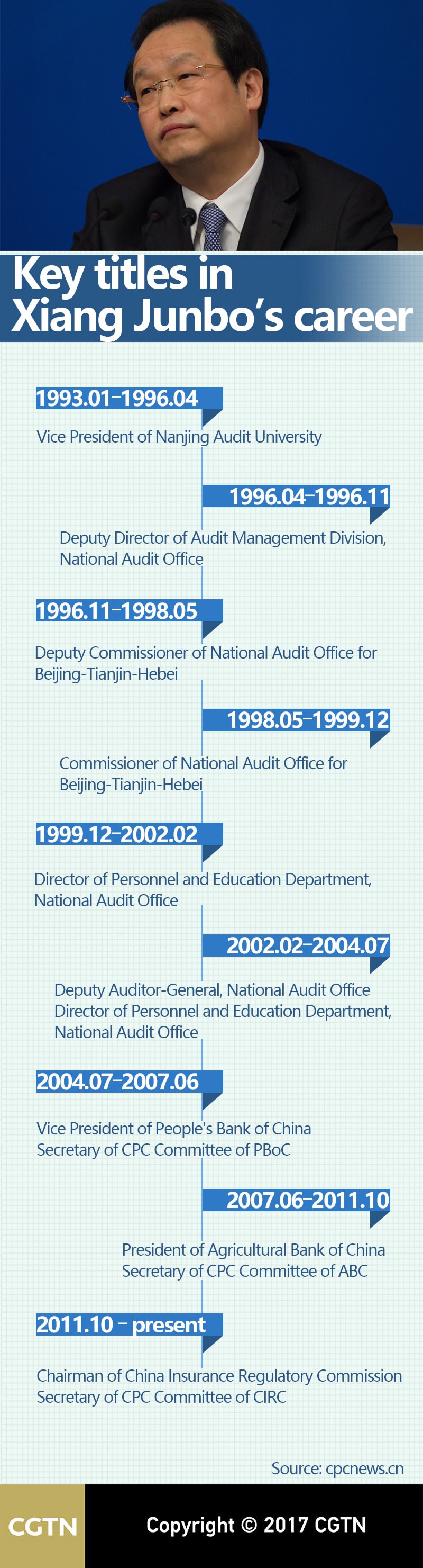

Xiang

became the insurance regulator’s chair in 2011 after serving as head of

Agricultural Bank of China, one of the country’s “Big Four” state-owned

lenders.

CGTN Photo

Controversial insurance policies

Under Xiang’s watch, CIRC introduced a series of policies to expand investment options for insurance funds, including the loosening of restrictions on investing overseas. Policies also encouraged the flow of capital to wealth management products.

China’s insurance sector has grown at a healthy pace since 2011, but industry experts said Xiang’s policies were problematic.

The China Business Network (CBN), citing an unnamed industry insider, said insurance licenses have been granted too freely under Xiang’s leadership. The industry’s steady growth has also glossed over corruption in the sector.

Xiang Junbo at a press conference in Beijing on February 22, 2017. /VCG Photo

CBN

said since 2014, the regulator has approved the establishment of over a hundred

insurance firms while only 10 applications were declined.

Xiang

has been a vocal supporter of the government’s anti-corruption efforts.

In February, Xiang said the CIRC would not allow China’s insurance industry to become a “rich man’s club” or a “sanctuary of financial crocodiles.” He said insurance companies should not be “ATM machines” or “financing platforms” for listed firms.

What is CIRC?

China Insurance Regulatory Commission. /VCG Photo

Established in 1998, the CIRC regulates insurance companies and intermediaries, including agents, brokers, loss adjusters and their business operations.

In September 2008, CIRC set up the nonprofit state-owned corporation China Insurance Security Fund Co., Ltd. with a registered capital of 100 million yuan (14 million US dollars) to manage its insurance protection fund, amounting to at least 7 billion yuan (about 1 billion US dollars).

Over the past decade, China’s insurance industry has grown into an important part of China’s capital markets. Official data show as of November 2016, the total assets of China’s insurance industry reached nearly 15 trillion yuan (2.2 trillion US dollars), up by 148 percent from 2011.

Related stories: