Opinions

14:23, 10-Feb-2018

Opinion: Tillerson has questions to answer on China trade

Guest commentary By Dr. John Gong

Chinese State Councilor Yang Jiechi spent two days in Washington this week to hold talks with US Secretary of State Rex Tillerson. This forms part of high-level dialogues between the US and China in four aspects: diplomacy and security; the economy; social and cultural exchange; and law enforcement and cybersecurity.

At the time of writing this article, there had not been much information disclosed by the US State Department other than a banal statement that the US is willing to deepen bilateral cooperation in various fields, and strengthen communication and coordination in international and regional issues. CGTN reported on Friday that the dialogue agenda includes three topics: trade, counter-terrorism and transnational crime.

I will just focus on the issue of trade, since I am no expert in the other two areas. Here is a list of things that I would have suggested Yang put on the table with Tillerson:

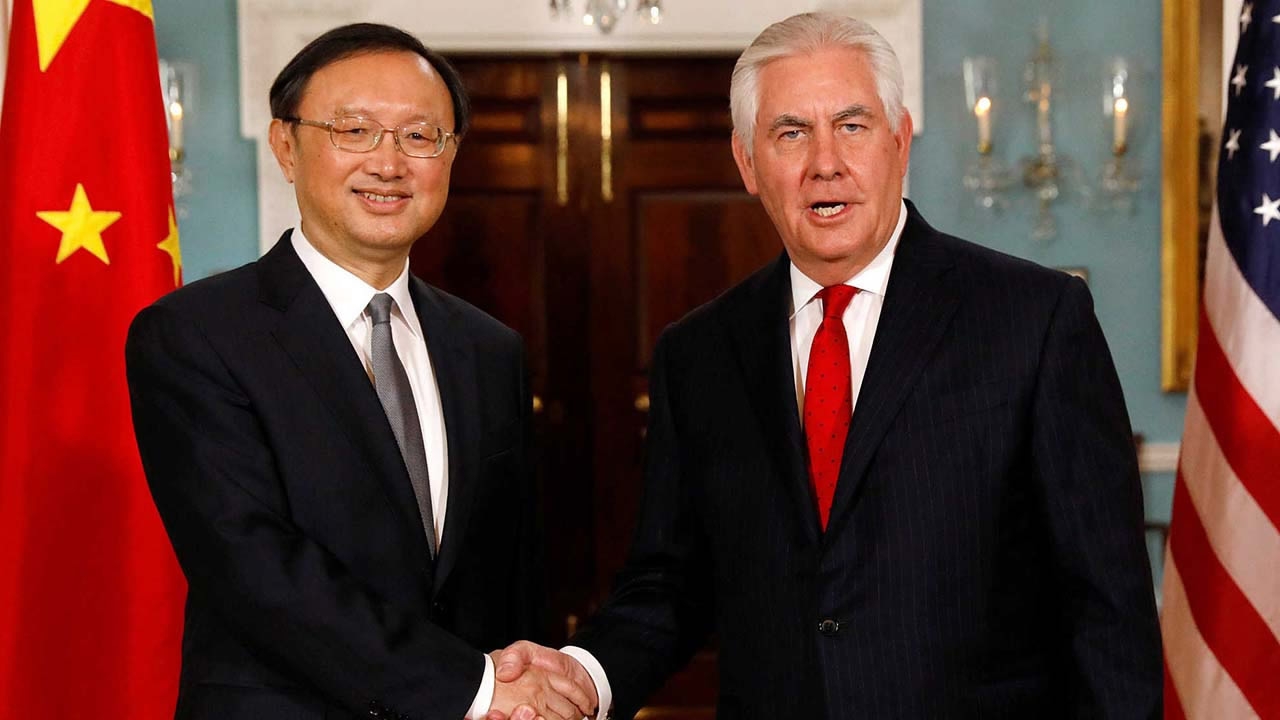

Chinese State Councilor Yang Jiechi shaking hands with US Secretary of State Rex Tillerson at the State Department in Washington, DC, February 8, 2018 /VCG Photo

Chinese State Councilor Yang Jiechi shaking hands with US Secretary of State Rex Tillerson at the State Department in Washington, DC, February 8, 2018 /VCG Photo

First, let’s agree on a common premise that the current trade surplus of some 300 billion US dollars with the US is not sustainable. Yes, I have argued here as well as via other CGTN venues that the true trade surplus can’t be that large if incorporating service trade or only counting value added, and yes, I have argued that the principal beneficiary of this trade imbalance is mostly Corporate America. But regardless of all these attenuating factors, this kind of figure every year is simply not sustainable in the long run, both economically and politically.

I think Beijing recognizes and admits that. And I know that the top brass of the Ministry of Commerce (MOFCOM) are in total agreement with this premise and are bent on rectifying it. As a matter of fact, I would venture to state that no government agency in the world charged with the same function as MOFCOM is so concerned with increasing imports!

VCG Photo

VCG Photo

Now listen very carefully, I am proclaiming the word “imports”!

But that is where the agreement stops, and the two sides’ positions diverge as to the approaches to rebalancing this trade flow. While Beijing is finding ways to increase American exports to China, the White House’s policy is all about curtailing imports from China – announcing one Department of Commerce (DOC) investigation after another, plus all those antidumping tariffs from solar products to washing machines.

Here is a list of things that the Chinese side has done to help American exports:

China started to have import fairs. The famed 60-year-old Canton Fair has changed its name from an exports exhibition to an imports-and-exports exhibition. There is also an exclusive imports exhibition in Zhejiang Province held in rotation among several large cities there. And I know there are other import fairs in the planning right now. There are not many countries in the world where the government would step in to host import fairs in a deliberate attempt to increase imports.

The Chinese currency has appreciated a great deal since Donald Trump’s inauguration, from close to 7 yuan to a dollar to less than 6.3 yuan to a dollar. This is a whopping 10-percent rise in about a year. Generally, the dollar’s depreciation vis-a-vis the yuan would render American exports cheaper and more competitive. I hope Trump picks up the currency manipulation banner right now as he was so often fond of talking about it on the campaign trail.

VCG Photo

VCG Photo

China recently introduced import VAT tax exemption for American agricultural exports, starting from sorghum products (I wrote a CGTN op-ed article recently about the US Department of Agriculture’s subsidies to sorghum farmers). That also makes American exports cheaper and more competitive.

As promised in the Davos speech by Liu He, President Xi Jinping’s main economic adviser, China is going to open up more in the financial market, meeting a major demand from the US side in bilateral trade talks. The American financial industry is highly advanced and competitive. Clearly, the beneficiary of opening up China’s financial market would be American bankers and financial service companies.

In light of the above, the question I want to ask Tillerson is, what more can China do for the moment to address the trade issue? Shouldn’t there be some reckoning on the Washington side other than just curtailing exports from China in a brute-force way? All those senseless DOC investigations are of no help with increasing American exports to China.

(Dr. John Gong is a professor at the University of International Business and Economics. The article reflects the author's opinion, and not necessarily the view of CGTN.)

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3